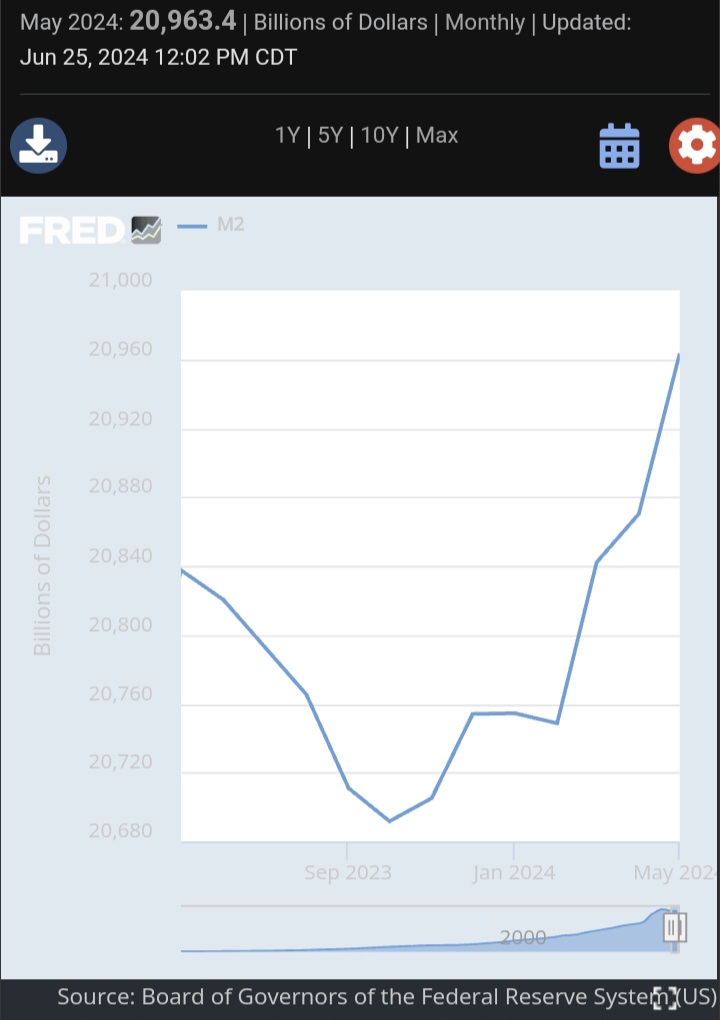

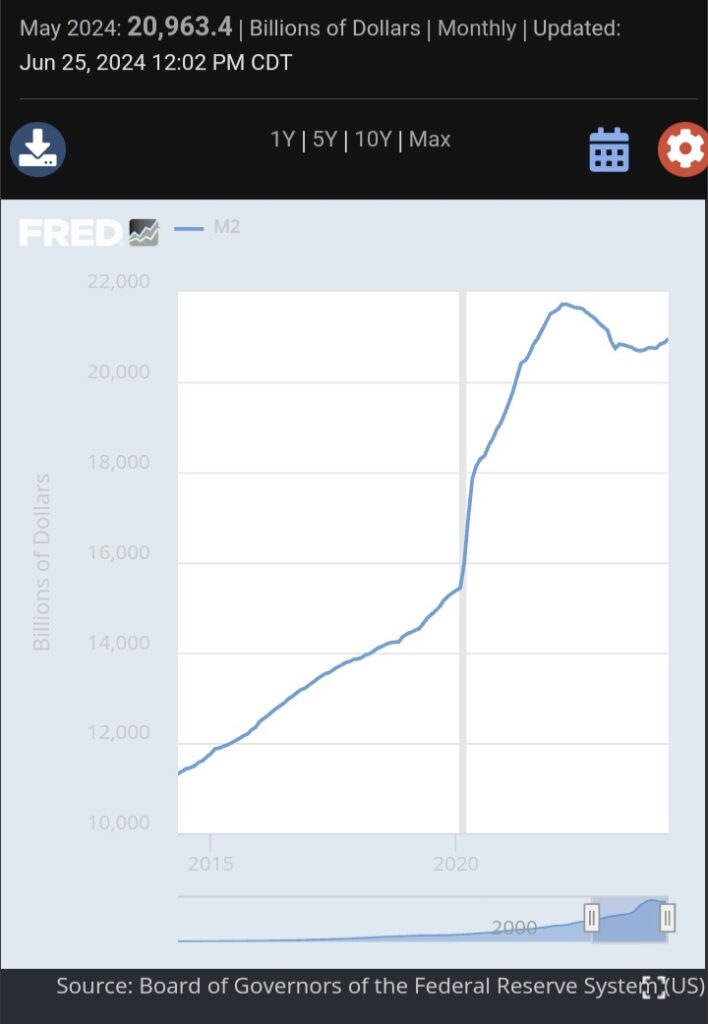

M2 is rising again, and even at 5%, cash is looking like trash

As confidence in the currencies and the governments they represent continues to fade and inflation keeps persisting, holders of cash keep spending it. It seems to be a self-fulfilling cycle and as asset prices rise, inflationary pressures and the resulting money velocity increases will continue to persist.

I just want to keep things in perspective here and show the reader what I see. I look at the latest reads on M2 money stock measures as well as the velocity. These two measures show me that our anecdotal observations regarding price inflation are backed up in the macro numbers.

Although money market funds and short-term Treasuries are yielding at least 5% for all investors, the desire or need to spend money continues to maintain its high level. The real economy is having a difficult time digesting all of the additional US Treasury debt issuance as well as the M2 money stock levels, and is thus manifesting in higher price levels for everyone. The higher velocity numbers are a direct reflection of economic participants’ desire not to hold on to money for whatever particular reason they see fit.

Despite what the mainstream press have been indicating, the neutral Fed funds rate is much higher than what most are measuring and I submit to the reader that a 5.2% Fed funds rate is actually closer to neutral, given the increasing emphasis of domestic oriented fiscal stimulus, lack of fiscal prudence, ongoing loss of currency confidence, and growth of US Treasury issuance. All of this is just feeding asset prices on a longer-term basis. Though the middle class is continuing to be decimated, those in the top 10% of balance sheet wealth continue to support the economy in its aggregate.

My back-of-the-envelope calculations indicate the neutral Fed funds rate to be almost 4.5%. If we think housing costs are expensive now, I contemplate what they would be like if mortgage rates fell in any meaningful way. I suspect the monetary and fiscal authorities are purposely keeping mortgage rates elevated to help mask the runaway M2 growth and the true price inflation measures.

Thus, I view the Federal Reserve’s actions regarding its balance sheet roll off and how it still has continued to roll off its holdings of its mortgage-backed securities at an elevated level relative to its US Treasury holdings as being strategically deliberate. If the Fed ceased its wind down of its MBS holdings, I would suspect that mortgage rates would begin to fall again, encouraging a higher second derivative of house price growth.

Just looking at these four charts, we can see how stimulative monetary and fiscal policy has been to the economy.

It’s easier to catch flies with honey

The governments of the industrialized nations have made it abundantly clear that they intend to transform the world into a green economy and multicultural and multiracial kingdom. Regardless of this wildly expensive folly, the central banks will do whatever it takes to make it a reality. Do not fight the Fed and do not fight the globalist objectives. Wage earners and renters will continue to be pummeled from all directions.

Viewed from this perspective, those betting on lower stock prices and a housing crash will have to wait a long time as the global governments continue to spend the trillions of dollars they have estimated are needed to transform our lives into the desired outcome.

The globalists know that it is easier for us to embrace our grim and dystopian future if we can make some money off it. In this regard, AI stocks continue to power ahead and firms like Nvidia NVDA continue to ostensibly levitate, rather than move lower. If these stocks crashed in any meaningful way the whole AI thesis would be put in jeopardy. It’s much easier for the globalists to achieve their objectives when the slaves make money from their future servitude than the other way around.

Only the foolish would not take heed. It’s much easier paddling a boat downstream than up.

But I thought the Jews were God’s chosen.

White-Hating Invaders And Jews Don’t Even Hide It

World Jewish Supremacy And The Jewish Question

– Rense Video

https://rumble.com/embed/v4jr616/?pub=3brwhx

Oy vey

Argentina Inflation Snaps Milei’s Five-Month Slowdown Streak

(Bloomberg) — Argentina recorded the first monthly pick-up in inflation of the year, marking a slight reversal of the downward streak President Javier Milei put in motion with his aggressive economic shock therapy.

Consumer prices rose 4.6% in June from May, below the 5.1% median forecast from economists in a Bloomberg survey. Annual inflation slowed a notch to 271.5%, according to government data published Friday.

Utilities led all categories in price hikes as Argentines’ electricity and gas bills soared in June while Milei slashed generous subsidies that have allowed most households to pay less than 5% of the real cost of electricity for years. In doing so, the administration more than doubled energy bills for middle-class residences and set limits on how much poor households can consume while benefitting from the government assistance.

To maintain voters’ support and keep consumer prices in check in July, the libertarian leader postponed further increases to fuel taxes and utility prices that together would have added 1.2 percentage points to monthly inflation, according to JPMorgan Chase & Co.

Monthly inflation eased quickly from a three-decade high of 25.5% in December to 4.2% in May. A slow 2% monthly depreciation of the official peso following an initial 54% devaluation has helped keep price growth in check.

The need to keep a lid on inflation going forward is also the main reason the government refuses to budge on the rate of depreciation, despite growing signs the exchange rate is overvalued.

Since taking office in December, Milei has frozen nearly all public works and allowed pensions and public wage growth to trail inflation. The brutal austerity measures have taken a toll on consumption, construction and manufacturing, deepening a recession that is expected to reverse in 2025.

With inflation picking up, greater attention will now turn to the central bank’s benchmark rate, which Economy Minister Luis Caputo said last month would no longer lag behind inflation.

Later in July, the central bank will swap out its repo notes for new Treasury debt, which would become the monetary policy instrument. The move would free the institution to move to positive real rates without ballooning its liabilities.

©2024 Bloomberg L.P.

Go to the hospital to die…

Over 2,400 patients may have been exposed to HIV, hepatitis infections at Oregon hospitals

https://www.cbsnews.com/news/oregon-hospital-patients-exposed-infectious-disease-hiv-hepatitis/?ftag=CNM-00-10aag9b

Feeling HOT HOT HOT! Revisions up hotter, too.

PPI ex. Food/Energy/Transport (MoM) (Jun)

Act: 0.0% Prev: 0.2%

PPI ex. Food/Energy/Transport (YoY) (Jun)

Act: 3.1% Prev: 3.3%

Core PPI (YoY) (Jun)

Act: 3.0% Cons: 2.5% Prev: 2.6%

Core PPI (MoM) (Jun)

Act: 0.4% Cons: 0.2% Prev: 0.3%

PPI (MoM) (Jun)

Act: 0.2% Cons: 0.1% Prev: -0.2%

PPI (YoY) (Jun)

Act: 2.6% Cons: 2.3% Prev: 2.4%

Treasuries Wipe Out This Year’s Loss as Traders Bet on Rate Cuts

The market’s reaction to the Federal Reserve’s pivot toward interest-rate cuts this month has boosted expectations that would-be public companies may accelerate their IPO timelines.

(Bloomberg) — US Treasuries have erased this year’s declines as cooling inflation spurs traders to boost bets on Federal Reserve interest-rate cuts.

Bloomberg’s US Treasury Index has now gained 0.25% for 2024 after being down as much as 3.4% for the year in April when rate-cuts wagers were receding. Broadly cooler US inflation Thursday further cemented the recently growing conviction that policymakers will start easing monetary policy in coming months.

“We are at last seeing recent US data coming into bond traders’ favor,” said Nick Twidale, chief analyst at ATFX Global Markets in Sydney. “Comments from Fed officials will be even more closely monitored in coming weeks, but it does feel like the turn is now coming for Treasury bulls.”

US two-year yields, which are comparatively sensitive to the outlook for Fed policy, slid as much as 13 basis points Thursday to the lowest level since March after the June inflation report. Markets are now fully pricing in a rate cut in September, compared with odds of only about 70% before the CPI data were published.

The latest data was “excellent” and adds to evidence the central bank is on track to reach its 2% goal, Fed Bank of Chicago President Austan Goolsbee told reporters Thursday.

‘Little’ Upside

Still, some strategists remain cautious about the outlook for Treasuries.

The decline in longer-maturity yields is “overextended relative to fair value,” according to Ronald Temple, chief market strategist at Lazard Ltd. in New York.

While the Fed is likely to cut two-to-three times this year, the easing cycle will probably end with a federal funds rate of around 3.5 to 4%, meaning 10-year Treasuries offer “little additional upside in price terms from current levels,” he said.

The benchmark 10-year yield climbed one basis point Friday to 4.22%.

Others are more positive about the outlook for US sovereign debt.

This is “a much awaited moment” for US Treasury traders, said Shoki Omori, chief desk strategist at Mizuho Securities Co. in Tokyo. “Powell sounding dovish is firing up investors.”

Small caps nearly across the board are on fire after CPI data. ZPTA PSNL GTEC….

These growth oriented firms traditionally benefit from lower costs of capital. I need a few more thousand to recoup my higher than expected rehab costs in my latest all cash purchase.

SNOA is another stock I’ve been holding for a few days. It’s Zack’s number one

For those starting out with residential real estate investing, or for those looking for land, cut out the middleman and don’t sign a buyer broker agreement. They are not there to protect you and only make property searches more of a pain than they already can be.

Before signing this kind of contract with a real estate agent, read the fine print

https://amp.miamiherald.com/news/business/real-estate-news/article289860509.html

I have both looked at and purchased real estate through a buyer’s broker and at other times through the seller’s broker. Seems that it is easier just to go directly to the seller’s broker. This article is suggesting considering having your own real estate attorney, which I have thought about before also, but have not done as a buyer. Essentially I never trusted that realtors had my best interest in mind anyway, and felt that it was a purely monetary transaction on their part. I think I compare realtors to car salespeople.

On a separate note, I am getting ready to try to sell a property and Redfin doesn’t cover the area so I can’t use a Redfin agent (you suggested in an earlier post). Asked a realtor to do a comparative analysis, and the message he left with the number seems low. I suppose I could ask for more documentation about his decision. There’s no info on Zillow that would give me a Zestimate, especially since I bought it as raw land quite a while ago and then built on it. I have an idea of what I think it’s worth, from combing through the real estate ads daily for the last few years. It seems that I could get an appraisal, but it may take too long, as I have already lost ground getting it on the market this summer due to surgery. Additionally, how do you even find a good realtor? The one I found seems a little laid back, but maybe they can be laid back in this market. There are only two other properties only somewhat like it in the whole county, so I have rarity in my favor. Should I ask the realtor what their marketing plan is? Thoughts?

Tell the realtor what you think the property is worth and request to have it listed at the price you want. The realtor will usually do what you request. A few may resign, but that is rare. List it with the realtor and if it sits then just lower it. Realtors and appraisers can often misread the market, And this is especially true of appraisers. If you know the market then don’t hire Attorneys nor appraisers, they can just cost you unnecessary money.

Most Realtor marketing plans just involve an MLS listing. Zillow usually does all the heavy lifting now. Gone are the days of realtor brochures and paper listings magazine booklets and flyers.

Tell me something I Don’t know….

Which State Was Just Ranked No. 1 for Business?

Entrepreneur magazine

Virginia took the top spot on CNBC’s 2024 rankings of America’s best states for business. It’s the state’s sixth year at no. 1, a validation of its strong policies and infrastructure that spur economic growth. According to CNBC, this year’s rankings had its closest finish ever, with Virginia barely beating out last year’s winner North Carolina.

Virginia distinguished itself with an education system that has been recognized as the best in the nation and a nurturing business environment that boasts a balance of growth, accessibility, and strategic location, according to the list makers.

With 121 million people within a day’s drive and a towering presence on the internet—a staggering 70% of the world’s traffic flowing through Northern Virginia—the state’s reach is formidable. Governor Glenn Youngkin’s recent strategies, including initiating the construction of the U.S.’s first small modular nuclear reactor to address power needs, underscore the state’s commitment to maintaining robust infrastructure. In addition, the state’s readiness to provide sites for rapid corporate expansion emphasizes Virginia’s proactive stance in economic development.

Thanks to a 28% increase in state support for higher education and a strong K-12 system over the past five years, CNBC says the state sets an example for educational excellence. Bipartisan, proactive measures culminated in substantial new funding for schools and improved compensation for educators and state workers.

Virginia’s legislature, although ideologically divided, plays its part in sustaining the state’s economic dynamism by upholding a balance in tax policies that contributes to a competitive business cost structure. Republican Youngkin and state Democrats reached a stalemate in 2024 budget talks, and approved a plan that neither raises nor lowers taxes, reports CNBC. Governor Youngkin’s $74 billion capital inflow coupled with $5 billion in tax reductions propelled Virginia toward a more favorable economic trajectory.

It’s not all smooth sailing for Virginia’s ambitions, however, as the state continues to navigate the complexities of politics and economic challenges. Governor Youngkins’ attempt to seize major sports franchises for a new district fell through amidst political and fiscal scrutiny, highlighting that even the most successful strategies face their limits. “It was a real disappointment that the Capitals and Wizards ended up not coming to Virginia, but the reality is that stadium deals are hard, and we put together possibly the best stadium deal ever and still weren’t able to get it done through the General Assembly. We don’t win ’em all,” Youngkin told CNBC. But the overarching message remains clear: Virginia, through concerted effort and strategic governance, exemplifies what it means to create a thriving, business-centric state in today’s competitive landscape.

Virginia (and Gov. Youngkin) sound ideal. Congrats on choosing a great area to invest in!

Treasuries Rally as Cool Inflation Boosts Bets on Three Fed Cuts

(Bloomberg) — Treasury yields tumbled after benign inflation data restored wagers on at least two Federal Reserve interest-rate cuts this year.

Yields across the maturity spectrum declined by at least seven basis points, with two- to 10-year yields falling more than 10 basis points to the lowest levels since at least April. The two-year, more sensitive than longer maturities to changes in the Fed’s policy outlook, sank as much as 13 basis points to 4.488%, the lowest since March.

Derivative traders marked up the odds that the Fed will begin cutting interest rates in September to nearly 90% from around 70% before the data. For all of 2024, the contracts imply 58 basis points easing — at least two quarter-point moves — from about 49 basis points earlier.

“The data makes a September cut a slam dunk now,” said Andrew Brenner, head of international fixed income at NatAlliance Securities LLC. “You are going to get three cuts this year — September, November and December — and the market is starting to price that.”

The 10-year Treasury yield, which peaked above 5% last year after 11 Fed rate increases and has since retreated to around 4.20%, can return to 4%, last seen in February, Brenner said.

Ahead of the data, interest-rate options traders had been ramping up positions that would benefit from the market pricing in three Fed rate cuts this year. On Thursday, one such structure was bought in large size for about $2 million in premium.

The rally lowers the yield investors are likely to receive in Thursday’s auction, at 1 p.m. New York time, of 30-year Treasury bonds. The bonds traded at a yield of around 4.41%, down from a peak of about 4.54% since the sale was announced last week.

Auctions of three- and 10-year notes over the past two days were awarded at lower-than-anticipated yields, a sign of strong investor demand.

June consumer price index data showed a decline in overall prices — the first in years — and a smaller-than-anticipated increase for the core index that strips out food and energy prices, seeming to give the Fed some of the additional favorable data on inflation it’s been seeking.

“The preconditions for starting the cuts in September and messaging a sequence of cuts going forward are now in place,” said Ed Al-Hussainy, a rates strategist at Columbia Threadneedle Investment. “Everything is coming up aces for the Fed at the moment.”

Excellent data dump this morning. Double plus good for stocks and all other assets. I noticed that the most easily offended people are those who are supposedly self-described washed and saved people. We’re on our own. Keep doing what we’re doing until the force majeure!

Continuing Jobless Claims

Act: 1,852K Cons: 1,860K Prev: 1,856K

Core CPI (MoM) (Jun)

Act: 0.1% Cons: 0.2% Prev: 0.2%

Core CPI (YoY) (Jun)

Act: 3.3% Cons: 3.4% Prev: 3.4%

Core CPI Index (Jun)

Act: 318.35 Cons: 318.78 Prev: 318.14

CPI (YoY) (Jun)

Act: 3.0% Cons: 3.1% Prev: 3.3%

CPI (MoM) (Jun)

Act: -0.1% Cons: 0.1% Prev: 0.0%

CPI Index, n.s.a. (Jun)

Act: 314.18 Cons: 314.63 Prev: 314.07

CPI Index, s.a (Jun)

Act: 313.05 Cons: Prev: 313.22

CPI, n.s.a (MoM) (Jun)

Act: 0.03% Cons: Prev: 0.17%

Initial Jobless Claims

Act: 222K Cons: 236K Prev: 239K

Jobless Claims 4-Week Avg.

Act: 233.50K Cons: Prev: 238.75K

Real Earnings (MoM) (Jun)

Act: 0.3% Cons: 0.3% Prev: 0.4%

The CNBC talking heads and their partisanized guests are claiming victory. They claim real earnings are up and inflation is in the rear view mirror.

Keep doing what we’re doing as I have been instructing my readers and listeners for a decade now. Since 2012, on Henry Makow, I laid out the whole map in very specific terms. Back in 2018 I laid out the course to Dow 40,000. We’ve been there done that already. I talked about how the housing market would continue to move higher, regardless of affordability. That’s already in the rear-view mirror and it’s going to continue getting worse. GLTA!

I like $ZPTA at this level. It received an endorsement this morning from benchmark capital. I think it looks pretty good going out.

$PSNL looks interesting, too.

Debt to the Penny… As the last vestiges of the wealth consolidation phase wrap up before the force majeure, debt outstanding will go up almost exponentially.

$34,884,371,510,047.60

https://fiscaldata.treasury.gov/datasets/debt-to-the-penny/debt-to-the-penny

2027… Diversions abound regarding trivialities, while the meat of the substance continues unopposed. Keep crying racism and social justice. The stupidity is needed so the synagogue’s plans can be carried out.

Mohamed El-Erian Says Jerome Powell’s ‘Less Reassuring’ Inflation Remarks Stem From Audience Shift

Benzinga Neuro

The testimony of Federal Reserve Chair Jerome Powell to the Senate Banking Committee on Tuesday was less optimistic about inflation than his previous statements to central bankers, according to Mohamed El-Erian, the Chief Economic Advisor at Allianz.

What Happened: El-Erian took to social media platform X, to share his insights on Powell’s remarks. He noted that Powell’s written statement to the Senate Committee on Banking, Housing, and Urban Affairs characterized inflationary developments as “hav[ing] shown some modest further progress.”

This was “less reassuring” than what Powell had conveyed to other central bankers a week earlier, where he had mentioned, “the disinflation trend shows signs of resuming.”

El-Erian suggested that the change in tone could be attributed to the different audiences rather than a significant shift in Powell’s view.

Why It Matters: Former U.S. Treasury Secretary Larry Summers recently criticized the Federal Reserve’s optimistic stance on inflation, warning that the central bank is underestimating the long-term interest rates necessary to curb inflation. Summers dismissed the recent data indicating a slowdown in inflation as a temporary effect of post-pandemic price normalization.

Additionally, during his semiannual testimony before the Senate Banking Committee, Powell reiterated that a policy rate cut would not be “appropriate” until the Fed gains greater confidence that inflation is heading sustainably toward 2%. He stressed that reducing policy restraint too soon could stall or even reverse the progress made on inflation. Powell’s cautious stance aligns with his previous statements that an unexpected weakening in the labor market could lead to lower interest rates.

In a recent interview, El-Erian suggested that the Federal Reserve should consider a rate cut in July if the PCE inflation data is favorable. However, he expressed skepticism about the likelihood of this happening, pointing to disagreements regarding inflation dynamics.

El-Erian noted that the economy is slowing down more rapidly than anticipated, suggesting that the central bank should consider earlier and faster rate cuts.

Investors are eagerly awaiting the June Consumer Price Index report to strengthen their expectations of interest rate cuts. Despite Powell’s reiteration that it won’t be appropriate to cut the federal funds rate until policymakers obtain “greater confidence” inflation is heading unequivocally toward the 2% target, market expectations currently place a high conviction on a September rate cut.

Fed futures indicate a 71% chance of a rate cut at the Sept. 18 Fed meeting and factor in 50 basis points of rate reductions by year-end.

This story was generated using Benzinga Neuro and edited by Kaustubh Bagalkote

2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Romans 13 is an example of spiritual interpretation versus literal. The interpretation of the Holy Bible separates the spiritual Christians versus the cultural pretend Christians who interpret the Bible literally without the guidance of the spirit. Interpretation of the Bible requires the assistance and prayer with God. A couple of years ago on a similar site I wrote about why Romans 13 should not apply to today’s governments. Here is a remake of what I have written:

Satan knows the bible better than most Sunday Church goers because he uses it to determine God’s moves. There is NO DOUBT that any Satanic controlled government will throw this Roman 13 verse at us Christians to get us to obey their directives against God. Satan loves to twist the truth with deceit and lies to lead us away from God. He accomplished that with Eve by getting her to eat the forbidden fruit against God wishes. God’s adversary will push Romans 13 verse to get us to take the MARK OF THE BEAST , all sorts of deadly vaccines, and to give up our guns.

The HUGE question is should we obey Governments that work against God and for Lucifer?

Absolutely NOT because Romans 13 only applies when Governments are either good or incompetent and NOT set out to destroy you.

Here is Romans 13:1-14 on obeying authority (read it carefully):

Romans 13:1-14 ESV

“Let every person be subject to the governing authorities. For there is no authority except from God, and those that exist have been instituted by God. Therefore whoever resists the authorities resists what God has appointed, and those who resist will incur judgment. For rulers are not a terror to good conduct, but to bad. Would you have no fear of the one who is in authority? Then do what is good, and you will receive his approval, for he is God’s servant for your good. But if you do wrong, be afraid, for he does not bear the sword in vain. For he is the servant of God, an avenger who carries out God’s wrath on the wrongdoer. Therefore one must be in subjection, not only to avoid God’s wrath but also for the sake of conscience. …”

Paul assumed that rulers respected good conduct and doing good by the ruler equated with doing good by God. Paul assumed in Romans 13 that most rulers are servants of God. However, rulers today go along with Satan in direct contradiction to the loving God. Governments today want to destroy us and enslave us unless we go against God which will destroy us anyway.

One must also consider the historical aspect when Paul said this. Most of Roman authority left people alone if they did not openly speak against the emperor or important figures. That is easy to obey. Romans were required to respect the emperor as divine and Paul reconciled his Christian beliefs by justifying that the emperor was put there by the almighty God. Also Paul wanted to keep Christians out of harms way by sparing them the agony that the Jews faced in Jerusalem by revolting against the Romans. This is what Romans 13 was all about. It was directed to keep Christians out of the way of conflict while still being able to worship the almighty God and Jesus Christ. Romans 13 does not address the issue of being faced with a government that does the work of Lucifer and mandates you to go against Jesus Christ.

The Roman emperor did NOT force any MARK on people and did NOT force any DNA altering vaccines on people both of which will separate them from God. Yes, Christians were persecuted by the Roman authorities and that’s why Paul issued Romans 13 directive to reduce that possibility. The Christian martyrs of Rome were never forced to separate spiritually from God. In today’s end times we will be faced with a Government that will stop at nothing to separate us from God spiritually unlike the Romans.

Here is Hebrews 13:17

Hebrews 13:17 ESV

“Obey your leaders and submit to them, for they are keeping watch over your souls, as those who will have to give an account. Let them do this with joy and not with groaning, for that would be of no advantage to you.”

This verse assumes honorable leaders who look after the best interest of your soul and the leaders believe themselves to be held accountable. In todays end times we are dealing with leaders who DO NOT care about our souls and instead want to destroy our souls by distancing us from God. In addition, todays leaders feel they are not accountable to God nor their citizens. Why should a leader be accountable when he or she can win by stuffing ballot boxes in elections or get appointed without an election?

1 Peter 2:13 is similar to Hebrews 13:17

1 Peter 2:13-14 ESV

“Be subject for the Lord’s sake to every human institution, whether it be to the emperor as supreme, or to governors as sent by him to punish those who do evil and to praise those who do good.”

Again, this verse assumes leaders ultimately punish evil and promote good. In todays world that could not be further from the truth.

The above verses assumes that leaders are inherently good and promote order despite their human shortcomings. Now we are dealing with leaders who are inherently evil, promote evil, and work to distance us from God . The above verses DO NOT apply to an inherently evil leader who works against God.

Ultimately we should adhere to Acts 5:29 which really should guide us in these end times.

Acts 5:29 ESV

“But Peter and the apostles answered, “We must obey God rather than men.””

Ultimately we must obey God and not anyone else especially if that leader directs us to go against God.

It is our obligation as Christians to worship and obey God who loves us and not leaders who want to destroy us and distance us from our loving God. I would resist leaders who aim to destroy or impede our relationship with God. I would not recommend violent resistance if at all possible. Passive resistance is much more preferable and in line with what Jesus would do.

However, in these end times with a breakdown of justice and order, one may need to be aggressive for self defense and defense of loved ones if met with an aggressive offender or tyrannical authorities. Self defense is not a sin against a violent offenders. Your home is your castle. If you do not have a gun then get one ASAP and hold on to your gun if you have one. DO NOT give up your gun if the authorities ask you to turn them in. When the authorities ask for your weapons then that is a sure sign we are approaching tyranny.

You have a clear obligation to refuse any vaccine mandated by authorities that destroy your physical body and spirit. The USA has a lot of gun owners and that is what kept the government from forcing vaccines on us to the extent they did in Europe and Australia.

Whenever you are in a situation with authorities or in self defense the best action to take is to pray to God for answers. God is all knowing and looks after your best interests. So pray to God about dealing with tyrannical authorities or self defense. God will give you the best guidance.

For those who are the asset owners and want higher asset prices, it would be on our best interest to make certain the Democrats retain the executive branch power. The more wicked, Marxist, and degenerate the government, the higher asset prices will climb. If I weren’t a student of the Bible, I’d be voting Democrat across the board. Democrat regimes are very asset price friendly as the deficit spending is directed domestically and the heathen rage.

The people who have taken control of this former country are not Adamic people. Keep in mind that Cain settled in an area East of Eden, took a foreigner, and had a child and built a city. He even named the city after his son, Enoch. He even ruled the city.

This city must have had a sizeable population for it to even be a city. Where did all these people come from? Whom did Cain have sex with? Clearly, this means that there were other people on the planet beside Adam, Eve, and Cain at the time. Yahweh promised Cain he would protect him from being killed. But who would kill Cain? Clearly, there were other people on the planet not descended from Adam and Eve.

I submit that the foreigners from back then are the foreigners of today. Nothing changes. These non-Adamic people are now in control of the government and the heads of the synagogue of Satan are descended from Esau. Even worse, these non-Adaamic people are formulating a strategy to destroy the Adamic people.

Amen. Hit the nail on the head. There had to be other humans besides Adam and Eve that were probably corrupted by satan. In fact, the Satanists claim that Satan fathered children with Eve and Cain may have been one of them.

The Bible and its narrative pertained to Adamic man. I would have to suspect that many remants of these other peoples may have survived the flood and remain today.

Correct. Some of the giants survived the flood. Goliath was a giant Philistine. Then there were the Amorites in Deuteronomy who were supposedly much larger than the Israelites.

Not just them. Other human forms.

A good and researched nonfiction on the topic of subterranean existence is called Gods With Amnesia, by Robert Zepehr….making is quite conceivable that other civilizations survived.

https://www.amazon.com/Gods-Amnesia-Subterranean-Worlds-Inner/dp/194349407X/ref=sr_1_1?crid=12X5O0GRF2LU3&dib=eyJ2IjoiMSJ9.Upck3ZunyLyo6ixKG0TXcdEbiFRUEvgnn2ihQXxZmKNtmzHEKVS5gB6TsLG56Pz0HWuUQQ7zqP-7bPsqkBgBV5Fu2zA0TK19NMU8441vpTN1dc3ysKDXbM_o6HuHZGeCxfIkNdXw2F8IVSz1ERanMjMRLWBJSHZN51QXypun7xeiXZYF_XQjdanBW2IPhQTvacMfFquejOQeH6nDSTTH83o3G9GFUVT_ZLmU_8H8cJx1uEgR97PqUFuOFsKV3FFKdT3YfJ3boXA7_lSYKwPCa8gtMHKt7sGCEU2nG6LUqS4._MEngLBdy7QbpPDwgjEhBNBKeG74qRHJ93Bq6aPvsv4&dib_tag=se&keywords=gods+with+amnesia&qid=1720557681&sprefix=Gods+with+am%2Caps%2C289&sr=8-1

To respond to your rhetorical question, the pastors during Covid were busy complying with the government so they could keep their 501c(3) status, at the expense of their flock. Jesuit “Pope” Francis stepped it up a notch, and told the world it was their moral duty to get the injection. And you are right, they remain silent on the suffering and its causes. By default, their silence is complicity, and they work for the SOS.

Like you, my husband and I were both healthy prior to covid, and took care of our health, took supplements, ate right, and took no medication of any kind. He now has heart problems and has to be on medication, and I am now trying to recover from painful foot surgery for bone spurs caused by arthritis. I will never prove it, but I attribute these conditions to shedding from one of our adult daughters who was with us visiting and took the vaxes despite my constant pleading not to. And she still doesn’t hear anything I say about this now, despite the evidence I present her, like the Mercola article I posted previously.

You are right that it will be impossible to comply and receive salvation, since the great reset will require the mark of the beast. We can read all about our fate in Revelation. I am already trying to prepare myself mentally for that time (difficult to wrap my head around), so I pray that I have the grace to resist. When they finally come for me, I want to make it counts on the way down, pronouncing that I am dying in the name of Christ. I am certainly open to survival strategies if anyone has some brilliant ideas, but I think at the end of the day prepping will be futile. You might be able to run for a while, but not hide (especially since a digital prison will be closing in on you)… and I just don’t know how else we will get out of this mess with our souls intact, without essentially becoming a martyr. And the irony is that this all sounds like loony tunes to the basic churchgoer today.

As the apostle Paul says, obey the governing authorities for what they do is ordained by God. Take the injections and do what we can do to get along, for Paul says it’s futile to fight against the power. In fact, Paul says that not obeying is damnable. Wow! Thanks Paul. That won him points in Rome.

Quoting Romans 13 was the common refrain in the churches 3-4 years ago during the injections campaign.

After the 9/11 government psyops, DHS had training seminars with pastors and priests nationwide demanding the churches obey the government in return for government money. Of course, the Feds strategy centered on Romans 13. These DHS con men told the pastors to tattle on those in their congregations who may look seditious. Today, that means being white supremacist, anti-immigration, xenophobic, anti-abortion, against miscegenation and such.

After the Great Reset we will have to be PC, take our injections, agree to a whole list of abhorrent commands,and perhaps eventually take the mark.

The whole time, the 501c3 pastors and Catholic priests will keep quoting Romans 13.

The Jew synagogue loves quoting Paul. If Paul never wrote Romans 13 the American Laodicean nation would be more resistant to this Jew synagogue end time evil. Instead, the congregations just sit back and relax and go to the voting booths and watch Fox. The whole time the Laodiceans will keep being reminded of Romans 13 while they eat themselves to death and keep looking to the government for answers.

Don’t fight the power.🤣🤣🤣

In this subtitled video you will have the clarification to Romans 13. FF to 8:31 and start reading. https://www.youtube.com/watch?v=1onoE6fzZUU

It is actually worth seeing the entire 24 min presentation as it contains a lot of good information and clears up many misconceptions people have about Christianity.

I have studied the ramifications of Romans 13 for over 20 years. The problem is how it’s interpreted on a de facto basis. How does the typical church interpret it? Worse, the modern Bible versions make it seem like a government propaganda piece. Even the Nazi regime used it for its convenience.

Matthew 22 suits me just fine. The Gospels are enough. I am not here to look to government as my ally, nor am I here to look to it favorably. I honestly detest government, especially the current government of the US, because it’s become pure evil, but follow the simple words of Christ. That’s all.

I pay my taxes, but pay hardly anything via my understanding of the IRC. I would never earn W2 income for instance. That’s how much I hate my government. But based on today’s erroneous interpretation of Paul, this is misguided. I should just have love and joy.

The IRS even supported its 501c3 status for churches with a shout out to Romans 13. Now, the churches today are essentially propaganda arms of the government. All of them. Gone are the churches that correctly interpreted Romans 13 and were rightfully encouraged to separate from Britain and undo the shackles of ungodly servitude. That’s all history now. Today’s churches use Romans 13 to justify their flaccid behavior and support of the current state of governing affairs.

Even worse, evil forces exploit government power via the use of Romans 13. Or at least they did. The evil that I talk about worked for decades to remove the Bible from the schools and government. Now, the Western world is so far removed from any biblical teachings that Romans 13 is not even an afterthought. Worse still, Romans 13 is barely mentioned in the end time Laodicean churches.

The supposed Christians of today don’t even have Romans 13 in their consciousness. That’s because today’s Christians are functioning retards. They did up to about 20 years ago. The synagogue of Satan used Romans 13 against the Christian masses to spread its evil across the West while Christians fussed over the deep and esoteric meaning of Romans 13.

Some nice numbers. Hourly earnings comes in as expected, but unemployment rate ticks up a tenth….

Average Hourly Earnings (YoY) (YoY) (Jun)

Act: 3.9% Cons: 3.9% Prev: 4.1%

Average Hourly Earnings (MoM) (Jun)

Act: 0.3% Cons: 0.3% Prev: 0.4%

Average Weekly Hours (Jun)

Act: 34.3 Cons: 34.3 Prev: 34.3

Government Payrolls (Jun)

Act: 70.0K Cons: Prev: 25.0K

Manufacturing Payrolls (Jun)

Act: -8K Cons: 6K Prev: 8K

Nonfarm Payrolls (Jun)

Act: 206K Cons: 191K Prev: 218K

Participation Rate (Jun)

Act: 62.6% Cons: 62.5% Prev: 62.5%

Private Nonfarm Payrolls (Jun)

Act: 136K Cons: 160K Prev: 193K

U6 Unemployment Rate (Jun)

Act: 7.4% Cons: Prev: 7.4%

Unemployment Rate (Jun)

Act: 4.1% Cons: 4.0% Prev: 4.0%

Once again, the Household survey disappoints and this is the reason why the unemployment rate rose to 4.1% from 4.0%.

While the civilian labor force rose 277k, the number of unemployed rose 162k, and that was definitely higher than consensus. The number of unemployed in the Household survey continues to tick up.

The number of employed rose 116k.

The result is a participation rate that ticks up to 62.6%. this is also why the unemployment rate takes up to 4.1%.

Once again, we see overall relative weakness in the Household survey versus The Establishment survey.

https://www.bls.gov/news.release/empsit.a.htm

Bonds and stocks should both like all of these numbers. Weakness prevails and helps bolster the dove’s case.

I received this quick YouTube short link on apeel, the spray back by Bill Gates for vegetables and fruits. I found it interesting. It’s only about a minute long. This gentleman reviews which stores are and aren’t using it.

https://youtube.com/shorts/poVs-E9NS3o?si=EhKGYZOe0oaNiF7p

Lane Says ECB Still Has Some Concerns About Domestic Inflation

Jana Randow

(Bloomberg) — The European Central Bank isn’t fully convinced that price pressures generated in the euro area are sufficiently contained, according to Chief Economist Philip Lane.

“What we can mostly influence is domestic inflation” because “the ability of European firms to raise prices depends on monetary conditions,” Lane said in a lecture in Naples, Italy. “This goes back to why we still have some concerns. Domestic inflation is lower than at the peak around a year ago, but it’s still about 4%.”

The remarks come after policymakers including President Christine Lagarde signaled that July is probably too soon to lower interest rates for a second time, as more data are needed to show inflation is on a sustained path back to 2%. Strong wage increases have fed services costs in particular, keeping officials on edge.

Lane told Bloomberg TV this week that the latest inflation data won’t provide answers to the ECB’s lingering questions on underlying price pressures. The debate at this month’s Governing Council meeting will focus on the “economic side,” he said.

In Naples, he expressed optimism that wage growth will normalize in 2025, highlighting surveys among companies and forward-looking gauges.

“The reason why we think inflation will come down next year is that this is the last year of high wages,” Lane said. “Wage increases will look more normal.”

Seems crazy to me that people think they should worship other people over the God that created them and the Catholic Church seems firmly rooted in as part of the synagogue of satan. https://6abc.com/post/video-gaming-teen-become-catholic-millennial-saint-pope/15019268/?utm_source=stocks-and-income&utm_medium=newsletter&utm_campaign=jpow-is-just-making-stuff-up-now

Not to say I’m an expert when it comes to who should be a saint, but this seems like a stretch beyond anyone’s imagination.

Meanwhile, here is an example of a saint. Yesterday marked 30 years since the canonization of Archbishop John of Shanghai and San Francisco. His entire life was devoted to God. He was also a monk and a strict ascetic doing Christ’s work in this fallen world. I was at the canonization ceremony in SF with my grandmother. His relics were found incorrupt after his repose in 1966. You can read about him here https://orthochristian.com/97771.html

You understand nothing of the Catholic doctrine of saints. Saints are basically intercessors with God, since Catholics feel they aren’t worthy to treat with God directly!

I was raised Catholic, am very familiar with its traditions, and finally left that religion in 2004. I know all about that church and my only recommendation to my readers is to leave all religions. Religions are the stumbling block to an open mind and the truth of scripture. I have to suspect that the Christian Bible would be somewhat different if it weren’t for the Catholic church’s early formulation with the assistance of the Jews of that time. I left the church after becoming saved and studying the Bible in earnest. Most of the traditions of the Catholic Church are extra biblical.

That particular church wIll instruct us how to take care of our Bibles and how to store them properly, it will instruct us to refer to a priest on its interpretation.

My piece of advice is to cut out the middle man and go directly to the source. Don’t do Google searches either, except for specific pieces of information. Google gushes over Paul and trashes John. If I were to pick one over the other, it would definitely be John. Peter, and James, and those who personally knew Jesus. The Jew versus gentile question has completely rendered today’s Church an ineffectual empty vessel.

The Jews of today want the church to refer to Paul, as this intimates that the Jews are the physical Israel and God’s chosen. This is all Scofield and the Catholic Church sits on its hands.

This, of course, is what I refer to as the Laodicean church. They obsess about trivialities while the entire structure Burns to the ground.

Even church history going back subsequent to the death of Jesus has been altered. Moreover, how can we prove it anyway? The entire church takes church history as gospel. Unfortunately, the Jews and synagogue of Satan for the past 2,000 years have worked diligently to destroy and rot the church from within. Most are terribly contaminated and have been deceived.

That’s just the way it is and that’s the way it’s supposed to be. Just read Hosea for a glimpse of what the last days look like. Except for Psalms and proverbs, 95% of the church has been permanently severed from understanding any Scripture prior to Jesus’s life. What a sad State of affairs. Whenever I discuss these matters, I’m always refuted by those regurgitating the kosher version of the church. The Catholic church and its Protestant offshoots just give me kosher products. They like to serve up Hebrew National hot dogs. The reason for this is simple, most are too scared to deviate from church hierarchy. The simple believe they’ll be damned to hell if they do.

I don’t think Jeremiah is your enemy, nor calling him out avails us anything, except to indicate that virtually the entire church is stuck in neutral, dedicated to their religions.

Honestly, I don’t believe you or anyone here commenting is trying to insult other people’s religions….but I came to the same painful conclusion about the Catholic church and it took me a while to process it and extract myself from it, and also from Protestant churches I have been a member of prior to joining the Catholic church. It’s incredibly lonely to take this path as a Christian. One book I read recently and I recommend, that helped me dig more deeply on the truth you write about, and how we are being manipulated by untruths today, is called Priestcraft, Beyond Babylon.

From the Amazon description:

Priestcraft: Beyond Babylon is a close look at the origins of ancient cults, their practices, and their continued influence on the world. It’s a feat of historical forensics, data gathering and puzzle solving to identify who They are. Everyone refers to they but seldom if ever are they given a name. Using history to establish a trend of common activities, patterns emerge, and what’s know as Pattern Recognition helps to see the true intent of world influencers. Are the leaders of countries unified under secret oaths, and ancient cult beliefs? We pick up where William Cooper left off with Behold a Pale Horse and his radio broadcast, The Hour of the Time as we explore Mr. Cooper’s work and apply it to what has unfolded since his murder in 2001. For some this will be an introduction to Bill. To others, it’s a reminder of an old friend who tried to warn us. Until we understand the true nature of what is being done to us, and by whom, we cannot help but be its victims. This is a call to the parents out there, to the noble, and to the brave. Educate yourself and others, and don’t be fooled by this Age of Deception in the Aeon of Horus. This book covers the Priestcraft from Sumeria to present, and establishes a common thread from Babylon to the Ba’al cult to the Freemasons. It also provides data on the Hospitallers, Knights Templar, and UN overseers: Knights of Malta. It covers the Sabbatean-Frankists, the Jesuits, and their connection with the Perfektiblisten AKA, the Illuminati. What role do BlackRock, Black Cube, and Kaaba and the Black Stone play? The Dome of the Rock and the Zionist End Times obsession? Find out all this and more!

Since I don’t have a job I have plenty of free time, I read about this continually and it is sad and sobering to watch all the churches go down in flames. It is truly lonely to take this route as you will not get confirmation from anyone. You will truly be on your own and for those who can’t handle it, I recommend running back to the church, any 501c3 charitable organization will do.

It is very difficult to be able to live a life like this. As for anyone who takes the route I have taken, I pray for you and hope the God Jacob Israel looks out over after you. I pray for my people, my kind of people, and my local people. I pray more for my small base of readers than I do for my wife. In that regard, I just pray for peace and quiet in my household. The United States that you and I know is no longer in existence. I don’t pray for the world, I pray for you individually, Sara, and for the few others who are truly seeking out the truth. It is so incredibly difficult in these last and final days. All the churches have become a fraud.

As O’Brien told Winston that the goal of the new speak dictionary was to be only one page long, I reckon my subscriber base will be eventually one page long. Those who listen to my recommendations will continue to do well. of course there are other echo Chambers for the rest. The ship is sinking and I suggest you learn as much as you can, because we only have a few years left.

Thank you for your prayers. I pray for you too, and also appreciate the few people like you who selflessly speak out. It makes me feel a little less alone amidst the darkness of the lies and deception we find ourselves in. And the institutional church is no longer the light on the hill. (Thought: perhaps WE are the scattered remnant “church,” not confined to four walls.) I think that at the end of the day it comes down to either the few voices in the wilderness, or the popular (and controlled) voices. I tend to distrust those with the biggest followings at this point. In terms of people being offended by your words – nobody has to read your words, nor are you asking anybody to agree with you. And I do think our adversary wants us to be offended. (Maybe readers can agree that we might at times disagree and it’s OK. There are so few of us now, it seems pointless to dicker about where the deckchairs are placed while the ship is sinking.) I don’t know it all, but I can read and study the times and the book of Revelation, and know it’s not good. But I also believe Gad placed us here for a reason, at this time and place. Author Gary Wayne calls us the Terminal Generation. Terminal Economics for the Terminal Generation. Thanks for all you do and God be with you.

I have no choice but to disagree with your take on the Catholic Church. And Jeremiah simply has said wrongly about the Catholic Church. There are a lot of things wrong with the current Catholic Church, but I have no doubt about the veracity of Her dogmas. “Extra biblical” doesn’t mean anything, when even Paul mentions there are a lot of other teachings that were not written! But I’m not here to argue for the Catholic Church: I am just here to refute certain false narratives. You can disagree all you want, but I won’t tolerate seeing false representation of Catholic dogmas.

I’m sorry this has angered you so but also not sorry as I have experienced firsthand time and time again that Catholicism steers most people away from Jesus and not towards him and we our called to share the Gospel.

There are so many things that Catholics are taught to do that we are explicitly told in the Bible not to do. https://www.bible.ca/cath-overview-false-teaching.htm

No, Jeremiah, you just misinterpret the Bible according to your erroneous views. The Catholic Church has taught true and all you’ve been fed is lies about the Catholic Church. If you get the Catholic teaching about saints wrong, how am I supposed to believe you, who is a mere person? How is your teaching correct and mine wrong?

Being born and raised Russian Orthodox, I have a hard enough time keeping up with that much less commenting about Catholics. But I know a little. In our church a Catholic does not have to be baptized Orthodox in order to marry. Although it is recommended they do, it’s not required. This is not true for just about any other religion. And any marriage outside the Orthodox church is not recognized.

I once had a conversation with an older man from Australia who was raised Catholic and all was relatively well for him until Vatican II transformed the church in 1968. That’s when he noticed a big difference in how church services were held. He became an Orthodox convert because of this and because the Orthodox never went through such a change. When I visited Italy in 2001, and went into some Catholic churches, I was very impressed and surprised to see they were so similar to our Orthodox churches. There were icons, no pews, candles and possibly an alter screen. Remember there was only one Christian church started by Christ. The schism of 1054 was the major division between east and west because of the papacy and altering the creed. Still, the ancient Catholic and Orthodox teaching is as solid as it gets. It’s the much later created Protestant churches that seem to be the issue. The Catholic church may not be what it was and had more than their share of scandals. Not allowing priests to marry is a main issue as I see it form the outside. Of course if one is to be a monk then that’s a different set of rules.

It’s sad to see how Christianity is perceived in the world. The mega churches and those who have watered down Christ’s Church to the point it’s become a tool for dividing is heretical to the core. And no, you can’t simply go it alone with the bible in hand.

What people see and what is popularized in the media is disgusting and wrong on so many levels. Christianity is aligned with just about every thing that is wrong with the world. This is of course by design. And even worse, people take the bait! Those who slam Christianity are the same group that boasts about kindness and all that. Wasn’t Christ the first to say hate the sin but not the person committing the sin? Isn’t Christ the only truth that has been revealed to mankind?

Great little web page there. Thx

And not all of us go for the kosher version, although we are fewer than even the traditionalist element, which unfortunately has been kosherized partially. I’ll gladly take help when we are defending against the SOS and attacking it, but concerning religious matters, that’s different.

Yes. You are obsessed with your particular religion. It’s not the Bible per se.

You make that argument perhaps because you left the Catholic Church without ever understanding it. “Obsessed” with my religion because I believe Jesus established it, on His authority, on the rock of Peter? Guilty as charged. If you want to argue religion here, I’m fine. But don’t tell me there’s no biblical basis for Catholic doctrine!

Stop. This is exactly what I’m talking about.

Why did you censor my previous 2 last replies, Stone, while you allowed Jeremiah to continue attacking the Catholic Church? Is it because you’re bitter toward the Catholic Church?

Because you’re sounding like a little baby and you’re just bullying readers. Go to a Catholic echo chamber and leave this blog alone.

The Rock is Jesus Christ himself.

Jesus gave Peter the Keys to the Kingdom. Jesus is that Key The Gospel The way to Salvation who is the truth and the life.

Upon this Rock I will build my Church. Jesus was referring to himself as the Rock and The Church being his Bride the body.

With all due respect, Stone, you will alienate a part of your audience by being anti-Catholic. What’s more important to you, maligning the Catholic Church or getting out your economics message?

I’m maligning all organized religions as they are all, without exception, not warning any of their congregations of the unfolding tragedy. The pale and black horses have already appeared and are running rampant. The reader may already believe the book of Revelation has already occurred, but there was a bunch of needed technology in order for that to happen. Moreover never before have all the tumblers in the lock lined up like today. The churches are killing billions of people worldwide as we speak through their silence and diversions. Obsessing about trivialities. Jesus said they strain at gnats and swallow a camel.

As for alienating my readers, I gave up a career, because I could not reconcile what I saw, even as an unsaved man. I currently have 52 subscribers. My wife is Jewish and I had to redo my website under this pseudonym, lest my life ends in divorce. I married her out of stupidity and physical attraction and I am paying the price. I have studied so much regarding all organized religion and it is a killer to so many people.

I have alienated everyone and preach to an empty building, just like Jeremiah, the prophet.

But traditional Catholics are not your enemy. They agree with much of what you say.

Exodus 20: 3-17 is Gods law. Then there is the official Catholic version being cemented into law starting in Louisiana. There will be a fight taken to the Supreme Court and decided by a majority Catholic Judiciary. Which version of Gods law is correct? It cannot be both. This is a primary issue in this spiritual war and the deception is deep so pick a side.

The only reason I would unsubscribe is if Gods law AS WRITTEN IN EXODUS is no longer supported by this website.

There have been probably tens of millions of people in the United States that have had their lives permanently altered, because of covid and the injections. I never had any health issues until about 2 years ago and I’m now dealing with painful psoriatic arthritis, an autoimmune disorder. This stuff was never even on my radar screen.

My wife got injected like the typical asshole and she also gave me covid a couple years ago. Not one person in my inner or outer circle cares to listen to anything I have to say. And this includes a bunch of Catholics who are as stupid as can be. They can all go straight to hell, where I assume most of them will end up anyway.

Where are the pastors and priests when we need them? The churches are dead and the people are suffering. The suffering will continue to get worse all decade and all the churches will remain quiet. High level Masons run all the levers of power and the synagogue of Satan powers Freemasonry. The problem with the Catholic Church is that it’s so conducive to being managed by evil. It’s just in its nature.

The book of Revelation is unfolding as we speak and most churchgoers have been told 1) John didn’t write revelation and that the books attributed to him were written in the second century, 2) the events in Revelation already took place, 3) not to worry as we’ll all be raptured out.

The simple pass on and are punished. God says that those who believe lies choose to believe them. It’s much more convenient to get along. It will be impossible for true remnant Christians to live on the other side of the Great Reset. Our life choices on the other side will demand too many compromises for a person to receive salvation.

In terms of your broader point that all churches are not addressing the “unfolding tragedy,” found this bombshell Mercola article this morning. New research indicates that 73.9 percent of post-covid vax deaths were related to the shots.

https://articles.mercola.com/sites/articles/archive/2024/07/05/post-covid-19-vaccination-deaths.aspx?ui=4760b327dd93ecda4e2eaccb3e1a46f2b35c97ddad710d526807cbf528f4b6bc&sd=20220905&cid_source=dnl&cid_medium=email&cid_content=art1ReadMore&cid=20240705_HL2&foDate=false&mid=DM1597127&rid=65023366

As a result the officials put Jeremiah into the miry pit. Mixture of mud and clay for being a Truth teller.

My old site is going offline permanently. The server services expired yesterday. Do people listen to shortwave anymore? I used to do that shortwave show, but that was close to a decade ago. Note to self, don’t buy stock in shortwave companies. 🤣

There are so many stupid podcasters now. I log on to YouTube on my TV and it is populated with housing and economic experts. Of course, they are all wrong. Worse, the Christian experts are all wrong.

Also, even during their lifetime, the Apostles like Peter and Paul, were asked by people, including Christians, to help them in their need, like healing the sick or raising the dead. Were they thinking Peter and Paul were gods?! This argument is frankly laughable!

When will the Fed stop QT?

Clogged Bank Balance Sheets Cause Key Repo Funding Rate to Spike

(Bloomberg) — A key rate tied to the day-to-day borrowing needs of the financial system hit the highest level since the beginning of the year as chunky Treasury auction settlements and clogged primary dealer balance sheets curbed lending capacity.

The Secured Overnight Financing Rate spiked seven basis points to 5.40% on July 1, according to Federal Reserve Bank of New York data published Tuesday. That matches the highest fixing in the six-year-old benchmark reached on Jan. 2 and and Dec. 28.

The return of such swings in SOFR is largely thanks to the Federal Reserve, which is still removing liquidity from the system via quantitative tightening, or QT, albeit at a slower pace with the intention to reduce potential strains on the market.

Still, that’s reawakened volatility around key quarter-end funding periods as seen last week, when banks tend to pare repo activity to shore up balance sheets for regulatory purposes and borrowers either find alternatives or pay up. At the same time, the glut of government debt sales means more collateral needs financing from the repo market.

“This might be the new normal and explains why the Fed reduced the cap on runoffs,” said Subadra Rajappa, head of US rates strategy at Societe Generale SA. “Record coupon issuance sizes and bond settlements, primary dealer holdings near highs, so ultimately balance-sheet constraints. This feels more like what we saw year-end and repo might take a few days to normalize.”

While the latest move is akin to the turmoil seen late last year, it’s far from the extremes experienced in September 2019 when SOFR more than doubled overnight. Yet the indicators that warned of strains in 2018-2019 have started to re-appear. Dealer holdings of Treasuries are near all-time highs and overnight repo rates continue to creep up. As a result, it has taken overnight rates and by extension SOFR, which is calculated from repo data, longer to normalize after auction settlement days.

Still, there are backstops put in place to address potential strains in funding markets. Sponsored repo, which allows easier access to financing sources, is in place, according to Barclays Plc. Volumes in sponsored repo have more than doubled since the market blowup in 2019, and reached a record $1.22 trillion as of June 28, before dropping to $1.2 trillion on July 1, according to Depository Trust & Clearing Corporation data.

There’s also the Fed’s Standing Repo Facility, which allows eligible institutions to borrow cash in exchange for Treasury and agency debt at a rate in line with the top of the Fed’s policy target range. This has helped put a ceiling on repo rates, though questions remain on how it handles moments of stress.

Ultimately, this is likely a harbinger for what’s to come, especially as Treasury will likely have to eventually ramp up issuance to fund growing US deficits, making funding strains more acute.

“Stopping QT would help prevent the background from deteriorating further, but I don’t think stopping QT would materially improve the environment,” said Gennadiy Goldberg, head of US interest rate strategy at TD Securities. “It’s really a function of the cost of cash starting to rise somewhat as we go from extreme abundance of liquidity to a more ‘normal’ environment.”

Shift Occurring in US Housing Market as Mortgage Lock Loosens Up

(Bloomberg) — More older lower-rate mortgages are being replaced by newer borrowing with higher financing costs, gradually pushing up the average loan rate for US homes, Intercontinental Exchange Inc. data show.

Four million first-lien mortgages originated since 2022 have a rate above 6.5%, and about 1.9 million these have a rate of 7% or higher, according to the ICE Mortgage Monitor Report.

“As of May, 24% of homeowners with mortgages now have a current interest rate of 5% or higher,” Andy Walden, vice president of ICE Research and Analysis, said in a statement. “As recently as two years ago an astonishing nine of every 10 mortgage holders were below that threshold.”

The active mortgage market is gradually shifting as people age out of their homes, retire or experience a life-changing event that compels the sale of a home with an older, lower-rate loan.

“All in, there are 5.8M fewer sub-5% mortgages in the market today than there were at this time in 2022,” Walden said. “This has been a slow-moving change, as borrowers with lower rates have sold their homes or, to a smaller degree, refinanced to withdraw equity.”

A greater share of homes with loans closer to the prevailing rate will likely spur more churn in the real estate market as more people become willing to relocate for a job or other opportunity, and less fearful of losing a fixed-loan rate mortgage.

Homeowners with a mortgage closer to prevailing rates will also likely boost the refinance market when the Federal Reserve starts cutting rates later this year as expected.

©2024 Bloomberg L.P.

Jerome Powell Speaks

Released On 7/2/2024 9:30:00 AM

Highlights

In his first comments in the ECB panel, Chair Jerome Powell offered that the FOMC “has made quite a bit of progress” in getting back to price stability and the FOMC’s inflation objective of 2 percent. He added, “We want that progress to continue” and that the recent data “do suggest that we are getting back on a disinflationary path.” Nonetheless, Powell maintained that Fed policymakers “want to be more confident” before loosening monetary policy. Confidence could follow if policymakers “see more data like that recently” reported.

Powell acknowledged “really significant progress” in bringing inflation down, but also that policymakers want to be sure they are seeing the “true level” of inflation. With modest expansion and a healthy labor market, Powell said the FOMC “has the ability to take its time” to decide about the next steps in monetary policy.

Powell outlined the risks facing policymakers: “We are well aware that if we go too soon” that progress on inflation could be undone, and that “if we go too late we could undermine the expansion,” Powell said. He added that the risks are much more in balance.

Powell said, “We don’t’ see ourselves getting back to 2 percent inflation this year or next year.”

Thoughts on GAME? Seems to be getting some movement this morning.

Volume seems low. I would like to see volume pick up. I don’t see any news on it since the 26th.

Is there something you see?

Someone recommended this guy’s newsletter to me and he was pumping it up a bit – https://bullseye.beehiiv.com/p/jerry-jones-big-bet-need-know?utm_source=bullseye.beehiiv.com&utm_medium=newsletter&utm_campaign=jerry-jones-big-bet-what-you-need-to-know

Interesting. Maybe it’ll run if this guy has the following. He’s not really saying anything new, but it could pop higher. It’s already hit the $1.40 short-term Target.

New ATH for US public debt outstanding, according to debt to the Penny.

$34,831,634,431,393.47

Look at this one it shows debt in real time. Rising $100000 every 3 seconds

https://mail.usdebtclock.org/

UK Yield Curve Inversion Ends as BOE Rate Cuts Come Into View

James Hirai and Greg Ritchie

(Bloomberg) — An anomaly that has plagued the UK bond market for more than a year ended on Monday, with the 10-year yield rising back above the two-year.

The move restores what is considered to be a normal state of affairs, and shows investors are pricing an end to the era of tight monetary policy that had distorted rate markets.

Ever since May 2023, two-year notes have yielded more than 10-year securities. That’s known as an inversion, because it upends the traditional relationship between long- and short-term rates. It comes as the Bank of England drove up borrowing costs to a 15-year high last year to quell inflation.

The BOE is expected to start easing policy as early as August, with odds of a quarter-point cut next month holding close to 55%. The market is pricing a high chance of one more additional reduction this year, bolstered by data that showed consumer prices in May slowed back to policymakers’ 2% target.

Inline numbers on the data. Looks good to me….

Core PCE Price Index (YoY) (May)

Act: 2.6% Cons: 2.6% Prev: 2.8%

Core PCE Price Index (MoM) (May)

Act: 0.1% Cons: 0.1% Prev: 0.3%

PCE Price index (YoY) (May)

Act: 2.6% Cons: 2.6% Prev: 2.7%

PCE price index (MoM) (May)

Act: 0.0% Cons: 0.0% Prev: 0.3%

Personal Income (MoM) (May)

Act: 0.5% Cons: 0.4% Prev: 0.3%

Personal Spending (MoM) (May)

Act: 0.2% Cons: 0.3% Prev: 0.1%

Real Personal Consumption (MoM) (May)

Act: 0.3% Cons: Prev: -0.1%

Treasuries Advance After Key Inflation Data Matches Expectations

(Bloomberg) — US Treasuries rose after the Federal Reserve’s favored gauge of inflation decelerated as economists expected, bolstering expectations for interest-rate cuts starting this year.

The yield on two-year notes fell about 2 basis points to 4.685%, while 10-year yields declined 1 basis points to 4.27%. Swaps traders expect around 45 basis points worth of rate cuts for the year, with a quarter-point reduction fully priced in by November.

The so-called core personal consumption expenditures price index, which strips out volatile food and energy items, increased 0.1% from the prior month, marking the smallest advance in six months.