The end of the road

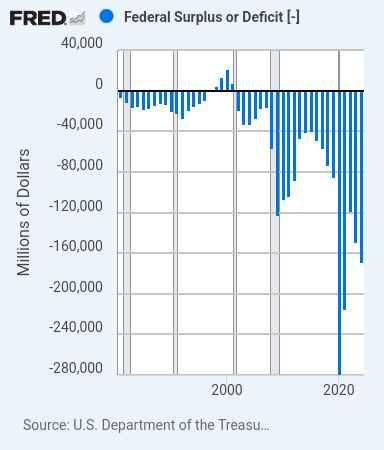

Long-term readers already know that QE is not a viable option for fiscal deficit spending when inflation growth remains above trend. This leaves the federal government left to the traditional debt markets to continue financing its ever larger deficits.

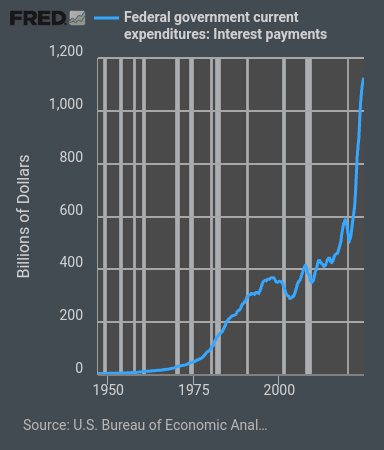

As you can see from the accompanying chart, the federal government’s interest outlays continue to skyrocket and are not sustainable for even more than a couple more years, regardless of the demand for Treasury securities.

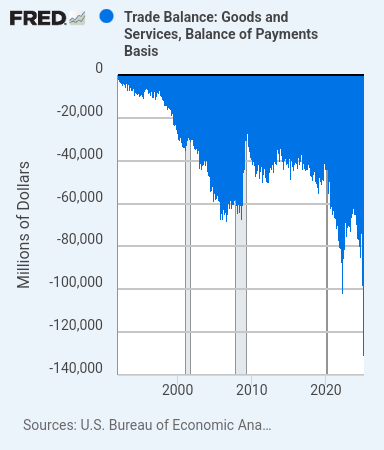

Taken in isolation, we might be able to somehow deal with these growing fiscal deficits, but when we add the concomitant growing trade and balance of payment deficits into the mix, it’s clear that we’re reaching the end of the road. It’s quickly become impossible to sustain the current trends.

Besides, there’s just not enough foreign demand anymore for US Treasuries, even at current yields; at least not enough to even out the balance of payments equation.

So I asked the reader, is what President Trump proposing nonsensical or is he reacting to reality?

While Trump may not be the most eloquent politician, he and his economic team know the seriousness of the time and the unprecedented circumstances that have been handed to them.

Trump’s economic policy formulators know that the deficits cannot continue.

QE is dead

As long as inflation remained low, the United States working with the Federal Reserve could have continued maintaining the triple fiscal, trade, and balance of payments deficits indefinitely.

Foreigners were still interested in holding US Treasury securities, since they needed to hold dollars for trade. Moreover, US politicians seemed more than willing to run the massive trade deficits, which helped to mask the true rate of monetary inflation.

Foreigners were still interested in holding US Treasury securities, since they needed to hold dollars for trade. Moreover, US politicians seemed more than willing to run the massive trade deficits, which helped to mask the true rate of monetary inflation.

In essence, low inflation begat low interest rates. Traditionally, Treasury securities also provided higher yields for its holders than the comparable securities of other industrialized nations. Thus, the deficits were relatively manageable. Kicking the can down the road was easier when interest outlays were reasonable.

The end is now

Unless the Federal Reserve can somehow conjure up a new set of monetary policies that have yet to be revealed, we have effectively reached the end of the road.

The most frustrating aspect of all this is that it was all avoidable in the first place. Beginning in early 2020, it seems the Federal government and Federal Reserve began embarking on a series of actions that set up the system for an inevitable failure.

The FED economists are not stupid, so what gives?

This slow-motion car crash was even pointed out by most nonpartisan economists at the time, who were warning in real time of the grim and inevitable outcome. Yes, it seems the country was being set up and the resulting inflation wasn’t transitory.

So, price inflation seems to be indefinitely elevated, which indicates to me that the inflationary conditions of COVID crisis were purposely manufactured to undermine QE and eliminate it as an effective go-to option for financing future fiscal deficit spending.

Why do I say this? The over-the-top stupidity and mismanagement are are just too overwhelming to chalk up as a series of mistakes.

Only elevated bond yields and relatively high short-term interest rates have been able to assist the federal government in financing its ongoing deficit spending. But this comes with a terminal toxic effect, which is the amount of interest expenses the government now accrues. It looks like it could be as large as $1.5 trillion annually within the next couple years. This number is absolutely mind blowing and cannot be sustained.

By design, by function, an unwinding of the dollar-based global trading system would result in the current geopolitical friction and inevitable global conflict that will unfold.

Yes, by function and design, the inevitable unwinding of the massive trillion-dollar deficits accruing in the United States will end up in war.

The engineers that created this dollar-based global trading system 54 years ago knew about the end game. It was all designed to build up America’s enemies, while bringing down America a couple notches.

My only conclusion is that there is a well coordinated supernatural element to all this. Despite the many criticisms that this dollar-based trading system receives, I can’t help but marvel at what it achieved.

Trump is finally realizing Putin is full of shit. We knew this for years.

Putin takes direct orders from the father of all lies Satan himself. So of course Putin is a lying hypocrite. Putin plays religion to give his lies credibility.

As usual, pay attention to what people do. Not what they say.

‘The only thing we learn from history,’ it has been said, ‘is that men never learn from history”. There are only two options here. This catastrophe was stumbled into by incompetent, short sighted people who don’t learn from history, or this is a diabolical plot designed by the god of this world and his henchmen. I’ll go with option two! Trump is the captain of the Titanic and he is being instructed to head into the ice field. He is on course with little that can now be done to avoid calamity!

That is a good reason why history always rhymes.