As World War III approaches, the nation states will have to continue ramping up defense spending, which will be highly inflationary. As Russia continues to gobble up its Eurasian sphere landmass, and the United States continues to consolidate the entire Western hemisphere for its means and defense initiatives, nation states, from Japan to Germany, will realize that the proverbial writing is on the wall. They will continue desperately trying to build up an arsenal to defend themselves against Russia and China. This Japheth-inspired tag team will steamroll the nation states as the United States withdraws to concentrate on the Western hemisphere.

As World War III approaches, the nation states will have to continue ramping up defense spending, which will be highly inflationary. As Russia continues to gobble up its Eurasian sphere landmass, and the United States continues to consolidate the entire Western hemisphere for its means and defense initiatives, nation states, from Japan to Germany, will realize that the proverbial writing is on the wall. They will continue desperately trying to build up an arsenal to defend themselves against Russia and China. This Japheth-inspired tag team will steamroll the nation states as the United States withdraws to concentrate on the Western hemisphere.

Inflation will never come down again until war and after. Bitcoin and all of the digital Ponzi schemes will be used to buy up all of the real estate. Do not sell your real estate or income generating assets, despite all of the bubble calls we hear.

I suspect the Trump regime is receiving orders to gut the public sector and hand it over to the private hands of the synagogue controlled bankers, who work through their private corporations.

Unfortunately, the amount of federal government spending cuts is relatively inconsequential. Moreover, there will still be spending, except it will be shifted over to the private sector and run as a profit center. Cutting a couple hundred thousand jobs from federal government payrolls is not going to solve anything. The increases in defense spending over the next few years will dwarf any DOGE headway and progress towards streamlining the Federal government’s finances.

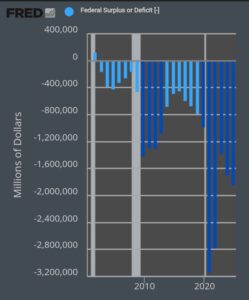

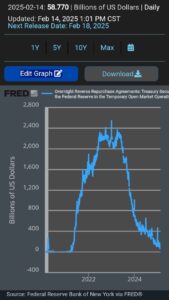

To wit, take a look at the growth in the money supply and the ballooning Federal budget deficits. Oy vey…

We need to face reality

Arguing from incredulity is never the proper way to make any economic nor financial prediction. Most well-regarded analysts in the alt media propose the kosher version of the conspiracy and argue from incredulity that the entire economy and financial markets are in a bubble.

So many of these analysts exclaim that real estate values are about to get destroyed. Of course, they have been saying the same things since 2008. They doubled down their calls after covid.

Unfortunately, the only thing I see losing value in any meaningful way is the entire stack of global fiat currencies. And that is the great non sequitur; how can we have rapidly depreciating currencies and dropping asset values on any sustained basis? The two ideas are incompatible, yet held in equal regard by those analyzing this conspiracy.

Based on my ongoing observations regarding the actions of the Trump regime, I actually see an acceleration of the War timeline. My readers know very well who’s guiding this.

Keeping the federal government afloat

Something has to give and the FED will deliver… Eventually

I don’t know what the stated catalysts will be, nor do I know its exact timing, but the Federal Reserve will have to begin resorting to some sort of QE type of federal government subsidized spending once again.

Some sort of exogenous set of circumstances will force the Fed’s hands and will provide an excuse to begin helping the US government spend once again with reckless abandon in anticipation of World War 3.

I think of the trillions that will need to be spent around the world and here domestically in order for the United States to consolidate its endeavors in creating an Oceania type of military land mass. This will include the consolidation of England as well. Donald Trump is receiving his orders from above.

My advice to my readers, stop discounting the obvious and plan for the inevitable. This spending steamroller will continue flattening the masses while enriching the asset owners. The global wealth and power need to be consolidated before this upcoming global conflict and it has been transpiring extremely effectively since the covid monetary and fiscal programs were announced five years ago.

Only an objective and trained economist can see the obvious. I can look at the data and tell you which pieces are important and which ones aren’t. I stopped listening to the economic predictions of former fighter pilots, CIA whistleblowers, organized church members, and medical experts dispensing the kosher version of the conspiracy long ago.

For all intents and purposes, the ways of life for the average person has already collapsed. While the average person feared about an economic collapse, the collapse has been taking place for the last few decades. We are now only seeing the final steps unfold into the desired result.

Not relevant to article but I want to ensure others can continue to think. They’re spraying us with aluminum which causes heavy metal toxicity and leads to cancer. Everyone here should take Biosil as it binds to aluminum and takes it out of the body.

Do you think Elon will cut Medicare, Medicaid, and SS? That’s what they said on a video I watched. They’re already cutting Medicare. I went to the pharmacy to pick up a prescription and it was a $500 copay. Another was a $1k copay. I already can’t pay that much – now it’s to get worse. A nurse told me “I swear they want these old people to die.”

Trump: If it saves the country, it’s not illegal

WASHINGTON (Reuters) – Echoing France’s Napoleon Bonaparte, U.S. President Donald Trump on Saturday took to social media to signal continued resistance to limits on his executive authority in the face of multiple legal challenges.

“He who saves his Country does not violate any Law,” Trump, a Republican, proclaimed on his Truth Social network. The White House did not respond to a request for more details.

The phrase, attributed to the French military leader who created the Napoleonic Code of civil law in 1804 before declaring himself emperor, drew immediate criticism from Democrats.

“Spoken like a true dictator,” Senator Adam Schiff of California, a longtime adversary of Trump, wrote on X.

Trump, who took office on January 20, has made broad assertions of executive power that appear headed toward U.S. Supreme Court showdowns. Some lawsuits accuse Trump of usurping the authority of Congress as set out in the U.S. Constitution.

While Trump said he abides by court rulings, his advisers have attacked judges on social media and called for their impeachment. Vice President JD Vance wrote on X this week that judges “aren’t allowed to control the executive’s legitimate power.”

Washington lawyer Norm Eisen, who like Schiff worked on the first of Trump’s two impeachment trials, said Trump’s lawyers have repeatedly tried to argue that if the president does it, it’s not illegal.

Napoleon’s saying, he said, excuses illegal acts.

“This is a trial balloon and a provocation,” Eisen said of Trump’s message.

Trump, whose longtime slogan is “Make America Great Again,” attributed his survival of an assassination attempt in July to God’s will.

“Many people have told me that God spared my life for a reason, and that reason was to save our country and to restore America to greatness,” he said after his election victory.

Maybe someone should investigate the Schiff family history and get some reparations going.

Houston’s Oldest Refinery Is Shutting. It Won’t be the Last.

(Bloomberg) — After more than a century of churning out fuel on the banks of the Houston Ship Channel, the city’s oldest refinery is preparing to shut down, potentially putting hundreds of people out of work. Its competitors are welcoming its demise.

The closure of the plant — built by industrialist Harry Sinclair in 1918 and now owned by petrochemicals giant LyondellBasell Industries NV — reflects the struggles of a sector that’s declining along with demand for its central product.

Gasoline consumption in the US peaked five years ago, according to federal data, and the transition to cleaner energy is eroding demand for other fuels, too. That’s turned the refining industry into a Darwinian battleground in which only the fittest survive.

Lyondell has faced stiff competition. When the Sinclair refinery began operating a century ago, the plant was little more than a cluster of pipestills on a swampy watershed, and the Houston Ship Channel had just opened as a deepsea port.

Now, the refinery is part of a massive petrochemical corridor and is one of 10 fuelmakers in Houston, many of which are modernized megaplants that have been retooled to process light oil from the Permian Basin. To stay viable, Lyondell would have had to sink significant capital – as much as $2 billion, according to RBN Energy Refined Fuels Analytics division – into improving the aging plant. After trying and failing to sell the refinery, the company in 2022 announced it would cease operations.

It’s not alone. Phillips 66 plans this year to close its Wilmington, California, refinery after shutting a hurricane-damaged Louisiana plant in 2021, and several other refineries are vulnerable. That’s on top of nearly 1 million barrels a day of refining capacity that shuttered after pandemic lockdowns decimated gasoline demand.

But the string of closures belie the reality of today’s market: Refining profits actually aren’t that bad. By one measure, they’re about 20% higher than the 10-year average. And in the aftermath of the pandemic, when oil prices tanked but fuel demand was resurging, those profits soared to record-high levels.

That post-pandemic jump in refining margins even prompted Lyondell to keep the Houston refinery running for more than two years following its closure announcement. That’s about as long as they could safety operate without investing in costly maintenance and upgrades.

Put simply, refineries don’t shut down because their margins are bad. They do so because the can’t justify the cost of upkeep.

“If I was looking at a several hundred million-dollar capital expense that I would want to pay off over five or 10 or 20 years, that is where I might start considering the pressure that declining demand will put on margins,” said Austin Lin, principal analyst refining and products North America at Wood Mackenzie.

Still, now that margins have settled back to pre-pandemic levels, fuelmakers facing a tepid demand outlook are anxious to keep them from falling further.

Ultimately, Lyondell’s closure “is a good thing for the market,” said Randy Hurburun, senior refinery analyst at London consultancy Energy Aspects.

Had the shutdown occurred a few years ago, it might have roiled markets, spiked prices and pushed competitors to quickly ramp up production to make up the shortfall.

Instead, the market’s treating the closure as “a pebble in a fairly big lake, not a boulder in a small lake,” said John Auers, managing director of RBN Energy’s Refined Fuels Analytics division.

The plant’s workforce reflects the industry’s shifting dynamics. Its staff has dwindled to around 450 from 1,200 a few years ago and most of those workers were hired after the closure announcement triggered a wave of departures. Only 125 of the plant’s current staff predate the shutdown decision and just 80 will stay on once operations cease, said Marcos Velez, assistant director of United Steel Workers District 13,

(Lyondell has said it will try to place many workers in jobs at its chemical plants.)

Market Impacts

The biggest impact to energy markets may be to fuel exports. Because the refinery is shutting at a time when many plants halt production for seasonal maintenance, supplies of gasoline and diesel will be tighter than usual. To keep the domestic market in balance when demand picks up in the spring, exports will have drop as much as 11%, said Paul Y. Cheng, an analyst with Scotiabank.

LyondellBasell on average produces 140,000 barrels a day of gasoline and 100,000 barrels of diesel, while the US exports about 1.9 million barrels a day of the fuels combined.

The refinery’s competitors will probably benefit from the closure right away. Gulf Coast and Midwestern plants that import heavy oil will see the price of that crude decline as demand for it wanes, according to Auers. The slack in the market could also mitigate price spikes from potential US tariffs on Canadian and Mexican oil.

Looming Shutdowns

More closures are probably on the horizon. Smaller, older refineries without access to a variety of crudes or export markets for their products are increasingly vulnerable compared to mega plants like Motiva Enterprises’ Port Arthur, Exxon Mobil Corp’s Beaumont and Marathon Petroleum Corp’s Galveston Bay refineries – three plants that together comprise 10% of US fuel production.

New regulations on refineries in California could spur retirements there, too. The largest US refiner by capacity, Valero Energy Corp, last year warned that “all options are on the table” for its California plants and — echoing the slow demise of LyondellBasell’s Houston refinery — said it had stopped investing in those West Coast assets beyond what’s necessary to keep them running.

Refineries reach a “natural decision point” when the cost of continuing to run outweighs expected future profits, said TD Cowen analyst Jason Gabelman.

Refineries unwilling or unable to absorb the cost to modernize, simply find themselves unable to stay competitive, said Auers. The rest get to enjoy “fairly attractive and sustainable refining margins.”

I am not convinced that the refining business is much different from any other, if the margins are bad the capital upgrade or maintenance expenditure won’t get made. Gasoline could become a luxury product.

Unique problem. Who will go without?

That’s the long term goal. If the Obama and Biden regimes hadn’t placed so many regulations on the vertically integrated oil companies along with the political uncertainty, the refinery business would be like any other capital intensive operation.

I find it interesting, too, that the United States still imports oil, because it’s easier and cheaper to bring in the ships to the refineries than to ship it from some of the more remote areas in the country where the oil is produced. Plus, the oil the US produces is normally of higher quality (light sweet), which isn’t compatible with the existing refineries that are built for sour.

The US still exports the refined products as well as its light sweet crude and produces enough to technically be self sufficient.

The US would have to retool refineries to be more compatible with its types of oil.

Maybe a WWIII scenario could be the catalyst?

I came across this link that I find interesting. Keep in mind it’s from 2022 and the numbers are somewhat dated as the US produces a couple million more barrels a day.

https://www.eia.gov/todayinenergy/detail.php?id=54199

That is good information, it is true that not all barrels are equivalent. A lot of energy (money) is wasted in refining various grades and blending them to suit existing refineries. It would be much better to retool as long as American sweet crude can give the fraction of diesel you need to be self sufficient and power industry.

Either that or we turn the lifetime achievement Harley Davidsons into ploughshares pulled by teams of boomers.

Yes some of the oil is so heavy it’s more like wax and needs to be heated just to get it through the pipes.

The light sweet oil is much nicer to deal with.

The real problem is what to do with the massive accumulation of deranged liberals in the West. How do we deal with that?

“How do we deal with that?”

Jabs, UBI, Soma, Tinder, Grindr. It will run its course, just stay clear.

Exceptions can be made….

Germany’s Scholz: debt ceiling will not cap our defence spending

MUNICH (Reuters) -German Chancellor Olaf Scholz on Saturday predicted that a new government would create an exemption for spending on defence and security when dealing with the nation’s constitutional limit on public debt.

Scholz said he was sure that the country’s future leadership, to be determined at a February 23 election, would put additional exemptions into place to loosen the so-called debt brake, as Germany and other European nations grapple over their response to Russia’s attack on Ukraine.

“I am predicting this today, there will be majority support for this after the election,” he said in a speech at the Munich Security Conference.

“The debt brake that is enshrined in the German constitution includes exceptions for emergency situations. A war in the middle of Europe is an emergency, what else would it be?” said Scholz.

The snap election this month follows the collapse of Scholz’s three-way coalition late last year, partly because the pro-business Liberal Democrats sought to limit spending amid a push by Scholz’s Social Democrats and the Greens to boost the defence budget.

The conservative CDU/CSU alliance led by Friedrich Merz, which is ahead in polls with around 30% support, has signalled that it is open to adjustments to the debt limit but generally wants to keep it in place.

The role of Germany and its European allies in the support of Ukraine has come into focus after a call on Wednesday between U.S. President Donald Trump and Russian leader Vladimir Putin over how to end the war in Ukraine.

Trump’s Reach for Power: Seven Court Cases to Watch

(Bloomberg) — President Donald Trump is now defending his wave of executive orders and directives against dozens of lawsuits that say he’s vastly overstepped his constitutional authority.

The cases, brought by nonprofits, state attorneys general, civil rights groups and private citizens, challenge Trump’s directives to freeze trillions of dollars in federal funding, shrink the federal workforce, allow access to citizens’ personal information and limit birthright citizenship, among others.

While they address different issues and legal specifics, most are asking the courts to decide a question fundamental to Trump’s second term: How much power can the President exercise without the approval of Congress? They also raise the question of whether the administration will abide by court decisions.

With over 70 cases filed and more arriving daily, it’s impossible to know which will advance or set lasting precedent. Some, though, will certainly be resolved by the US Supreme Court, where three Trump appointees are part of the 6-to-3 conservative majority. Here are seven we’re watching:

Free link to article:

https://www.union-bulletin.com/news/national/trump-s-reach-for-power-7-court-cases-to-watch/article_7b9fece0-3139-5f66-bc87-46c64111fca2.html