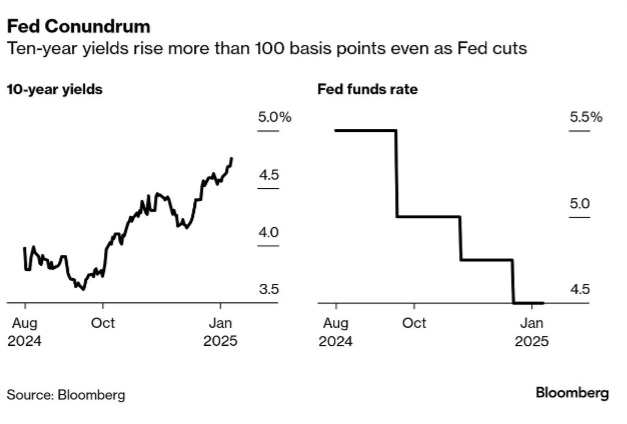

Note to reader: As I have been saying for a long time now, I estimate the neutral Fed funds rate to be exactly what it is right now, 4.25%. There is a growing consensus that the FED may be done cutting overnight rates, since the employment and GDP data continue to remain robust, while the elevated inflation growth remains sticky.

I also note that the blame for these higher worldwide bond yields are being pinned on the incoming Trump regime. Although this is not justified, this all points to the higher costs of money and only those who have positioned themselves to benefit from higher inflation (e.g. underlevered landlords that can generate higher rent rolls and publicly traded firms and other businesses with inelastic demand) should actually benefit.

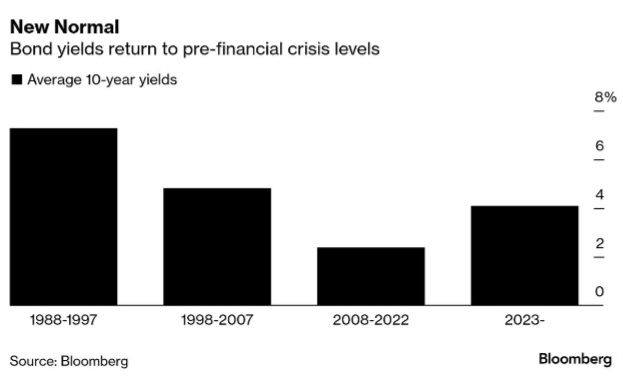

This blog has been noting the upward shift in the longer end of the yield curve, since the FED began cutting rates as an important dynamic to watch. However, it has not yet translated into lower stock prices. Since I have estimated that the neutral Fed funds rate was higher than others on the street estimated, I suspect stock prices will eventually adjust to a 10-year Treasury yield of 5.0 to 5.5%.

I suspect that real sovereign bond yields continue to grind higher, because there is a growing loss of confidence in the nation-state governments to control their ballooning fiscal deficits as well as the inability of the central banks to facilitate this outcome without generating higher trend inflation. In a world of global quantitative easing, these circumstances are without precedent.

If what I think will happen during Trump’s presidency does happen and the 10-year Treasury yield crosses 6%, circumstances in the asset markets could change quite markedly. It’s still not too late for investors to lock in 7% mortgages. I just raised the rents for several of my longer-term tenants by at least 5%. The world will adjust.

______________________

The Surging Cost of Money

From Bloomberg:

If strategists at Bank of America are correct, the US bond market is now in the sixth year of the third great bear market since 1790.

Few investors would beg to differ after a week in which US Treasury yields soared, propelling the rate on the 10-year note to the brink of the 5% barrier rarely seen since the financial crisis of 2008.

Other nations are experiencing a similar exodus from debt. The yield on 30-year UK gilts last week touched the highest since 1998, forcing the new Labour government to start seeking money-saving measures, and UK assets are weak again today.

The message from many in markets, and Bloomberg’s latest Big Take, is to get used to it: The price of money will be permanently higher as risks to the supposedly safest of assets mount.

Friday’s blowout jobs report shows the economy continues to power ahead, leaving Bank of America among those on Wall Street now betting the Federal Reserve won’t cut interest rates in 2025. Goldman sees two reductions, down from three previously.

With data this week set to show inflation is staying sticky (see our week ahead below), central bankers are already signaling they’re on hold.

And we are now a week away from the second Trump presidency which lands with promises of lower taxes and higher tariffs. That’s a recipe, in the opinion of many, for faster inflation and greater debt. A fight also looms over lifting the federal debt limit.

Put it all together and it’s no wonder the so-called term premium on 10-year notes — the extra yield investors demand to accept the risk of taking on longer-term debt — is now at a decade high.

The result is BlackRock, T. Rowe Price and Bianco Research are among those penciling in 5% as a reasonable target for yields amid expectations investors will demand juicier rates to keep buying longer-dated Treasuries.

That has implications for other markets, with historians noting the multiple times that higher borrowing costs have accompanied market and economic meltdowns.

Stock investors are already nervous the higher yields could bring an end to the tech-led bull run. The spillover in stocks was already apparent Friday as the S&P 500 fell 1.5%.

“There is a tantrum-esque type of environment here and it’s global,” said Gregory Peters, who helps oversee about $800 billion as co-chief investment officer at PGIM Fixed Income.

Petrus Romanus is at it again. He’s a one worlder and is spreading his Babylonian liberation theology.

__________

Pope describes Trump’s planned deportations of immigrants as a ‘disgrace’

https://www.cnn.com/2025/01/19/world/pope-says-trump-immigrant-deportations-disgrace-intl-latam/index.html

Why sure! These are the popes people. Non Israelite.

All of the organized so-called Christian churches are actually communist in mindset and structure. They all say we are equal and the same. It All began in 325 ad.

The truth is all busting forth in the final last few days before Yahweh’s return.

The organized so-called Judeo-Christian religions, especially that of the Catholic Mongol Church, instills a double-mindedness into its unwitting followers. On one hand, many of them disdain the one world Government, yet these churches’ extra biblical doctrines manufacture the antithesis into the minds of the sad sack lost. Many of them actually say the Book of Revelation is either a metaphor or it already took place.

Even those begging for Jesus and who belong to these churches have been woefully deceived. They’ll end up in the guillotines. The small remnant who have left the churches and all of that polluted Babylonian doctor have a much better shot at making it all the way through.

Many of these small remnant started taking fenbendazole and ivermectin to overcome the bioweapons that many of these sad sacks deny exist..

Why will they end up on the guillotines?

The Rabbis say Christians deserve to be beheaded for idolatry.

They claim that Jesus is boiling in a pot of shit in hell because Christians worship him (but he’s not a god) and therefore Christians are causing his suffering and deserve to suffer too. Jesus (Messiah son of Joseph, the pre-Messiah who will pave the way for the true Messiah son of David), takes all the sins upon him, therefore receives their rightful punishment instead. According to the Jews this is not fair to Jesus but Christians keep piling their sins onto him and drinking his blood. Thus, Jesus is trapped in hell and punished. If Christians stop doing that he will escape and get revenge. He returns as the anti-Christ, ready to take names and crush heads like grapes in the winepress. He will make sweet wine from the blood of the filthy goyim according to the writings.

They also believe Jesus is Satan (which means the Accuser and Judger) and he will therefore judge the Christians and they are in for it for what they have done. They believe (or at least say) that Christianity is a trap for the goyim.

I’ve seen Rabbis say Hindus are even worse because they worship more gods so Hindu neck integrity is also deemed to be quite temporary.

So, in the coming days, the story is that unless you repent, stop worshipping Jesus, and follow the Noachide laws – you get your head cut off.

Rabbis say that once this truth is revealed (and it’s almost here) Christians will lose their minds. Many will go nuts. There will be chaos like never before. The Masons expect people to start worshipping Lucifer (according to Albert Pike) and since Jesus is Lucifer in the Rabbinical understanding of things it’s not such a big leap.

In 2030, it will be the 2000th anniversary of the crucifixion, and time’s up goyim.

That’s it in a nutshell. I think that’s the general gist. Since goyim always trust the Jews (they wrote the bible right?), many will probably believe all this stuff and it will blow everyone’s minds. The vax and lockdowns were prep for instant world-shaking “ok we’re doing this now” overnight mass shifts in society, IMO. We are now like a flock of sheep and big things are possible because everyone knows the drill. They could announce another lockdown at any time and within 2 hours everyone will be at home like a military operation.

I got this from channels that watch and analyse hundreds of Rabbi lectures and read their books like the Talmud, Zohar, Torah, etc. It seems to be what the Kabbalists believe.

Of course, mRNA injections don’t cause turbo prostate cancer.🤣🤣🤣 The real breakthrough discovery would be from the mRNA injections.

Breakthrough discovery shows big cause of prostate cancer spread

https://knowridge.com/2025/01/breakthrough-discovery-shows-big-cause-of-prostate-cancer-spread/

Of course, dementia and Alzheimer’s symptoms don’t have anything to do with injections…. 😃😃😃

Home temperatures play a big role in cognitive decline in older adults

https://knowridge.com/2025/01/home-temperatures-play-a-big-role-in-cognitive-decline-in-older-adults/

All these propaganda articles are vetted through the senior editors who were picked by the Pentagon and DoD. I have the answer; these sad sacks all got their mRNA injections. That’s the only circumstance that has changed in the past four years….

So many young people with colon cancer have clean diets. What gives?

•Increasingly, young people with clean diets and healthy lifestyles are getting colon cancer.

•Doctors say diet plays a role in the rising risk, but doesn’t tell the whole story.

•We are learning more about ways microplastics, sleep cycles, and our environment may play a role

https://www.businessinsider.com/colon-cancer-environmental-causes-microplastics-antibiotics-sleep-2025-1

I have no doubt that the shot plays a major role. Of course, I doubt the average person really understands what a clean diet is! Leviticus 11. Now with gmo grains, a host of shots given to the livestock, and so on, it is becoming more difficult to eat clean. How many of these people practice sodomy for instance?

The problem, as we know is that Israel has rejected YHVH, so He has rejected them.

GMO goes back 40 years. Roundup goes back 30 years. Livestock antibiotics goes back 40 years and longer. Sodomy goes back a long way.

What has changed in the past four years? The more I contemplate and research these matters, the more I’m concluding that those who received their mRNA injections will not be able to enter the kingdom, because their DNA has been altered.

The fearful will not make it.

Yes, the jab is definitely changing the make up of what was intended. In my opinion, it is an operating system and upgrades your DNA, so they would say. Those that are jabbed will be accessible to a different wave length. Satan is the prince and power of the air and he broadcasts. When the man of sin is revealed, they will easily accept him.

The new Trump Treasury Secretary, Scott Bessent, is a homosexual. Welcome to the New World Order.

The new boss is the same as the old boss with queers in the administration.

Right! Also a Yale grad. Skull and bones alum!

mRNA injected Hollywood actor dies at 46. This time, the excuse is from a protracted case of pneumonia from obsessive vaping….

Paul Danan dies at 46 just months after revealing tragic health battle

The Hollyoaks star has died at 46 years old, his management has tragically confirmed

Excerpt; It comes just months after he was rushed to hospital and given CPR after he suffered respiratory failure brought on by his addiction to vapes. His diagnosis at the time was so bad that his family had been warned that “he might not make it”.

https://www.mirror.co.uk/3am/celebrity-news/breaking-paul-danan-dies-46-32913236.amp

I find it interesting that people like Bill Gates, Mark Zuckerberg, Musk, Jeff Bezos etc are on the Trump train!

The technocrats are all in…

Any thoughts on the Trump coin?

Just one. Shameless.

Big numbers.

Building Permits (Dec)

Act: 1.483M Cons: 1.460M Prev: 1.493M

Building Permits (MoM) (Dec)

Act: -0.7% Cons: Prev: 5.2%

Housing Starts (MoM) (Dec)

Act: 15.8% Cons: Prev: -3.7%

Housing Starts (Dec)

Act: 1.499M Cons: 1.330M Prev: 1.294M

Michael Obama is not attending Trump’s inauguration. It seems Barry will attend, but not his husband.

Obama’s and Michael’s gay marriage is on the rocks.

He might be doing another river cruise in Europe. Maybe the LA fire wasn’t his thing.

Remember when Big Mike was on the Paris river cruise with some other celebs, and raised a wine glass in the photo? If you zoomed in there was a reflection of Notre Dame burning in the glass. They claimed to have not seen the fire at that point. Busted.

Whether they knew about the reflection, didn’t know, or put it there on purpose – mike was there and thought it was funny. Lots of other Muslims thought it was funny too.

Then the French govt kept suggesting to rebuilt the church with pyramids and other illuminati stuff, but didn’t go through with it. Were they just messing with people?

Notice when this woman first became sick with all of her nerve and semi-paralysis disorders. It was April 2021. This article blames her covid-injection caused conditions on taking Cipro.

So many of these articles are now in mainstream to deflect attention away from the obvious. These people are permanently damaged from their mRNA injections….

‘I was fit and healthy until I took three pills for a common condition – now I’m in a hospice’

At 44, Talia Smith was a fit, healthy and active woman who worked out seven days a week, but after taking a simple medication, she is now wheelchair-bound and receiving palliative care in a hospice

https://www.mirror.co.uk/news/world-news/i-fit-healthy-until-took-34491220.amp

Excerpt; Talia’s health deteriorated swiftly after taking the drugs in April 2021. “I started experiencing tremors, unbearable nerve pain, and stiffness that left me unable to move. Within five months, I was in hospice care,” she says.

I noticed lately that the MSM are suddenly attacking social alcohol drinking as causing serious cancer risks. Granted that drinking everyday is not best for physical health, but I think they are using wine and beer as a cover for other causes of cancer such as the Covid vaccines. Lately they have been using cover stories for all these new diseases in the last 3 years.

Equally interesting is that nobody is discussing the side effects of marijuana because the beings up top want to normalize marijuana to dumb down humanity. Marijuana is a fast track to declining health and addiction to other drugs. Also they are pushing marijuana use to cover up the side effects of vaccines.

That’s right. I see so many articles now that blame things like antibiotics, alcohol and wine, existing pharmaceuticals, climate change, oil and natural gas, etc. But all of these things have been around for many decades and longer. So what changed in the past 4 years to cause the mass of uptick in cancer and other debilitating diseases and chronic conditions?

The answer is self-evident.

Stone, how do you interpret some major businesses and institutions dropping DEI and net zero? I am suspicious of this not being what it seems.

The pendulum swings from left to right. It’s all part of the dialectic process as the residue of DEI will persist. Once people get sick of Trump and the right, DEI will reappear and seem almost normal. The same goes for NetZero.

Let’s take a look at homosexuality. There are a number of conservative homosexuals and they often appear in the alt media. The sodomite mentality becomes more normal everyday. As the mongrelization of society continues according to the desires of the talmudic community, degeneracy will abound and seem normal to a majority of the population.

For people like you and me, and I assume you’re similar to my age, if not older, we find much of it abhorrent and illogical. But to the people under 45 years old, they see nothing wrong with most of this.

If you and I live to a normal age, by the time we pass from this planet, the world will accept the most disgusting and deplorable concepts. It truly will be a talmudic toilet.

Even if gone completely, most whites hired now will have diverse bosses.

Mission accomplished (for now).

Hot data overall with the Philly Fed much much higher than consensus….

Continuing Jobless Claims

Act: 1,859K Cons: 1,870K Prev: 1,877K

Core Retail Sales (MoM) (Dec)

Act: 0.4% Cons: 0.5% Prev: 0.2%

Export Price Index (MoM) (Dec)

Act: 0.3% Cons: 0.2% Prev: 0.0%

Import Price Index (MoM) (Dec)

Act: 0.1% Cons: -0.1% Prev: 0.1%

Initial Jobless Claims

Act: 217K Cons: 210K Prev: 203K

Jobless Claims 4-Week Avg.

Act: 212.75K Cons: Prev: 213.50K

Philadelphia Fed Manufacturing Index (Jan)

Act: 44.3 Cons: -5.0 Prev: -10.9

Philly Fed Business Conditions (Jan)

Act: 46.3 Cons: Prev: 33.8

Philly Fed CAPEX Index (Jan)

Act: 39.00 Cons: Prev: 22.20

Philly Fed Employment (Jan)

Act: 11.9 Cons: Prev: 4.8

Philly Fed New Orders (Jan)

Act: 42.9 Cons: Prev: -3.6

Philly Fed Prices Paid (Jan)

Act: 31.90 Cons: Prev: 26.60

Retail Control (MoM) (Dec)

Act: 0.7% Cons: 0.4% Prev: 0.4%

Retail Sales (YoY) (Dec)

Act: 3.92% Cons: Prev: 4.12%

Retail Sales (MoM) (Dec)

Act: 0.4% Cons: 0.6% Prev: 0.8%

Retail Sales Ex Gas/Autos (MoM) (Dec)

Act: 0.3% Cons: 0.4% Prev: 0.2%

Exponential is a misunderstood function.

“It’s rising exponentially!!” is a phrase used to describe metrics that are exploding upwards.

But something can rise exponentially by 0.00001% a decade, and it’s still exponential. They could decay by 0.0001% a decade, or 50% a week, and it’s still exponential.

http://www.321gold.com/editorials/nagasundaram/nagasundaram150125.pdf

This article says the end is nigh because “each president now adds more debt in one term than was accumulated in the previous 200 years”. OK that just means the exponential growth rate is 100% in four years. The next president will do it too. They all will. (Exponential means a constant percent growth rate, so it might be worse than exponential in reality.)

It seems to me that the elites are the ones with the Weimar wheelbarrows, suitcases, and pallets of easy cash while normal people have to grind for it note-by-note as usual.

Asset owners are doing well (until the Great Taking?). What are your thoughts on the Great Taking? I know that in NZ for example, the bail-in system was set up years ago – they can merely adjust a percentage slider control on a computer program’s form and click a button to give every bank account in the country an instant haircut. All the banks were forced/asked/allowed to integrate with this system. It was even in the news. One of the developers of the system blew the whistle that it was this easy to operate. One mouse click and all that money just gets fleeced off everyone in a second.

Mike Yeadon talked to a few billionaires about this and when he told them about the Great Taking they didn’t believe it, but after learning more they just slumped down and went “Oh crap”.

The LA fires are a message that the elites who thought they were at the top of the food chain are not at the top. So many high level people took the vax and now lost their fancy houses too. Will Hollywood make a truthful movie about the fires??? They have the motivation, but they might find they are all just tools after all. They might discover than such a movie is not allowed. Lots of life-long libtards are getting redpilled by this though, so let’s see.

Let’s see what Mel Gibson does (although he seems to be saying “It’s only a house, I’m just happy my family and friends are safe” so maybe he won’t do much).

Bonds and stocks love this morning CPI data. The headline come in as expected, but the core is definitely cooler. The empire State index comes in below consensus, too. Let’s see how bonds respond throughout the day. If the Bond rally can be sustained, perhaps we can get some relief from the relentless upward grind. If bonds fall back later on, that’s not a good sign.

CPI (YoY) (Dec)

Act: 2.9% Cons: 2.9% Prev: 2.7%

CPI (MoM) (Dec)

Act: 0.4% Cons: 0.4% Prev: 0.3%

CPI Index, n.s.a. (Dec)

Act: 315.61 Cons: 315.62 Prev: 315.49

Core CPI (MoM) (Dec)

Act: 0.2% Cons: 0.3% Prev: 0.3%

Core CPI (YoY) (Dec)

Act: 3.2% Cons: 3.3% Prev: 3.3%

Core CPI Index (Dec)

Act: 323.38 Cons: 323.40 Prev: 322.66

Real Earnings (MoM) (Dec)

Act: -0.1% Cons: Prev: 0.1%

NY Empire State Manufacturing Index (Jan)

Act: -12.60 Cons: 2.70 Prev: 2.10

Stone, how are all the insurance claims in California going to affect things? Just another excuse for the FIRE sector to jack up prices?

The following is a link to a timely article that I think helps to address your questions.

How the Los Angeles wildfires can increase insurance rates for all Californians

https://www.cbsnews.com/losangeles/news/how-the-los-angeles-wildfires-can-increase-insurance-rates-for-all-californians/?ftag=CNM-00-10aag9b

I suspect that as time goes on, we’ll see greater calls to “socialize” homeowners insurance. There are already programs on the books in Florida and California, two states that are prone to experiencing natural disasters. I also suspect that instead of being funded by private money insurers, we will see greater calls for the pool of taxpayers to subsidize these socialized insurance programs. This would help to alleviate any catastrophic unique costs that could bankrupt private insurers or otherwise compel them to drop coverage in a certain area, because of underwriting risks.

You and I will never know for sure how these fires started, but there is enough coincidences present to allow us to contemplate the conspiratorial aspect behind this event. I do take note of the nonchalance of California politicians, as if they either knew beforehand or are instructed to act this way.

Regardless, I notice a complete lockdown on the talk of arson or any other type of cause. MSM are almost exclusively focusing on the concept of climate change. Do the ends justify the means? It certainly seems that way, especially to the marxists who run California.

What’s going on in bonds? Is the Fed getting involved?

Oh boy. Not good.

Welcome to the New World Order. In so many ways it’s socialist. But really, what’s the difference between Soviet, communist, and socialist? Not much….

In the case of insurance, the underwriters make the profits and the taxpayers take the risk. Now that is modern socialism or communism.

Like the old Aaron Russo video, he noted that in the West we implement so many of the 10 planks of Communism.

https://www.conservativeusa.net/10planksofcommunism.htm

Most of us have planks 2, 4 (partly), 5 (partly), 6 (partly – big tech is a proxy too), 7 (partly, and often in reverse these days), 10.

They are working on a few others, and the remainder seem to have been dropped in favor of more efficient methods.

I’m wondering if instead of another huge one off hoax like 911, Ukraine, Covid, etc..if they are doing more smaller events to have a similar effect. Natural disasters, regardless if they are man made or even actually happen, are money pits.

Isn’t incredible, like all the other events, how they are getting away with it. NOBODY of any authority is stepping in to expose what actually is happening. Even at your local level, all authority figures are towing the mainstream line. How can we ever trust people again???

It seems to be true that the world and society are both dying a slow death. It’s a death by a thousand cuts. From time to time, there is one large seismic event like covid or 9/11 or the 2008 collapses, but most the time it’s just a slow, gradual, and demoralizing death.

Imagine being dependent on the allopathic medical system for a condition that truly was caused by a man-made source? Now that’s demoralizing.

It seems one of the goals of this many faceted attack by the SOS is to demoralize the remnant. As Ecclesiastes says, For with much wisdom comes much sorrow, and as knowledge grows, grief increases.

The majority are blissfully hopping and skipping to there destruction!

We of course have a hope and destiny most will never know!

I doubt the majority are hopping and skipping. They are suffering, but do so to a greater extent, because they live in ignorance. What’s worse is that they don’t own the assets and have been engineered to spend every last dollar without any control. More over, so many of them are suffering with debilitating illnesses that are new and unique to the past 50 years.

Euro to Fall to Parity If US Yields Hit 5%, State Street Says

(Bloomberg) — Rising bond yields in the US will heap more pressure on the euro, triggering a drop to parity with the dollar, according to State Street Global Advisors.

The dollar’s surge to a more-than two year high has taken place in lockstep with the rise in the 10-year Treasury yield, which is now likely to reach 5% from around 4.8% on Tuesday, according to Aaron Hurd, a portfolio manager at State Street Global Advisors. Although Hurd is a long-term dollar bear, he correctly forecast the recent jump in the US currency, opening a tactically long position in the fourth quarter of last year.

“Euro/dollar could break parity and maybe go a little below” if the Treasury yield reaches 5%, Hurd said. He added that a further drop toward 0.95 in the euro would require a fresh driver, including further clarity on the outlook for US tariffs.

Hurd’s forecast chimes with a growing number of calls for the 10-year yield to rise to 5% and the euro to reach parity with the dollar as incoming US President Donald Trump’s tariff proposals keep the Federal Reserve cautious about further interest rate cuts.

Market consensus is still for the euro to stay above $1.03 throughout 2025 and only two out of 52 analysts surveyed by Bloomberg see US yields reaching 5% by the end of the year.

Still, moves in the options market point to a growing possibility that the 10-year yield could hit 5%. The last time the 10-year yield traded above 5% for a sustained period was in 2007, in the lead-up to the global financial crisis.

Note the last paragraph in the article!

Treasuries immediately rallied after the release of these cool PPI numbers, but have since fallen back. Bond yields are almost unchanged on the day. Despite dovish headline inflation data, bonds are still creaking under the weight of the growing loss of investor confidence.

Core PPI (MoM) (Dec)

Act: 0.0% Cons: 0.3% Prev: 0.2%

Core PPI (YoY) (Dec)

Act: 3.5% Cons: 3.8% Prev: 3.5%

PPI (YoY) (Dec)

Act: 3.3% Cons: 3.5% Prev: 3.0%

PPI (MoM) (Dec)

Act: 0.2% Cons: 0.4% Prev: 0.4%

PPI ex. Food/Energy/Transport (YoY) (Dec)

Act: 3.3% Cons: Prev: 3.5%

PPI ex. Food/Energy/Transport (MoM) (Dec)

Act: 0.1% Cons: 0.3% Prev: 0.1%

Newsom comparing notes with his counterpart in Hawaii.

https://x.com/TaraBull808/status/1878682435044712768

Interesting body language there. He’s a bit vague about the “myriad of issues” he’s dealing with, but it’s something to do with “land use concerns… around speculators coming in, buying up properties and the like”.

What is he talking about exactly? Anyone know?

Smart cities! His counterpart is a one of those! His body language is saying, I know something you don’t know!

Here is a link on Smart LA 2028. https://ita.lacity.gov/sites/g/files/wph1626/files/2021-05/SmartLA2028%20-%20Smart%20City%20Strategy.pdf

Just a coincidence right?

Maybe Mel will make a movie about it?

It’s worth reviewing the Dr. Day predictions again.

This part has relevance to this site:

PRIVATELY OWNED HOMES — “A THING OF PAST”

Privately owned housing would become a thing of the past. The cost of housing and financing housing would gradually be made so high that most people couldn’t afford it. People who already owned their houses would be allowed to keep them but as years go by it would be more and more difficult for young people to buy a house. Young people would more and more become renters, particularly in apartments or condominiums.

More and more unsold houses would stand vacant. People just couldn’t buy them. But the cost of housing would not come down.

You’d right away think, well the vacant house, the price would come down, the people would buy it. But there was some statement to the effect that the price would be held high even though there were many available so that free market places would not operate. People would not be able to buy these and gradually more and more of the population would be forced into small apartments… small apartments which would not accommodate very many children. Then as the number of real home-owners diminished they would become a minority.

https://archive.org/details/dunegan-lawrence-the-new-order-of-the-barbarians_202403/page/n9/mode/2up

A very interesting read. Thanks for the link. As we can see, there is still more to accomplish, but the final products are within their grasp. I say these elites are about 30 years behind from what the speaker enumerated.

As an older man, I don’t see the drastic changes already made. The younger people have already been groomed and are well acclimated to their desired fate. Their false reality is all they know. As more people like me die off, the final touches are easier to achieve.

The original speech was from 1969, and he said some things would take longer.

He also said it was already unstoppable even by then.

I notice around where I live, developers will buy a house and section for 1.5 million, and remove the house. They will then put 8 units on the section and sell them for at least 600k each. The units are tiny. The sections are not even 1/4 acre. So we have steadily increasing supply here, but they are getting smaller.

The effect is starting in Australia and NZ a little bit. Chinese buyers will buy 50 houses at once without seeing them, and leave them empty. It’s just an investment for them and leaving them empty increases demand. They pay cash and don’t care about rent. They just want to get the money out of China, away from the CCP. It’s their backup plan in case they upset the CCP and need to leave. The NZ govt accommodates them in this. In fact there was a scandal where a NZ politician was bribed for $20,000 for some deal.

The Chinese thought it was hilarious – normally it costs millions to bribe a politician (and they don’t mind paying) but in NZ it’s so cheap it’s embarrassing.

Thanks for the link. I was just reading about the Oneida Community and other eugenic Socialist Utopia experiments. Those seemed to fall apart when passing to the next generation, or the sociopathic leader ended up with a statutory rape charge. At some level they seemed to believe they could pass on their level of consciousness via selective breeding. I get the impression that the blood oath is required to get to their utopia.

Satan hates marriage and children because procreation is a gift to humanity from God the Father. Satan being an angel does not have the ability to procreate and does his worst to destroy this gift through his agents who I am sure have taken a blood oath. Even Cain took a wife and had a son, very human.

It takes a lot of selective breeding to do such a thing, but could be done.

There was a Maori woman in NZ (and I’m sure she is not the only one) that did a DNA test and showed as 100% Maori, even though she has some European grandparents or great grandparents.

Genes travel in clumps (chromosomes) so it’s not impossible to remove all the unwanted clumps and breed true. the genes don’t entangle completely and unseparably. Aside from pure chance (as in her case) it probably takes several generations. Breeders in NZ were able to re-create Scottish Hairy Cows here using only imported SHC sperm and selective breeding with normal cows to recreate the breed here. They appear to be 100% SHC now.

So who are the most selective breeders (at least in their inner circles), while telling everyone else to mix to the max?

Remember, everything in the MSM is a lie. I mean everything. The synagogue and Freemasons do not want us knowing the truth about what’s on the other side after the silver cord is cut. There’s going to be a lot of disappointed people.

Ecclesiastes 12 KJV……

_______

Man who died for three minutes ‘saw what hell is like’ and one thing surprised him

Excerpt;

Taking to Reddit, the friend said: “He remembers the stroke, and being wheeled to the ambulance on a stretcher. Then he felt like he was floating under ice cold water, and it was dark, but he wasn’t really thinking or feeling anything emotionally, just existing and knowing it was very, very cold and he couldn’t see.

https://www.mirror.co.uk/news/weird-news/man-who-died-three-minutes-34467053.amp

That description sounds a lot like where the fallen angels are bound till the end!

What action…he’s a do nothing stooge!

Goldman Says Drop in Funding Spread Signals Brisk Equity Selling

(Bloomberg) — This year’s sharp decline in funding spread suggests that institutional investors’ positioning in equities is shifting as markets rethink the Federal Reserve’s interest-rate path, according to strategists at Goldman Sachs Group Inc.

The funding spread — a measure of demand for long exposure through equity derivatives such as swaps, options and futures — has tumbled to around 70 basis points from about 130 basis points in late December, they said.

“In our experience, large short-term moves in funding almost always mean that there has been a change in demand trends from professional investors,” the team led by Head of Derivatives Research John Marshall wrote in a note to clients. “We believe that pension funds, asset managers, hedge funds and CTAs have all been net sellers over the past few weeks.”

https://finance.yahoo.com/news/goldman-says-drop-funding-spread-113804244.html

So, naturally one of the goals is to blow up the U.S. dollar and as a result, the rest of the currencies. They will be calling Trump the second Herbert Hoover soon enough!

Agreed. I think the SoS is setting up Trump and all Republicans for a fall just like Herbert Hoover.

It will be interesting to see if Trump will act like Herbert Hoover and do nothing or take action to counteract the economic contraction.

That 10 year UST chart looks like it may overcome 5% soon.

Imagine what will happen to that chart when they pull the plug on bitcon in 3 years?? That will be the catalist for the great taking.