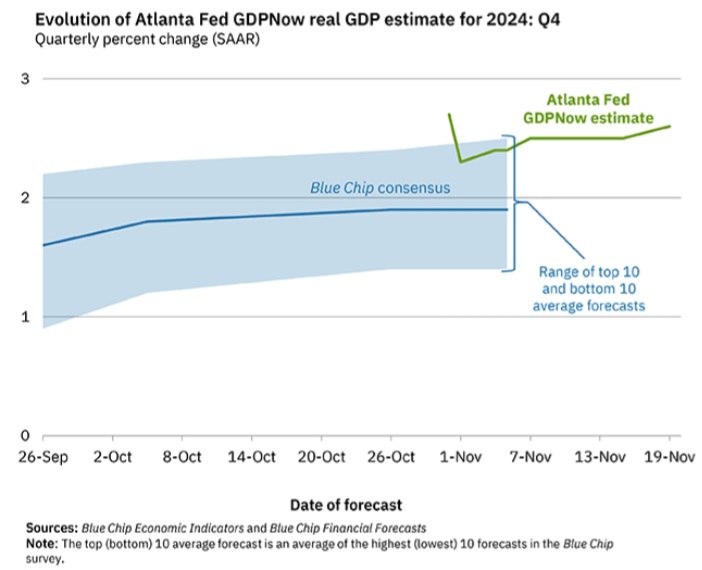

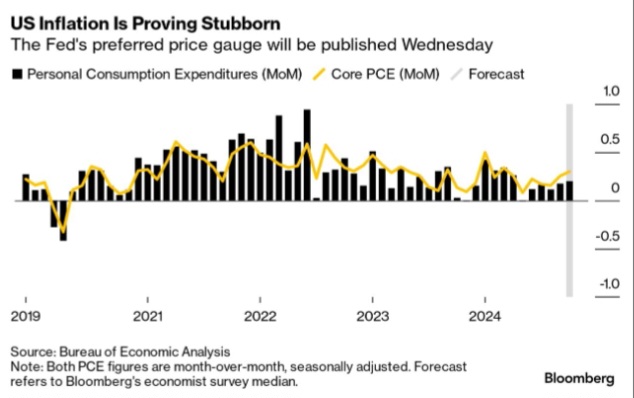

For most of this year, US inflation has been on a steady downward trend, fanning hopes that surging prices would give way to falling interest rates.

But as 2025 looms, there are signs that some pockets of inflation are proving more stubborn than expected, prodding economists to ask if this is as good as it gets.

We will get an update on the state of play when a gauge of prices that is closely watched by the Federal Reserve is released on Wednesday. The personal consumption expenditures index (PCE) is expected to have risen 0.2% in October from the prior month and 2.3% from a year ago.

US inflation is proving stubborn and the PCE is forecast to rise in October.

The Fed watches this indicator because it’s generally understood to be more comprehensive than other inflation measures, capturing not only what consumers spend out-of-pocket, but also indirect expenditures, including by third parties and the government.

If this week’s reading comes in as forecast or on the lower side of those expectations, then it will cement views that the great disinflation trend remains broadly intact and the Fed will have room to cut rates when it meets in mid-December.

But a higher reading would stoke the opposite reaction and ignite bets that the Fed has less room to maneuver. That scenario has extra potency given president-elect Donald Trump has promised sweeping tariffs on imported goods, which economists say will pressure inflation. All of which means that if policy makers at the Fed thought the inflation story this year was complicated, just wait until 12 months from now.

Mr Stone, I would value your assessment of this article regarding the US collapse everyone’s expecting.

http://www.321gold.com/editorials/nagasundaram/nagasundaram112824.pdf

I guess once the US blows up enough goyim it’s time to pull the plug and let them “dry up and blow away”.

Obviously, they haven’t done the required damage yet however.

JPMorgan Sees Half-Point ECB Cut in December on Weak Economy

(Bloomberg) — JPMorgan Chase & Co. has brought forward its call for a half-point interest-rate cut from the European Central Bank to December, citing the bloc’s slowing economic activity.

The bank previously expected policymakers to wait until January to accelerate the pace of easing. The JPM report encouraged money market traders to bet on a 50-basis-point cut next month, boosting the chance of such outcome to 20% from 10%.

“The case seems strong given the sharp PMI drop, slowing services inflation momentum, likelihood of persistent trade uncertainty and a starting point of restrictive rates,” economist Greg Fuzesi wrote in a client note.

Euro-area business activity unexpectedly shrank in November, and inflation in Germany failed to accelerate as economists expected. Also the bloc’s core inflation rate didn’t edge higher as forecast.

The JPMorgan economist says there appears to be a “lack of any clear push” from dovish ECB members for a half-point cut, but the “data have moved too quickly,” justifying a bolder action soon.

Governing Council member Francois Villeroy de Galhau said Friday the ECB should continue to cut interest rates, while the exact pace of easing will be determined in coming months. Earlier this week, his colleague Isabel Schnabel came up with a more hawkish tone, saying borrowing costs are already near a level that no longer restrains the economy.

“Even though internal dynamics in the Governing Council can at times result in hard-to-understand outcomes, the data have moved in a way that in our view makes a 50bps cut compelling already in December,” JPM’s Fuzesi wrote.

German bonds extended gains after the report, with the two-year yield falling five basis points to 1.95%, the lowest since November 2022.

Gotta keep the plates spinning a little longer!

https://www.youtube.com/watch?v=Cb6NS_F5xTE

Indeed! These are the individual central banks, which behind the scenes are working with one another, and will continue making a mess of things until the force majeure.

The central banks and their golem governments are manufacturing their existential enemies for World War 3, which are Soviet Russia and CCP China. We might as well call Vladimir Putin the Party Chairman.

Here’s an interesting headline! Trump threatens 100% tariff on the BRIC bloc of nations if they act to undermine US dollar

Don’t bet against the dollar.

For some reason ZeroHedge never mentions the Bank of Russia. ZH excoriates all the other central banks, except the Russian government and its privately run Soviet Gosbank knockoff.

That is very curious! If one does a search, you can see the trouble the Russian economy is in, but ZH is out of the picture! Do you have a theory?

Soviet-style propagandists never reveal the faults of their handlers. Communists are still in power in Russia.

As the saying goes, “If you want to know who controls you, look at who you are not allowed to criticize!

Ha ha!

(Bloomberg) — China boosted its cash injection into the banking system via a recently launched policy tool, in a move designed to ensure sufficient liquidity amid a surge in local government bond sales.

The People’s Bank of China conducted 800 billion yuan ($111 billion) of outright reverse repurchase agreements in November, according to a statement Friday, exceeding the 500 billion yuan injected last month. The contracts are for three months and are aimed at safeguarding the availability of “reasonably ample” liquidity in the banking system, it said.

In another statement Friday, the central bank said it bought a net 200 billion yuan of sovereign bonds from dealers in November, a move also aimed at ensuring plentiful cash supply.

The injection expands an effort to ease the funding pressure that had been building in the market after China kicked off a $1.4 trillion program to help local governments cope with their off-balance-sheet debt by allowing them to sell more bonds. As a result, banks — the main investors in these securities — are in need of more cash to absorb the higher debt supply while at the same time continuing to lend to consumers and businesses.

The PBOC will likely need to take further action — potentially by cutting the amount of cash banks must set aside in reserves — to avoid a liquidity squeeze in the coming months. A total of 2.4 trillion yuan in loans extended through the medium-term lending facility will mature in December and January, when the demand for cash usually increases due to public holidays.

So you are saying the money supply is going UP. With all the Powell cuts we went thru the few years, its effect didn’t last and going back up again. What does this mean?

It means higher asset prices and higher costs of living.

I know you said that once prices go up they won’t come back down, but in the past they have went down at least in certain areas..

If you were in charge, What would be your solution to reverse it then?

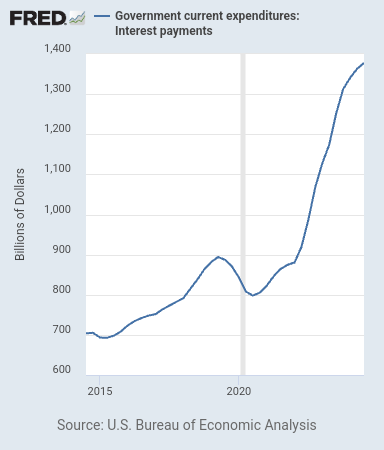

The growing money supply and the sharply rising supply of sovereign debt securities both work to enhance asset prices.

We sort of have the best of both worlds, so to speak. We have elevated inflation growth, interest rates that are close to neutral already, and a lot of interest income that is being generated paid out to fixed income investors. Thus, it’s very difficult to turn this worm around right now.

Moreover, all of these nation-state sovereign debt securities like US Treasuries are all used as collateral to buy up everything. Those who own these newly minted Treasuries can front run all the markets and buy up all the businesses and stocks as well as the nation’s real estate.

With this said, what would turn it around would be to see a marked decrease in fiscal deficit spending. That would essentially stop the asset markets in their tracks.

Unfortunately, the wheels have been set in motion and I do not see how a fiscal deficit spending reversal is possible anymore. On one hand, higher neutral interest rates and bond yields create ever-rising interest payments and the build up to the force majeure or World War 3 will continue for the next several years.

While the stock markets and real estate values are getting ahead of themselves in anticipation of what is to come and has been ongoing, they can remain elevated for a lot longer than people think.

Bloomberg – Russian President Vladimir Putin warned of potential strikes on “decision-making centers” in Ukraine’s capital Kyiv with new ballistic missiles that he said could turn the city into dust.

As this plays out, Russia’s defense minister is in North Korea to meet with his counterpart, stoking concerns over deepening military cooperation between Pyongyang and Moscow.

Stone – I am in a really tough spot and need your advice. I lent a family member money to purchase a beat up house, in a wealthy development. Another man owned it but the people were paying my son rent so he was the property manager I guess. It was rent to buy. The woman is crazy. They stopped paying rent completely. The family member badgered me until I lent him the money. It was going to be an easy flip he said. He and another relative got out there.and the people said they needed to get their van working and they weren’t leaving. The family member filed with the. court and posted the door. He has the woman acting crazy on video. So they labored fixing their van for days – all the while paying to stay in a campground. They promised to be out by the 1st, then the 5th, now she’s saying she’s not leaving – they’re going to fight it in court.

I am LIVID. I didn’t want to get involved and they badgered me. I badly need that money. Have you had any issue with this? Do they need a lawyer?

I am sort of confused. Send me an email and we can correspond that way. Thanks.

The rule of thumb is to never lend to a family member unless you are okay with never getting it back or, if it’s real estate, always run title and get the lien against the property legally. Treat any RE loan to a family member like you were a first lien mortgagee.

Despite having some of the wealthiest households in the nation, the blacks in office in Maryland are destroying the state’s finances. That’s what blacks do best as it’s in their DNA.

I sold half my MD rentals and deployed the money into the fiscally prudent red areas in Virginia, but I still have five suburban MD properties left to sell. All the properties I sold were condos and through tax exchanges I purchased detached single-family houses and townhomes. There are no schvartzes in local government office where I manage VA properties….

Two years ago, 2/2 condos in Strasburg, VA were selling for $147,000. One of these just sold this week for $199,000. That’s an increase of at least 30%. Click the link to see the particular property.

https://www.zillow.com/homedetails/165-Hailey-G12-Ln-Strasburg-VA-22657/2066431298_zpid/

The condos I owned in Prince George’s County, MD are up about 5% over the same time frame. At one time I owned six condos in PG, but I only have one left. The price on this last one has not budged in 2 years. The common charge has gone up almost $200 a month since then. Of course, blacks manage the property and blacks do what they do best. They drive up costs as they are cursed. Don’t rely on non-Adamic man.

_________

Maryland’s five-year state budget projection foresees ‘enormous gap’ not seen in two decades

Budget cuts, taxes among options to close budget deficits that rise into billions of dollars

https://marylandmatters.org/2024/11/12/five-year-state-budget-projection-foresees-enormous-gap-not-seen-in-two-decades/

I’m playing songs on YouTube this morning and all of the advertisements are full of niggers. They’re all very fat and primitive, too. Non-Adamic man. The Jew synagogue advertising agencies explicitly advertise this way in order to demoralize the Israelite remnants, which are part of Adamic man. It’s very successful.

Yes sir! We experience the same. I hate those commercials! My wife loved your comment by the way!

https://www.terminaleconomics.com/wp-content/uploads/2024/11/images.mp4

Classic!

We get the same in Canada, in Quebec YT ads they all speak french on top of it. Or it’s multi-breeds ice fishing and sitting down to Christmas dinner and driving Land Rovers.

I pay for Deezer music streaming, not for everyone but less aggravating for me.

Download the Brave browser and all the ads go away.

https://brave.com/

Despite all the manufactured fear surrounding the lack of affordable housing, homeownership rates remain slightly above historical averages….

____________

U.S. housing affordability to worsen even as price rises slow: Reuters poll

(Reuters) – Purchasing affordability for first-time U.S. homebuyers will worsen over the coming year on tight supply and just a few more Federal Reserve interest rate cuts, even as average home price rises slow, according to a Reuters poll of property experts.

Without enough entry-level housing for sale, particularly for families, affordability has long been the burning issue in the housing market of the world’s largest economy, consistently pricing out prospective first-time homebuyers.

Slightly lower interest rates over the coming six months will not be enough to entice new buyers into a housing market where prices are still over 50% higher than pre-pandemic levels, according to a Nov. 12-27 Reuters poll of property analysts.

On purchasing affordability expectations, 10 of 19 survey respondents changed their view to “worsen” from “improve” compared with an August survey. All 26 polled in August said it would improve.

“Take the U.S. and a lot of the West – they’re getting older. That’s where the wealth is. They take on second homes, even third homes, pricing out younger generations who just haven’t had enough time to build up any savings,” said John LaForge, head of real asset strategy, Wells Fargo Investment Institute.

“We continue to have these big overhangs – do you have the money for down payments? Do you have savings with the younger generation? I’d say we’re getting better, but we’re nowhere close to where we need to be.”

The median age of U.S. homebuyers is 49, up from 31 in 1981, according to recent research from Apollo Global Management.

Average U.S. home price rises, based on the S&P CoreLogic Case-Shiller composite index of 20 metropolitan areas, will slow from 5.1% this year to 3.2% next, and 3.5% in 2026, Reuters poll medians showed.

Those forecasts are roughly unchanged from August. That comes despite financial markets currently pricing only about three more quarter-point interest rate cuts from the Fed, just half what was expected then, on worries of an inflation resurgence following Donald Trump’s election victory.

HOUSE PRICE RISES TO OUTPACE RENTS

Expensive homes have also forced many to keep renting, making up slightly over one-third of occupied U.S. housing. Asked what would happen to average rent inflation over the coming year, over 70% of survey respondents, 13 of 18, said it would stay about the same or decrease.

Nearly two-thirds of respondents, 13 of 20, said average home prices would rise faster than average rents over the coming year.

“We expect house price growth will continue to slow as low affordability forces more buyers out of the market. Sellers will have to adjust their expectations on price increases to sell their properties,” said Cristian deRitis, deputy chief economist at Moody’s Analytics.

Existing home sales, comprising more than 90% of total sales, are forecast to rise only slightly to a 4.0 million unit annualized rate next quarter and stay around that rate over coming quarters. That is well below 6.6 million units in 2021, in the middle of the pandemic boom.

Fewer Fed rate cuts will also prevent mortgage rates from falling much more.

The 30-year mortgage rate, which averaged nearly 7% through 2023, is forecast to average 6.5% next year and decline only to 6.3% in 2026 – higher than 6.1% and 5.9%, respectively, predicted in the August survey.

“With home prices expected to continue to rise and mortgage rates declining less than we previously expected after Trump’s election, conditions for first-time buyers are likely to worsen,” said Grace Zwemmer from Oxford Economics.

US Sanctions Hit Ruble as Russia’s FX Sources Are Drying Up

Bloomberg News

(Bloomberg) — Fresh US sanctions against Russian banks have caused a further slide in the ruble, putting at risk some of the last channels of direct foreign-currency flows into the country.

The ruble has fallen almost 8% against the dollar since November 21, when the US sanctioned some 50 Russian banks with connections to the global financial system. On Wednesday, the currency went beyond 108 per dollar after passing 105 the day before, the weakest levels since March 2022 during the aftermath of the first sweeping sanctions over the invasion of Ukraine. It closed near 113 per dollar going into the Thanksgiving holiday.

The targets of the new penalties included Gazprombank, which serviced international payments for key Russian gas exports.

“Market participants are actively buying foreign currency to promptly make payments to counterparties,” said Evgeny Loktyukhov at Promsvyazbank. “Sanctions are creating concerns that in the near future, currency inflows from exporters may be limited.”

The Bank of Russia has used interbank transactions to calculate the rate since June, when the US sanctioned the Moscow Exchange — which immediately halted dollar and euro trading. On Wednesday, the bank also said it wouldn’t purchase foreign currency on the domestic market until the end of 2024 in order to reduce volatility in financial markets.

Since the beginning of this year, the Russian currency has dropped by more than 19% versus the dollar, central bank data shows. It also lost almost 18% against the Chinese yuan.

Russian exporters and importers have been suffering from difficulties with international payments since the end of 2023, when the US intensified pressure on friendly countries through a threat of secondary penalties against financial institutions working with Russia.

As a result, direct payments to and from Russia’s main trading partners have mostly ground to a halt. Russia still conducts a thriving trade in commodities via intermediaries, often paid in rubles.

New rounds of restrictions may complicate foreign trade transactions even more and reduce incentives for bringing foreign-exchange liquidity into Russia, Rosbank analysts wrote in a note.

“The current trend of a weakening ruble may prove sustainable on the horizon of 2025,” Rosbank wrote. Prior to Wednesday’s central bank statement, the analysts forecast the ruble may reach 119.8 versus the dollar next year due to geopolitical tensions and the lack of incentives for authorities to limit exchange-rate volatility.

Stone,

Have a great Thanksgiving Holiday.

Hopefully it is a peaceful reconciliation with your family.

I am thankful for your site as your wonderful commentary has pulled me through trying times in the last four years. They were trying times for me between being bullied for refusing the Covid kill shot, being bullied for my non-communist views, isolated for my belief in Jesus Christ the savior, the 2020 riots and buying guns as a result, and the threat of a heavy handed bullying government.

Your site has provided an excellent moral support for true to heart Christians and anybody else who does not go along with the Satanic program that is being imposed on us.

In addition, your stock picks helped me net some profits which is icing on the cake.

Thank You

Stone. Thank you for being aggressively bullish for what seems like forever despite all the fear mongering. I never sold anything. I bank on the communist spending and government military build all the way to World War III.

Debt to the Penny; $36,113,570,535,802.53

Up $61 billion overnight….

Asset prices have only one place to go…

Stone,

I also thank you for your valuable and very accurate economic insight. Your insight has helped me push back the fear mongering from alt media and also mainstream media of imminent economic collapse. That fear mongering is designed to keep the average person from investing in income producing assets in order to keep them poor. I held on to my investments over the years thanks to your insights and that kept me from being dependent on some miserable boss who probably would require all the vaccinations out there that shortens my life.

Lots of data, little change. Nothing moving the needle….

Continuing Jobless Claims

Act: 1,907K Cons: 1,910K Prev: 1,898K

Core Durable Goods Orders (MoM) (Oct)

Act: 0.1% Cons: 0.2% Prev: 0.4%

Core PCE Prices (Q3)

Act: 2.10% Cons: 2.20% Prev: 2.80%

Corporate Profits (QoQ) (Q3)

Act: 0.0% Cons: Prev: 3.5%

Durable Goods Orders (MoM) (Oct)

Act: 0.2% Cons: -0.8% Prev: -0.4%

Durables Excluding Defense (MoM) (Oct)

Act: 0.4% Cons: Prev: -0.9%

GDP (QoQ) (Q3)

Act: 2.8% Cons: 2.8% Prev: 3.0%

GDP Price Index (QoQ) (Q3)

Act: 1.9% Cons: 1.8% Prev: 2.5%

GDP Sales (Q3)

Act: 3.0% Cons: 3.0% Prev: 1.9%

Goods Orders Non Defense Ex Air (MoM) (Oct)

Act: -0.2% Cons: 0.5% Prev: 0.3%

Goods Trade Balance (Oct)

Act: -99.08B Cons: -102.20B Prev: -108.23B

Initial Jobless Claims

Act: 213K Cons: 215K Prev: 215K

Jobless Claims 4-Week Avg.

Act: 217.00K Cons: Prev: 218.25K

PCE Prices (Q3)

Act: 1.5% Cons: 1.5% Prev: 2.5%

Personal Income (MoM) (Oct)

Act: Cons: 0.3% Prev: 0.3%

Personal Spending (MoM) (Oct)

Act: Cons: 0.4% Prev: 0.5%

Real Consumer Spending (Q3)

Act: 3.5% Cons: 3.7% Prev: 2.8%

Real Personal Consumption (MoM) (Oct)

Act: Cons: Prev: 0.4%

Retail Inventories Ex Auto (Oct)

Act: 0.1% Cons: Prev: 0.1%

Wholesale Inventories (MoM) (Oct)

Act: 0.2% Cons: 0.0% Prev: -0.2%

As the ruble and Russian economy collapse, Putin gets more desperate and hyperbolic. Putin never thought oil would be selling this inexpensively. Russia is going through all its reserves to support the ruble and fund its military.

In one regard, Trump is actually a bigger enemy of Russia than Biden. Trump’s energy policy has the effect of kicking Russia’s economy to the curb. Oil prices have already followed suit in anticipation of Trump’s relaxation of energy regulations, and this only hurts Russia at the worst time. Oil revenue will continue to fall.

So, at some point this and other factors will compel, like hooks in the jaw, Russia and their allies to do what is takes for survival! America first policies may be the spark that lights the flame.

The table is being set. Absolutely!

Great point. An America First policy will seem more of a threat to Russia, China, and Iran. When they are threatened economically that will drive their leaders to pick a war to distract from a bad economy at home. Trump is definitely playing into the end time plans based on this scenario.

Absolutely!

Happy Thanksgiving to you Stone, and all readers and all who comment on this blog! I appreciate this site and your efforts to keep it going.

Psalm 105:1 O give thanks unto the YHVH; call upon his name: make known his deeds among the people.

Thank You

I wish everybody on this blog a wonderful Thanksgiving Holiday.

BOJ reaps $8.3 billion in dividends from ETF holdings

TOKYO (Reuters) – The Bank of Japan said it reaped 1.264 trillion yen ($8.31 billion) in dividends from its holdings of exchange-traded funds (ETFs) in the April-September first half of the current fiscal year, up from 1.137 trillion yen in the year-before period.

The central bank paid 392.2 billion yen worth of interest to excess reserves financial institutions park with the BOJ, up from 92 billion yen in the same period of the previous year, its fiscal first-half earnings results showed on Wednesday.

($1 = 152.0400 yen)

This morning’s housing data is a mixed bag with the Fed’s data coming in better than expected while Case Shiller disappoints.

FHFA House Price Index (YoY) (Sep)

Act: 4.4% Cons: 4.3% Prev: 4.4%

FHFA House Price Index (MoM) (Sep)

Act: 0.7% Cons: 0.3% Prev: 0.4%

FHFA House Price Index (Sep)

Act: 430.3 Cons: Prev: 427.4

S&P/CS HPI Composite – 20 s.a. (MoM) (Sep)

Act: 0.2% Cons: Prev: 0.3%

S&P/CS HPI Composite – 20 n.s.a. (YoY) (Sep)

Act: 4.6% Cons: 4.7% Prev: 5.2%

S&P/CS HPI Composite – 20 n.s.a. (MoM) (Sep)

Act: -0.4% Cons: Prev: -0.3%

As the Russian ruble and economy continue to crumble, Vladimir Putin will step up his calls warning the world of an imminent World War 3.

Putin is not a master chess player. Rather, Putin has been in power too long and is increasingly becoming delusional and out of touch. He’s taking Russia down with him.

Perhaps, when he’s ready with China, he’ll take down the United States as well with a bunch of nuclear bombs. That’s if he’s not killed by his own countrymen beforehand.

When white people control almost 90% of the nation’s wealth, these large Blue Chip firms know that they can’t continue offending the big ticket shopper.

To wit, Walmart (WMT) has become the latest corporation to back away from diversity, equity and inclusion initiatives amid growing pressure ahead of Black Friday and the holiday shopping season. The latest drive was led (again) by influencer and political activist Robby Starbuck, who called it the “biggest win yet for our movement to end wokeness in corporate America.” The policy decision by the biggest U.S. retailer and private employer is likely to send shockwaves across Corporate America, especially for larger competitors like Amazon (AMZN) and Target (TGT).

Roll them back, roll them out: Walmart will stop using the terms “DEI” and “LatinX” in its communications, as well as curbing racial equity training for staff and diversity hiring guidelines. It will also no longer factor in race and gender when granting supplier contracts, while eligibility for financing will not be based on certain demographic data. Walmart will additionally remove all “sexual and/or transgender products marketed to children,” review all funding for LGBT+ Pride events, and stop participating in the Human Rights Council’s LGBT+ equality index.

Looks like MSTR stopped buying BTC for now.