The damage is done; whatever the Fed does won’t matter

The US 10-year Treasury yield is up 70 basis points since the Fed cut the Fed funds rate 50 basis points.

We will soon have a positive sloped yield curve, just not in the way most bond investors imagined.

Permanent and everlasting damage has been done, because of the monetary and fiscal policy “errors” since the covid stimulus packages were promulgated as well as the continually growing fiscal deficits that accrued under Biden after covid was no longer an issue.

QE or no QE? It doesn’t matter anymore

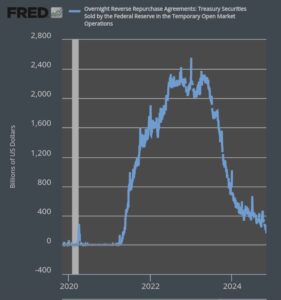

Even if the Federal Reserve begins to add to its existing balance sheet once again to make up for the shortfall in organic Treasury demand and as the funds in the reverse repo facility effectively shrink to zero, yields are still going to continue rising.

Sure, there will be a knee-jerk bond rally if the Fed begins to add to its balance sheet once again, but the markets and global investors will know any balance sheet additions are because of the spending gap reality and that the Fed has backtracked on everything that it’s supposedly stood for.

Inflation will also rip as a result of the reinstitution of Fed bond purchases and fixed income investors will be throwing in the towel regardless of what the FED does. They already are throwing in the towel even though the FED has been cutting overnight rates. This is self-evident as bond yields are rising.

What’s worse is that the continual Democrat inspired fiscal deficit spending is causing house prices and rents to continue to spiral higher. If the Fed adds Treasuries to its balance sheet to help suppress bond yields and lower the government’s cost of debt financing, house prices will once again rip higher.

The damage is done and regardless of what the FED does, bond yields will continue rising after any short-term rally.

Watch for the unfolding UST market catastrophe to continue for the next few years under Harris until the force majeure.

The deliberate wipe out of the middle class

The largest single component to inflation is something most don’t think about. The largest single component to inflation is the rising cost of borrowing money that is depreciating by the day. It is a punishing inflation that will ruin the entire working class and those who don’t already own the assets.

Yes, I’m sorry to say that the window to accumulate income generating assets has effectively been shut.

I predicted this and it is happening now as expected. I knew this beforehand because I am a well-trained and formally educated economist who understands the conspiracy. I also have a thorough background in finance and applied mathematics, unlike the other prognosticators in the alt-media.

https://youtu.be/y1_GFh6sOgY?si=J9Zec4fZUXAJu2qh

What are your thoughts on leaving the USA based on what this guy says? Have you ever travelled to other countries? Which ones?

I’m not leaving and have indicated that over the years on this blog. I’m staying in the United States. The world has been conditioned to hate Americans and after what happens, happens, Americans will be hated even more. Foreigners will take our money and our lives. I have a better shot living here and dealing with what is coming. Unless someone is familiar with others in another country and can speak the language, I would suggest staying here. It’s entirely your call. I won’t watch the video as I have other more important things to tend to.

All right, that makes sense, have you ever travelled abroad though?

What do you think of this article on Henry’s site?

In particular, what is your opinion on the comment from “Insider”?

https://henrymakow.com/2024/11/migchels-us-debt-crisis-proportions.html

I guess Insider could be right. Mark Skidmore’s paper found enough theft in only two govt depts to pay off the entire debt. There seems to be two economies. The one where normal people work for their money and the dollar seems to have at least some value, and the one with the fake money-printing economy that spends trillions.

In New Zealand they say Covid cost $70 billion, yet when it’s time to build a new Harbour Bridge or tunnel in Auckland (5-8 billion est) we “don’t have the money”.

Make it make sense. Thanks.

Elon Musk profits much more handsomely with the greenies and the Democrats in office. It’s estimated that each car he sells receives direct and indirect Federal government subsidies of at least $15,000 per car. Under a Trump regime, that would be cut substantially. Musk’s entire portfolio of companies profit handsomely off government largesse. This is especially true of SpaceX. He’s a hypocrite to the core, but he is a genius.

Musk is told to support Trump and perpetuate the false dichotomy of the Left/Right paradigm, and he carries out his duties like a good little goy boy…..

Elon Musk Warns Of ‘Hardship’ For Americans If Trump Puts Him In Charge Of Cutting $33 Trillion Debt

https://www.benzinga.com/personal-finance/24/11/41701075/elon-musk-warns-of-hardship-for-americans-if-trump-puts-him-in-charge-of-cutting-33-trillion-deb

By the way, Elon Musk turned away from Trump in the 2020 election withdrawing his support. Obviously a turncoat. That was the same time that Matt Drudge also turned against Trump. This election is a false dichotomy. This is the Hegelian dialectic being played out.

This time Musk “saw the light “ and is supposedly supporting Trump. It is obvious that he is playing a role that is ordered from the higher ups. I do not think he is genuinely supporting Trump.

Basic questions: Who is the interest/debt owed to? The Federal Government borrows from The FED, so basically borrows from itself? Can’t they just say we aren’t going to pay it so reset it to zero and start over?

It appears they want “the debt” to be a big issue in the public mindset so they can bring in CBDC financial apparatus?

Anyone owning a treasury money market fund is cleaning up gratis the amount of money the US government is paying an interest, especially on its short-term outstanding debt. Pensions and commoners and treasury money market fund holders are generating a lot more interest income than last decade.

According to the terms that the Federal Reserve has with the US Treasury, any interest income the FED earns on its Bond portfolio minus Capital losses and operating expenses are to be remitted back to the US Treasury.

Thus, if the Federal Reserve incurs no unrealized or realized Capital losses on its treasury holdings, the interest income it earns minus its operating costs is returned to the US Treasury.

If the Fed sustains a large amount of capital losses like it did over the past three or so years, the US Treasury is supposed to then reimburse the Fed for the losses it incurs on its portfolio of Treasury holdings. I think the US Treasury has been sending payments to the Federal Reserve. While I’m not 100% certain on that, since I don’t know if the Federal Reserve has been marking to market, so to speak, I think they did.

Hypothetically speaking, if the Federal Reserve owned all of the Treasuries outstanding or substantial percentage like the Bank of Japan does with respect to Japanese sovereign debt, the United States government can essentially remain in business forever.

QE could have lasted indefinitely, meaning for 20 or 30 or 40 years if the US government pretended to be fiscally prudent. But it seems that confidence is quickly being lost and ultimately, QE can only sustain itself if investors are confident it can do so.

I recall back in the early-mid ’80s during the first Reagan regime when the United States government began to accrue outsized and unprecedented large peacetime fiscal deficits. The Cassandra’s were out and were pushing gold really hard. It seems that the media have been pointing to these deficits for over 40 years now. Over the years, they continue to grow and yet we’re still here.

I basically take it for granted that another crisis will occur in which the Fed will use it as an excuse to begin adding to its balance sheet once again. However, Bond investors were destroyed over the past four years and I doubt that the markets have the stomach to deal with that ever again. If there is a crisis this time around, I doubt very much overnight rates and bond yields will be able to sustain any meaningful downturn in yields.

I ask, who in their right mind would bid up the 10-year Treasury, so that it’s yield was back below 2% again? Only a stupid retard or a Federal Reserve intent on buying up every last Treasury security. If any of that comes close to occurring, look out for asset and price inflation.

More anti-Caucasian propaganda fresh from the DoD senior editors….

America has a shoplifting epidemic. The thieves aren’t who you think.

https://www.businessinsider.com/middle-class-shoplifting-retail-theft-crime-stealing-stores-2024-11

Carson estimates that he “saves” around $1,000 by shoplifting each year, but it’s hard to say since he might not get those expensive cheeses if he actually had to pay for them. He recognizes the fact that being a “white dude” gives him a certain amount of privilege in avoiding employee suspicion. And before you ask, no, he doesn’t feel bad about it, especially when he pilfers from Whole Foods. It became an “open field” at the high-end grocer after Amazon acquired it in 2017, he says, in large part because of Jeff Bezos.

“It’s run by a guy who’s shooting himself into outer space,” he said. “It just became so hard to find the reason that you actually hurt anybody by doing this.”

Yes, I’ve seen those videos of large groups of white guys storming into stores and looting! Just like those white guys burning cities down a few years ago!

Psychological war fare!

What is interesting is when the riots were happening in 2020 I saw videos of young white women and white guys looting items from the high end stores in the big cities. I really thought that these people were self entitled assholes because they were dressed like they could easily afford the items. They just wanted free items.

When the white Caucasian people start acting like the low life colored mongrels then that is a clear indication that society is headed towards an anarchic collapse.

This reminds me of the 1987 movie “RoboCop” with scenes of white kids along with their white adult chaperones stealing items from a store. The movie portrayed Detroit as a hollowed out anarchic slum with high crime that was managed by a corporate elite. I think Robocop was portending where this country was headed 30 years ahead of its time.

Yea, the George Floyd incident was just an excuse to cause mayhem by a bunch of disgruntled low life’s. We may see more on display in the near future.

The purpose of that was to demoralize the majority. This is a common communist tactic. You mentioned the movie Dr Zhivago, and that was a common communist tactic during the Bolshevik revolution. The disenfranchised rise up, but this time around, with disenfranchised are too retarded and are just used as a cudgel to demoralize and subdue the majority. It works well.

https://youtube.com/shorts/gjQRXP77Mqw?si=FA0dCt8NT2W6MjYI

Following up on that “conclave” movie, and the conversation you mentioned on the last Pope, been Pope Francis. I definitely think this is a revelation of the method technique of what is to come. Impeccable timing for the masses, I will not spoiled the plot but let’s just say an androgynous figure comes out!

Things are aligning perfectly!

You got that right. There is no more honor anywhere. There’s no more honor in the Vatican, there’s no more honor in the household, there’s no more honor in the town hall and local government agencies.

Some conspiracy theorists believe BlackRock owns everything.

Not true, BlackStone owns some too.

Completely different companies.

These corporations are just fronts for Rothschild and the other members of the synagogue.

Fed and Peers Will Go Ahead With Rate Cuts After This Week’s US Election

(Bloomberg) — The Federal Reserve and many rich-world peers are widely expected to lower interest rates again in the coming week, right after a US presidential election that may not be decided yet.

Central banks responsible for more than a third of the global economy will set borrowing costs in the wake of the vote, clinging to whatever certainties they can discern on the likely path of American policy for the next four years.

With Vice President Kamala Harris and former President Donald Trump neck-and-neck before Election Day on Nov. 5, monetary officials from Washington to London may find themselves still in suspense.

Election aside, US policymakers have already communicated a desire to proceed with a more gradual pace of rate cuts after September’s half-point reduction. Economists widely expect a quarter-point move on Thursday, followed by another in December — and their conviction grew after data on Friday showed the weakest hiring since 2020.

Fed officials try to steer clear of politics, yet they kicked off a rate-cutting cycle heading into the final stretch of an election whose outcome may hinge on how voters feel about the economy. While Chair Jerome Powell will likely stress that the current conditions warrant less restrictive policy when he speaks after the decision, he and his colleagues still risk political backlash.

Berkshire Hathaway’s Cash Pile Reaches Record $325.2 Billion

(Bloomberg) — Berkshire Hathaway Inc.’s cash pile reached $325.2 billion in the third quarter, a record for the conglomerate, as Warren Buffett continued to refrain from major acquisitions while trimming some of his most significant equity stakes.

Berkshire once again cut its holdings in Apple Inc., the Omaha, Nebraska-based company said Saturday in a statement. Its stake in the iPhone maker was valued at $69.9 billion at the end of the quarter, down from $84.2 billion in the second quarter, indicating that Berkshire cut its stake by about 25%.

Berkshire first disclosed its Apple stake in 2016 and had spent $31.1 billion for the 908 million Apple shares it held through the end of 2021.

Buffett said in May that Apple would likely remain Berkshire’s top holding, indicating that tax issues had motivated the sale. “I don’t mind at all, under current conditions, building the cash position,” he said at the annual shareholder meeting.

“I don’t think Warren Buffett’s ever really been super comfortable with technology,” said Jim Shanahan, an analyst at Edward Jones.

Cathy Seifert, a research analyst at CFRA, said Berkshire’s Apple stake was “starting to become an outsized percentage” of its overall portfolio. “I think it made sense to sort of lighten that exposure a little bit,” she said.

Net Seller

Berkshire reported $34.6 billion of net share sales in the three months through September.

The company has struggled to find ways to deploy its cash pile, as Buffett has found market prices too high to find attractive deals. At the annual meeting, Buffett said Berkshire wasn’t in a rush to spend “unless we think we’re doing something that has very little risk and can make us a lot of money.”

Higher yields on cash holdings set “the bar a little bit higher for other opportunities,” Shanahan said.

Interest and other investment income has more than doubled at the conglomerate’s insurance business, reaching $3.5 billion in the three months through September.

Buffett, 94, has used some of the cash hoard to repurchase some of its own stock, though even that had become costlier recently. Shares of Berkshire have gained 25% this year, boosting its market value to $974.3 billion. Its market capitalization eclipsed $1 trillion for the first time on Aug. 28.

This past quarter, Berkshire declined to buy back its own stock for the first time since it changed its policy in 2018.

“I think investors are going to be disappointed by that,” Seifert said.

Operating Earnings

Berkshire’s operating earnings fell 6% from a year earlier, to $10.09 billion, as insurance underwriting earnings slumped. The company also recorded a $1.1 billion foreign-currency-exchange loss during the quarter.

Earnings from underwriting at the firm’s collection of insurance businesses plunged 69%, to $750 million, versus $2.4 billion a year earlier, driven by higher losses at Berkshire Hathaway Primary Group.

Berkshire estimated that the impact of hurricane Helene on its earnings this quarter came to $565 million. Hurricane Milton is expected to result in a pretax hit of $1.3 billion to $1.5 billion in the fourth quarter.

While earned premiums grew at car insurer GEICO, they declined about 5.6% across Berkshire’s reinsurance businesses. Seifert said this could signal that Berkshire is embracing a “risk-off” strategy this quarter.

The article should be titled “campaign to kill children continues in north Gaza”

__________

Campaign to vaccinate children against polio continues in north Gaza

https://nordot.app/1225489381295243395

Vaccinations are a covert way of killing people.

I had to log into my email server account to edit stuff and it showed I have 45 subscribers. My job will not be complete until I offend everyone and there is nobody left.

I think about what O’Brien said to Winston when asked about the ongoing revisions to the Newspeak dictionary. O’Brien said the party’s job won’t be complete until the dictionary is reduced to only one page. Then it will be perfect.

My job won’t be done and won’t be perfect until there are no subscribers left.

The honest truth separates the adults from the children. Those who walk with Jesus Christ know , accept, and understand the truth. Those who don’t walk with Jesus Christ are susceptible to living and believing lies and meltdown when confronted with the facts. Children have trouble understanding the truth.

Well, you better get going! There is not much time left!

Seriously though, John 17:17! As long as the Truth is in your message, you will only alienate those that should be alienated!

I ain’t goin’ anywhere!

I have thick skin; I can take it. I already know I am a mongoloid invader with probably an IQ of 50 or less, who needs to be obliterated like when Israel killed the ham descendants before they got soft and then got overran by them.

Bring it on, Mr. Stone but increase it a few more notches, might as well, like you told your local congressmen office, burn it to the ground, might as well.

You remember me telling you about those emails I sent to my two senators and local congressman. I said I own my whole stash of firearms not for personal safety but for the tyranny that’s coming out of DC and for the hell they are approving.

I told them I own my firearms for the true enemy, my elected officials who need to be kept in line lest they trample on what remaining rights I have. Any selected official who tries to take away my gun rights is not looking out for me but looking out for his bosses. I told them that they will never get any of my property and if they try to take any of my houses I’ll burn them to the ground before that happens.

They actually sent me personal responses, which specifically referred to topics in my emails, telling me how they were trying to be good elected politicians. Of course, they’re all Democrat.

Just thought about this, and those guys who unsubscribed, I can almost predict, they will be the first ones to get raped, murdered, tortured, see their family gone at the legendary holodomor style, the moment China comes to invade these unwalled lands.

The dragon 🐉 is up there getting ready. I can’t help but find some amusement in all of this.

The people who unsubscribed don’t like the tough love message. They don’t like hearing these things as they still believe somewhere there is hope that everything will work out. They still cling on to Trump, the pre-trib rapture, a mass awakening, real estate prices collapsing so they can buy, the fatal misconceptions of the last day Christians, etc. Most of these people cannot comprehend and accept that they believe lies. They hate the west, they hate their own people, and believe we’re all equal in the same like the devil says.

I’m certain that Martin Armstrong has a subscription list of 40- to 50,000, perhaps more. These people like to be lied to and listen to a convicted felon who played a shell game to swindle investors of $700 million, while hiding personal assets of $15 million and going to jail for 11 years.

I read about Armstrong’s case. While he didn’t intentionally defraud investors of up to $700 million, he lost that money trading it for other people. He then created fake statements that hid the losses and developed a type of Ponzi scheme to keep it going.

This goes to show you that Armstrong’s supposed algorithms (which is a bunch of bunk) not only doesn’t work, but will lose anyone who listens a fortune.

People love lies. Armstrong is partisan and he’s a Jew. People love this. Let them burn.

Lol…I think you made it. You have one page of subscribers. Cheers!

In the wake of the relatively economically bearish data dump yesterday, the Atlanta Fed slashed its current quarter’s GDP growth forecast by 0.4%.

Under normal circumstances bond prices at least should have held their own yesterday, and on a technical basis, should have rallied instead of falling.

On a short-term basis, bonds were already oversold and were waiting for some sort of catalyst to rally. Yesterday’s data should have provided that catalyst, yet bonds continued to fall and broke out of weekly resistance levels.

If someone had showed me yesterday’s economic data and the daily US 10-year Treasury chart from the day before, I would have predicted a bond rally with the yield dropping to at least 4.2% and maybe lower. We can clearly see that the bonds sell off had been overdone on a short-term basis and a retracement was due from any bond-market positive catalyst.

We didn’t get that at all and after an initial rally in the morning, bonds continued to weaken throughout the day.

After a knee-jerk dump after yesterday’s job data, the USDX began to March higher throughout the day and closed at a daily breakout high. This march coincided with the breakout in bond yields.

These are weak numbers from the Household survey and the unemployment rate of 4.1%, which remains unchanged from the previous month, masks the relative weakness in the overall job market data.

Under normal circumstances, the bond market should have responded more favorably to the numbers. I look at the jobs data from yesterday and there’s no real reason why bond yield should have spiked the way they did.

The number of the employed dropped by 368,000 while those not in the labor force rose by 428,000. Thus, the labor participation rate fell 1/10 to 62.6%. Moreover, the civilian labor force declined by 220,000. That’s why the unemployment rate remains steady at 4.1%, despite the rise in the total unemployed.

On any other occasion, these numbers would indicate to me that bonds would rally all other things being equal. The fact that bonds took a big dump yesterday is very telling.

https://www.bls.gov/news.release/empsit.a.htm

$35.951 Trillions.

Wow.

It’s in our faces now. This government malfeasance is intentional and is being generated to undermine global investors confidence.

It’s accelerating now. QE could have been used indefinitely, but the authorities want to bring it down. They have a replacement system ready to go when all confidence is lost.

Bond yields and the price of gold are the two important confidence gauges now.

Friday’s jump in bond yields sealed it.

Do you have any ideas on what crapto will do in the near future?

I’ve only ever recommended BTC and not anything else since 2020 and continue to do so. I used to recommend others last decade, but don’t spend much time analyzing crypto anymore. I have no opinion on it, don’t understand the technology, but look at supply/demand. It’s going higher. I think the only to make it for sure is BTC. Stay with that.

What BTC does in the near future is another thing altogether. It’s been my experience to profitably accumulate on dips, thus I would not be accumulating here, but holding what I have.

Have faith in the value proposition, so wait for the price to weaken to accumulate more.

I would begin accumulating in the 65-66k range and would hold for an eventual break out to new ATHs up to 80k.

The typical American right up until the second half of 2027. Watch til the end. A little over a minute.

https://youtu.be/0SNpTCZFhtc?si=8V6cecstS7bLTLse

Yep, either never saw it coming, clueless or just suicidal!

The problem with one string banjos like Rogers is that I could never invest according to his recommendations as I would lose everything waiting to be vindicated.

The same with Armstrong. He declared that sovereign issues would begin to collapse in 2015, yet they continued to rally alongside everything else while there was low inflation. After contemplating his theories into 2016, I viewed it like a bunch of non sequiturs, and said so on my old blog and shortwave radio.

How can a supposed economist not account for QE when determining forecasting scenarios? I couldn’t. QE changed everything.

Namely, how can yields rise with the low inflation of last decade? Conversely, how can inflation remain low like last decade with rising yields? We need to investigate why bond yields would be rising as Armstrong said into 2015, and it’s usually because of a loss of confidence. A loss of confidence is absolutely inflationary, yet we experienced low inflation for another five years.

We can’t have rising stock prices with rising yields and low inflation. We can have rising stock and asset prices with either low yields OR high inflation. Moreover, he was bullish on stocks and bearish on real estate. Ha?

But since 2019-2020 and until recently, we had the best of both worlds; rising inflation AND low bond yields and/or low overnight rates.

I have calculated that neutral rates are at least 4% and have said so for almost a year. Given current fiscal policy, monetary policy is still dovish and taken together, both fiscal and monetary policies are inflationary.

Good call and insight on Armstrong, Thomas! I only read him for entertainment purposes.

He has just called for a significant pullback in gold….duh.

I sold off two more properties…..problems with tenants I couldn’t evict…… the Trudeau government won’t let Landlords evict problem tenants any longer, especially if they are non-white.

Buying MMF with the cash and a grocery store REIT: SGR.UN yield is 8%+.

What is your call on the Fed Fund rate? I just read an Economist suggesting 6.25% in 18 months (?) Wow!

Keep up the good work!

I’m trying to understand why the Fed decided to drop 50 basis points. Of course, I can chalk it up to politics, but I suspect there’s something else going on. I suspect the upper echelons at the Fed are concerned about the USGs financing needs and its spiraling costs and are sending up trial balloons to see if they can lower the overnight rate.

I suspect the senior economists at the Fed wanted to see what would happen to longer dated note and bond yields if they slashed the overnight rate 50 basis points. It’s clear that we have our answer.

It’s clear to me and to those behind closed doors at the Fed that overnight rates cannot be cut much further. Fixed income investors are growing more concerned by the day over inflation risk and a nascent credit risk of the United States government and its ability to finance its ballooning fiscal deficits.

Fixed income investors are looking at the horror in Washington and the willful nonchalance at the spending habits.

With this said, I do not see how the Federal Reserve can continue cutting overnight rates without unleashing an inflationary resurgence, which would continue to cause longer dated yields to rise.

Okay, I suspect that as the creditworthiness of the United States continues to degrade and inflation persists as more and more global investors lose the respect of the government economic data reporting, bond prices are going to suffer.

In order for the overnight rate to continue dropping, I suspect there’s going to be some sort of exogenous crisis or catastrophe that will be used as the catalyst to slash overnight rates once again, in a similar vein to covid in early 2020 or the repo crisis of late 2019.

But this time, investors won’t be fooled and caught off guard, for they had to endure 3 years of massive inflation. Bond investors got decimated as the yields escalated. Thus any crisis will not have the same effect as the others previously. I think of the saying, fool me one shame on you, fool me twice shame on me.

Those who know me know I am loathe to resort to hyperbole, but I submit to you that the FED has lost most of its credibility. The only ones who are not saying so are the analysts on the Jew synagogue media. Eventually, even these people will say it.

I still recommend sticking fixed income money into money market type instruments that still generate a decent yield with little to no risk to principal. For anyone who decides to own treasuries directly I would only own those that have less than one year left to maturity. And I would hold them to maturity.

If what I think happens to mortgage rates pans out and they approach 10% during Harris’s first term, only a fool would want to be owning bonds. Under a Harris regime, what credibility the fiscal and monetary authorities have left will be almost gone by the time the force majeure occurs. I would still only recommend money market funds. I don’t recommend CDs. Why would anyone want to buy a CD and lock up that principle when we can buy a money market fund and withdraw the money whenever we felt like it and get actually of higher yield?

We can always second guess Warren buffett’s trading choices, but his decision to stick all of his cash in overnight instruments is his single best decision.

Excellent analysis! Thank you.

You are so right on. Despite the weak jobs report today, treasury yields are still rising. Any bond bull who bought 10yr T bonds would have lost money.

There were 50 to 100 year bonds issued 10 years ago by various sovereign nations and corporations. I would not be surprised to see these selling for pennies on the dollar.

Given where the world is going, there is no guarantee the bond issuer will be around to pay the principal 10 years from now.

I would not go out more than 6 months on a bond or Treasury bill.

I think the bond vigilantes are showing up in the bond market these days. It is obvious that nobody cares about fiscal restraint.

I was receiving emails from readers saying they were going to buy long-term treasuries, because they were certain longer dated yields would drop when the FED started to cut rates. I told them not to play that game for the very reasons I just enumerated.

It’s clear the stock and asset markets were perfectly fine with the FED funds rate at 5.25 to 5.5%.