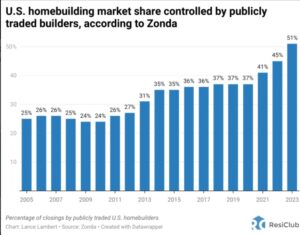

Note to reader: There are a number of factors that work to determine housing market supply and demand. As we can see from the chart below, the publicly traded home builders were able to capitalize on the 2008 GFC fallout and subsequent covid pandemic stimulus packages at the expense of the smaller and privately owned home building firms.

We can observe this consolidation phenomenon across the entire economy and in every economic sector as each financial crisis is met with waves of consolidation. The small home builders are continually placed at a disadvantage to the large players and have been effectively marginalized.

This has the effect of restricting new home supply as the large firms will, by nature, build less then the market requires and will demand a higher price for what they do produce. Indeed, the market has become functionally oligopolistic by design as the smaller builders find it increasingly difficult to compete.

None of this is left to chance, but is a direct result and a functional dynamic of the ongoing monetary and fiscal policies in place since the initiation of QE. As in all other economic sectors, we continue to observe the consolidation of the wealth and power throughout the economy.

Giant homebuilders tighten their grip on the housing market

Lance Lambert – Fast Company

This summer, KB Home CEO Jeffrey Mezger told ResiClub that big builders continue to take market share from smaller private homebuilders. The higher interest rate environment has only sped it up.

This summer, KB Home CEO Jeffrey Mezger told ResiClub that big builders continue to take market share from smaller private homebuilders. The higher interest rate environment has only sped it up.

“The numbers support that the larger builders are [taking market share]—we’re taking share from two sources. One is smaller builders that are having difficulty with financing,” Mezger told ResiClub in July. “Banks are very conservative right now on what they’ll lend a small builder to go develop lots. But, you’re also taking share from resale because of the limited resale inventory.”

“The numbers support that the larger builders are [taking market share]—we’re taking share from two sources. One is smaller builders that are having difficulty with financing,” Mezger told ResiClub in July. “Banks are very conservative right now on what they’ll lend a small builder to go develop lots. But, you’re also taking share from resale because of the limited resale inventory.”

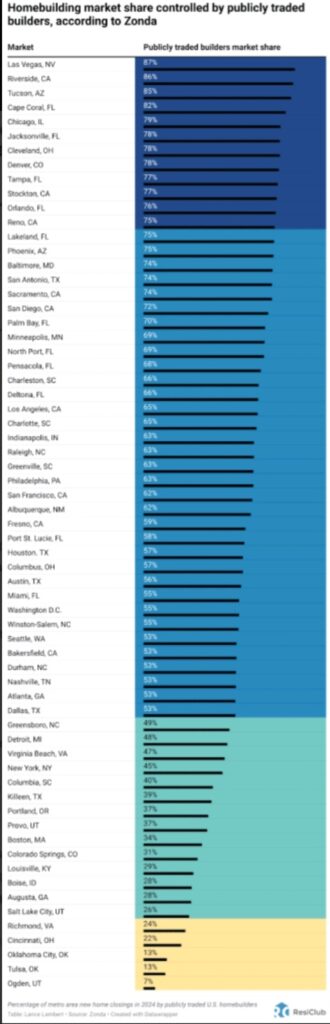

The interactive map below (please click the link to the original article to view) shows where giant publicly traded homebuilders have the largest market share, according to data from Zonda, which tracks the housing market.

Among the largest metro area housing markets tracked by Zonda, publicly-traded homebuilders hold the largest share of new home closings in these 5 markets:

Las Vegas, NV (87%)

Riverside, CA (86%)

Tucson, AZ (85%)

Cape Coral, FL (82%)

Chicago, IL (79%)

And these are the large metro area housing markets where publicly-traded homebuilders hold the smallest share of new home closings:

Ogden, UT (7%)

Tulsa, OK (13%)

Oklahoma City, OK (13%)

Cincinnati, OH (22%)

Richmond, VA (24%)

Publicly-traded homebuilders have been taking market share for decades. Back in 2005, publicly-traded homebuilders made up 25% of U.S. new home closings. That figure slowly ticked up to 37% by 2019. However, the recent mortgage rate shock has coincided with publicly traded homebuilders’ market share spiking to 51% in 2023. Zonda chief economist Ali Wolf predicts it could soon top 60%.

There are a few reasons that publicly-traded homebuilders have been taking market share from smaller builders:

- Access to capital: Publicly traded homebuilders have greater access to capital through equity markets, which enables them to fund large-scale projects and secure land more aggressively. This financial stability allows them to navigate economic downturns more effectively than smaller builders, who often face challenges with cash flow or financing.

- Increased demand for built-to-rent communities: Publicly traded homebuilders have been tapping into the growing BTR sector. Small private builders may find it harder to compete in this space.

- Economies of scale: Large homebuilders benefit from economies of scale, enabling them to negotiate better deals with suppliers and contractors, reducing per-unit costs. Many publicly traded homebuilders have built their own in-house mortgage companies, including PulteGroup (Pulte Mortgage) and Lennar (Lennar Mortgage). This allows them to offer homes at more competitive prices or with higher margins, putting pressure on smaller builders who can’t achieve the same cost efficiencies.

- Ability to absorb risks: Larger builders may be better equipped to absorb risks such as fluctuating material costs, regulatory changes, or economic downturns.

Link to original article, including the aforementioned interactive map:

Few weeks ago, we mentioned that silver’s next stop was $34 according to the chart and market action. We then said 36 was shortly there after that. It looks like a done deal for both.

If you’re bullish on silver, take a look at ASM. Zack’s name that a new #1 this morning and the chart action looks very favorable.

So is the next level $50.00 after that? With the gold silver ratio over 80, I suspect silver could take off especially with the election chaos right around the corner!

I have learned the hard way over the decades playing the metal ratios. Probably the most frustrating one is the Au/Pt ratio. Anyone invested in Platinum has left a lot of money on the table. Up until QE started, platinum used to always trade at a premium to gold. I just recall when silver was trading in the 31 range that the chart was telling us 34 and 36 were logical shorter term targets. We’ve obviously seen 34 taken out and so 36 looks very ripe.

With this said, I would not want to be short anything on silver and though I like gold over all the other metals, silver could play catch up like it did in 2011. But the persistent gold silver ratio could remain longer term. Silver is primarily an industrial metal and if anyone thinks the economy is about to collapse, I would rather be long gold over silver.

If someone is still playing the modular nuclear stocks, NNE looks like another small cap trade. It looks like there’s only about 30 million shares outstanding. I loaded up on a few earlier this morning. Given what we see in LTBR, why not give the wheel a spin?

Look at the 10-year treasury yield. What a sucker’s bet going out to the force majeure. The wealth and power must be consolidated over the next two to three years and sovereign debt is a dead end to destruction.

This time I didn’t pull the trigger too soon. In addition, I loaded up on LTBR when it dropped back two bucks from its high. Today is a good day!

Yeah it’s really wild how these nuclear stocks are exploding (maybe a tad ironic too). Kinda feels like this might be a peak mania before a big election market dump though.

It always pays to take good profits going into close. Look at what NNE did after close. They announced an offering. Less than 2mm shares, but the price got walloped aftermarket. They also offered warrants with the shares. Warrants are a share price killer. Just like BCTX.

Boise and Eagle ID builders have been building faster than demand so my rental housing price dropped the past 3 years. A realtor told me prices would plunge after rate hikes and she was 110% right.

It may seem like a letdown after what happened in the immediate COVID aftermath, but Zillow says prices are still edging up. According to the data, the large builders are not overly represented in Boise (28%).

FHFA says Boise ID home prices are up at least 50% since the COVID recession.

In VA, prices are seasonal and may seem to be coming down now, but next year’s selling season will be a doozy.

Longer term owners should be very happy. How long have you owned there? It’s a great area to live….

Here in the DC area, price trajectory is different, but overall price movement since the COVID recession is lower than ID. DC area is up “only” 38% or so.

I agree…. Don’t listen to the Cassandra’s…..

Blackstone’s Schwarzman: Real estate up-cycle “happening now”

Blackstone called the bottom of the commercial real estate market earlier this year.

Now, Jon Gray and the rest of the company’s top brass say they have put $22 billion into real estate this year, nearly twice what it invested during the same period last year.

The investment giant reported strong quarterly earnings Thursday. Net income totaled $780.8 million, or $1.02 a share, up from $552 million a year earlier. As a result, Blackstone’s stock shot up over 6 percent to $170.28, an all-time high.

Its real estate segment’s inflows fell to $5.8 billion from $9.1 billion in the previous year. But the firm deployed nearly $1 billion more capital into real estate in the third quarter — $3.6 billion in total.

Blackstone thinks the Federal Reserve’s decision to lower interest rates will drive more real estate deals, both for itself and others.

“We expect lower base rates will be supportive of transaction activity and deployment,” said Gray in Blackstone’s third-quarter earnings call.

Blackstone is the world’s largest commercial property owner and its earnings are closely watched as a barometer of the broader market. In recent years, the firm has made a lucrative bet on logistics.

Blackstone has now adopted a similar game plan with data centers. The push is driven by developments in AI and the resulting need for computing power. Chairman and CEO Stephen Schwarzman has equated AI to “what occurred in 1880 when Thomas Edison patented the electric light bulb.”

Blackstone recently acquired AirTrunk, the largest data center operator in the Asia-Pacific region, in a $24 billion deal. The firm called data centers the “single largest driver of appreciation in our infrastructure real estate businesses and for the firm overall in the third quarter.”

Outside of data centers, Schwartzman said real estate is in the middle of a broad-based recovery. The firm even said it will consider opportunities to buy higher quality office buildings. Its investments in logistics and rental apartments will benefit from a projected fall in construction starts and availability of apartments and warehouses.

Schwartzman cited other positive signs in the market. He said Blackstone has seen “two to three times the number of buyers showing up to buy things like apartments and logistics.”

“As we work through the cycle and values recover, you’ll see a pickup in sales, and you can feel that happening now,” said Schwarzman.

Building Permits (MoM) (Sep)

Act: -2.9% Cons: Prev: 4.6%

Building Permits (Sep)

Act: 1.428M Cons: 1.450M Prev: 1.470M

Housing Starts (MoM) (Sep)

Act: -0.5% Cons: Prev: 7.8%

Housing Starts (Sep)

Act: 1.354M Cons: 1.350M Prev: 1.361M