Despite what most in the alt-media will proclaim that this is a disaster in the making, I can’t help but conclude that there is intent here on the part of the CCP government.

There will be plenty of idle young Chinese men who will take up arms when their government says so. The tableau to World War III continues to be established.

And to those incredulous eye-rolling fools I present you with some compelling circumstantial evidence.

Nothing is running independently here, but many of these ostensibly random circumstances are all running concurrently for a reason.

•The amount of sovereign debt generation continues to explode, which is solely designed to consolidate the global wealth and power.

•The price of gold continues to grind higher, which means it’s being aggressively accumulated by the nation states and other large players. The central banking authorities, working with the governments, no longer seem to care about suppressing its price.

•Asset prices continue to escalate, while the true costs of living continue to be under reported by the governing authorities.

•Western governments are becoming increasingly repressive and brutal.

•Donald Trump has been deftly employed by the so called Deep State as controlled opposition, so that previously unelectable politicians like Kamela Harris can be presented as the leader leading up to this global conflict. Harris has an extremely weak personality and is not up to running the United States government, especially during a wartime scenario. I find it interesting that Putin endorses Harris although the Democrats have been instrumental in embarrassing Russia in Ukraine.

•The covid injection campaign was primarily designed to soften up the population, so Westerners pose less of a threat when confronted with their mortal enemy.

All the heads of the major governments around the world, including Russia and China, as well as the United States, are in on it. For that sizable remnant here in the states, this global conflict and the take out of the US as we know it will mean the time of Jacob’s trouble in its complete fulfillment.

The vast majority of the population is under the misconception that their politicians represent their countries. Nothing could be further from the truth as virtually all the major heads of state and decision makers aspire to achieve a global government that transcends borders. You and I need to wipe away the notion that these politicians are incompetent. They don’t like your country, they don’t like you, and they seek global governance.

This will be just another reason for you to discard your current pastor, preacher, or priest. They won’t have answers for you, and the only answer your government will provide you will be to take a mark and show your allegiance.

Here’s what happens when a firm that manufactures advanced goods is forced to accept DEI hiring requirements. All those inferior employees destroy corporations. Boeing is the latest example. Happy Kwanzaa!🚽

How did it come to this? S&P Global Ratings is weighing downgrading the credit score of Boeing, one of America’s most storied companies, to junk. The embattled planemaker continues to suffer from the fallout of a protracted labor strike. The walkout however is just the latest crisis for a company whose recent stretch of troubles go back at least six years, to two horrific crashes of its flawed 737 Max planes that killed 346 people. Since then, the hits have kept coming for Boeing. As for S&P, it estimates the company will incur a cash outflow of approximately $10 billion in 2024, due in part to costs associated with the strike. The company is also likely to need additional funding to meet its day-to-day cash needs and finance debt maturities. Junk rated companies usually face higher borrowing costs than their investment-grade counterparts. Boeing has $4 billion of debt coming due in 2025 and also $8 billion coming due in 2026, Moody’s Ratings said last month. If the strike continues toward the end of the year, a credit rating downgrade is more likely, S&P warned. —David E. Rovella

Kwanzaa! That’s what Harris celebrates!

BTW of the remnant here in the United States, which I estimate to be a good 10%, I would reckon that 97% of that is of Caucasian European descent.

While there may be a lot of non Caucasians who will be saved, they are not part of the remnant and are easily deceived. The minorities suffer from a curse of easy deception. For instance, anyone who votes Democrat can in no way be considered a remnant. I ask, how can a member of the remnant support anything the Democrats promote? Blacks vote over 90% across the board for Democrats. Most of the remnant don’t even bother voting anymore, for they see it for what it is.

Most of the remnant struggle in this world. They have a hard time fitting in and could be what we consider loners. They are lone wolves in a sea of sodomy. That’s why I have my blog; keeps me from feeling so alone.

I also ask, how can anyone line up and take a bio weapon jab at this stage in humanity’s life cycle?

The typical person of the remnant is not looking to the government for answers or has given up on that, since the government is wicked and demonic to the Jew synagogue core.

Of course, I’m painting with a broad brush here. But by default, the true remnant who will fight the CCP soldiers will be the white Western European descendants. There is no way in God’s green earth that I see any minorities fighting alongside. It will all be a white man’s War here in the states. The European Caucasians DNA programs these people to act, behave, and think in a way that is completely unique to everyone else on the planet. This is especially true of the blacks who are just being used by the communist synagogue as a cudgel.

As the wheat is separated from the chaff going out to the force majeure we will begin to see the manifestation of the remnant in action, and 97% of this remnant will be Caucasian European.

Excellent assessment!

Interesting quote from Mr. T yesterday, “I will defend our American Jewish population. I will protect your communities, your schools, your places of worship and your values. We will remove the jihadist sympathizers and Jew haters. We’re going to remove the Jew haters who do nothing to help our country, they only want to destroy our country,” he said during the event at his golf course in Doral, Florida.

Mr T is directing his pre-packaged words toward us. Mr T doesn’t give a crap about his people and his supporters only to the extent that it enhances his standing.

His writers are directed to speak these things, because many of his supporters can’t stand the synagogue and know all about what the synagogue has done to this country.

I think Trump supporters are drifting away after his latest comments about various issues.

At the end of the day Trump is as Christian as King Herod was in ancient Israel(the one who beheaded John the Baptist). I think before all is said and done on November 5, many conservatives won’t come to the polls.

Alexander Dugin, ‘God save the Tsar!’: Putin receives first wishes for 72nd birthday

By Reuters

October 6, 2024 9:32 PM EDT Updated 2 hours ago

Oct 7 (Reuters) – “God save the Tsar!” was one of the first public birthday wishes for President Vladimir Putin who turns 72 on Monday and who has been Russia’s paramount leader for nearly quarter of a century.

The greeting came from ultra-nationalist Russian ideologue Alexander Dugin on his Telegram messaging channel minutes after midnight.

Dugin, 62, has long advocated the unification of Russian-speaking and other territories in a vast new Russian empire, which he wants to include Ukraine, where Russia has been waging a war. Dugin’s daughter was killed in a suspected car bomb in 2022.

Article continues….

https://www.reuters.com/world/europe/god-save-tsar-putin-receives-first-wishes-72nd-birthday-2024-10-07/?utm_medium=Social&utm_source=twitter

Anyone buying the 10-year UST the day the Fed dropped the Fed funds rate 50bp is underwater. The 10 year yield is up 30 bps since the 18th, the day of the Fed’s announcement.

The reason why is that the synagogue Communists want to consolidate their wealth and power over the people while bankrupting what’s left of the Western nations.

Public debt is up $350 billion in only the past few days….

It looks like the 10-year yield has just edged over 4% this morning. As I’ve been saying all along, the neutral Fed funds rate is probably at least 4.0%. given the massive amount of fiscal injection and the concerns about who will buy the debt are keeping a lid on longer-term Treasury price gains.

With the stronger job market data coming in, rising commodity prices, the growing war drum beat, and a persistently elevated GDP growth level gratis the Federal government deficit spending, perhaps the neutral rate is now stuck at about 4.25%.

Other than money market funds and short-term duration Treasuries, I think owning US Treasuries is the biggest suckers bet going out to the force majeure.

The only way the longer dated yields will come down is if the governing authorities working with the US Fed manufacture some sort of exogenous event or liquidity crisis like the one in the second half of 2019.

What type of crisis will that be? What type of crisis or set of circumstances will cause the FED to begin adding Treasuries to its balance sheet once again? Stay tuned!

statistical effect of migration on rent prices

https://tnc.news/2024/10/03/mmigration-drive-rent-5600-per-month/

Holy moly! Be the landlord.

In the first half of 2020 when all of that covid fiscal and monetary stimulus was being injected into the domestic economy and not being sterilized like traditional deficit spending, I begged everyone to buy rental properties. I begged everyone to buy as many rental properties as they could. I was telling the people on my prior blog as well as those whom I consulted with that it wouldn’t matter if the people were getting sick and dropping dead in the streets, asset prices were going to continue flying.

What made matters worse is that the Federal Reserve did absolutely nothing to quell the growing inflationary pressures and I began warning people in the end of 2020 that inflation was going to begin picking up and that the FED needed to unwind some of the unnecessary stimulus.

Of course, we know why the federal government and fed did what they did. The people who controlled these entities want to make life as dreadful as possible for the sleeping masses. That means we needed to be the landlords. Instead of those who pay the rent, we need to be those who collect the rent.

Marburg virus is back in the news. Just like last year, it makes it’s coincidental appearance on the anniversary of the Marburg Colloquy.

https://en.m.wikipedia.org/wiki/Marburg_Colloquy

Pete Rose, one of the greatest MLB players ever to play the game and the all time leader in hits, died today at 83.

In addition to the hit title, Rose also played in more games, had more at-bats, had gotten on base more and had singled more than anyone in baseball history. He also made the most outs in MLB history.

Rose was named National League Rookie of the Year in his first year for the Reds in 1963, even though he had barely been scouted and got a tryout only because of his uncle’s connections.

Over his 24-year career, Rose was named an All-Star 17 times and was the National League’s Most Valuable Player in 1973. He won three batting titles and two Gold Gloves despite playing more than 500 games at five different positions during his career.

His 44-game hitting streak in 1978 garnered national attention as well, eventually tying a nearly 100-year-old National League record and setting the modern-day mark for the NL.

Rose also was part of three World Series-winning teams, including two with the so-called Big Red Machine here in Cincinnati in the 1970s (he was the MVP of the 1975 series). He won the other title with the Philadelphia Phillies in 1980.

Rob Schneider Mutombo Post Draws Backlash For Promoting Anti-Vax Stance

Many wish he would’ve just left it at that … as the rest of his post — which quoted a video Mutombo made in 2021 to promote the Covid vaccine — speculated if getting the jab had anything to do with the former All-Star’s death.

As we previously reported, Mutombo succumbed to brain cancer … a battle he went public with back in 2022.

Schneider sarcastically said it was “just (another) coincidence” that someone who got the vaccine died at just 58 … and said he’ll continue to tell everyone he knows not to get the vaccine.

https://amp.tmz.com/2024/09/30/rob-schneider-dikembe-mutombo-death-anti-vax-stance/

They are dropping like flies….

R.I.P. Gavin Creel, Tony Award-winning Broadway star

Emma Keates

Gavin Creel—the talented, Tony Award-winning star of musicals such as Hello, Dolly!, Into The Woods, Hair, and more—died on Monday in his home in Manhattan. Per The New York Times, his death was confirmed by his partner, Alex Temple Ward, via a publicist, Matt Polk. The cause was metastatic melanotic peripheral nerve sheath sarcoma, which Creel only learned he had in July. He was 48.

https://www.avclub.com/gavin-creel-obituary-broadway-hello-dolly-hair-into-the-woods

Slowly some partial truth filters out from the lame stream media here in Canadastan. All that is missing is an explanation from the scientists. For now, it is “not clear” but continue to use “safe sleeping practises”.

https://nationalpost.com/news/rates-of-sudden-unexplained-infant-deaths-increased-during-pandemic

I was at the September 1985 game at Wrigley Field when Rose tied Cobbs record. What a game to just happen to attend.

It looks like things are rapidly heating up in the M.E.

2027… Keep preparing.

ISM manufacturing again in Sharp contraction. This morning’s read of 47.2 was 0.4 below the already underwhelming consensus. Manufacturing in the state seems to be in a prolonged contractionary situation.

The FED should continue cutting rates and forget about inflation. If it weren’t for the federal government and its deficit spending, the country would be in a deep depression, with real GDP growth of a belt -5%.

August JOLTs data come in a little better than expected at 8.0 million job openings versus the consensus of 7.7 million. It’s still not enough to ignite higher wage inflation trajectories. The FED should continue cutting and forget about inflation.

I sold another third of the BCTX on the initial news this morning, and sold off another bit after it went to 1.13. still holding about 4500 shares. Hmmm….. Oh well.

Stopped out at 1.00. I don’t have any open positions right now. EMKR still looking good. I’m on the sidelines now.

With BCTX volume so high, that’s bearish. Unrelenting selling off of goods news. If it were low volume I would think things were okay. Not of high volume.

Stocks suck today.

Sold off my EMKR this morning at $2.45.

BCTX is a stock I have been holding and trading in and out of for about a week. It’s a Zack’s #1 and has some compelling recent news regarding its cancer treatments. The stock could greatly benefit from the ballooning rates of turbo cancer caused by the bio-weapon injections. The FDA has green lighted firm’s breast cancer treatment for compassionate Care during ongoing phase 3 trials, because it has proven itself to be efficacious when other treatments fail. It’s the stock that I would be keeping an eye on.

EMKR received an all cash buyout offer for $3.80, while I just loaded up below $2. Seems like another roll of the dice. A few thousand shares. I have 10,000 shares for BCTX and weill buy on any dip, but the institutions look like they’re buying fast and furiously.

I just sold a third of my BCTX position @ 1.06. Still holding 7,000 shares. Will buy on any dip below a dollar. When I’m up a solid four figures this morning on the position, I figure I’ll take a little profit.

I have a limit order on BWAY for 1,000 shares at $8.60.

I have a limit order to sell 50% of my EMKR @ $2.42. That’ll give me a profit of $1,500 on the day. I’ll keep the rest and see what happens.

My best trading day in months. Mid 4 figures. Even RMTI found support. My small INTC hold doing squat.

Congrats! Make hay while the sun shines.

BCTX fell in aftermarket on low volume. Bought back my earlier sales.

HUGE press release on BCTX in pre-market.

Stone, do you use technical analysis mainly for your picks?

Yes. But when the technicals turn, I normally liquidate. For instance, the RMTI technicals have turned since it dropped below four and have used the opportunity to sell the rest of my steak at about $4.10. I announced that in real time. I am on the side lines as the technicals have turned against it. It’s still on my screen and I keep an eye on it.

With regards to BCTX, I still hold a position, while the story and technicals are still in its favor. Firm management has dealt us a blow with an add-on offering. The story is still intact, but I profited when the initial story was released by selling a third of my position. Unfortunately, I rode the final part of my position back down to $1, and load it back up here in the 95 cents area.

I use technicals all the time and trade in and out of the positions as I see fit. While I may leave money on the table by selling too early, I minimize my downside risk. I am reluctant to give trade advice as it’s difficult to do it in real time and the technicals can change quickly. We saw this with BCTX.

INTC is an unfolding story. I sold out after it hit 24, but have it on my trading screen and I’m waiting another catalyst. There will be more. I suspect management will eventually relent and decide to break up the company. It’s the only viable option at this point.

These are the numbers I look at as a real estate investor. The properties in the jurisdictions I invest are up about 6% yoy. Based on current market value, I also have cap rates that are currently 6.5%. My return last year on my properties, not including any leverage considerations, was about 12.5%.

This also doesn’t include any value added I provide to raise market values, nor does this include what the market rents would be, which are higher than what I charge. My 6.5% cap rate is based on the rents I charge, which are lower than full market.

Based on my real estate activity in its entirety, I estimate I’ve returned about 20% over the past year.

With military spending accelerating around the world, especially here in the states, look for asset prices, as well as house prices to continue rising until the force majeure.

That’s the problem with these real estate Cassandras, they they are not able to think outside the box and are stuck with outdated and partisanized concepts such as housing affordability. That was so pre-QE. That was so pre-Covid. That was so pre-democrat inspired deficit spending. That was so pre-World War III preparation.

Stone – Wondering if you forsee Kamala’s tax on unrealized capital gains impacting housing & asset prices (even in the short term) or if spending and liquidity injections will override any softness

BTW – 3.5 years ago you predicted Kamala would be president by the end of the Bidens term — another one of your predictions that has by all meaningful measures effectively been realized

The Harris regime will make it difficult for a lot of asset owners, but in the long run leading up to the force majeure, we will still come out ahead as it is clear that the federal government will spend many more trillions of dollars.

Regardless of what the federal government promulgates, asset owners will still shine.

The Jews say it themselves; Communism is Judaism.

THE JEWS THEMSELVES TELL US WHO THEY ARE

https://rumble.com/v5glfsl-the-jews-themselves-tell-us-who-they-are-by-dr.-james-p.-wickstrom-teacher-.html?e9s=src_v1_ucp

thanks for sharing

The man we will identify as the Antichrist will ostensibly come out of nowhere, and may be a Jewish homosexual. He will be a puppet, but will seem to have solutions to a number of manufactured problems. Pope Francis will fully endorse him.

From this morning’s Bloomberg feed…

Prime Minister Benjamin Netanyahu vowed at the United Nations that Israel would press ahead with its attacks on Hezbollah, the Iranian-backed militant group, inside Lebanon. On Friday, Netanyahu’s forces bombed what they said was Hezbollah’s Beirut headquarters inside a densely packed neighborhood, the heaviest attack on the Lebanese capital in almost two decades and a major escalation of a broader conflict tied to the war with Hamas in Gaza. The target, Israel said, was Hassan Nasrallah, the group’s leader. “Israel has every right to remove this threat,” Netanyahu said of Hezbollah during a frosty reception at the United Nations on Friday. On Saturday, Israel said it had killed Nasrallah, but Hezbollah hasn’t confirmed the claim.

Hezbollah rockets have forced evacuation of parts of Israel’s north, and Israel said it began its most recent bombing campaign to allow Israelis to return home. Some 700 people in Lebanon have been killed since the first major strikes earlier this week. The conflict took a decisive turn after a deadly attack—widely believed to be by Israel—in which thousands of pagers and walkie-talkies owned primarily by Hezbollah members exploded. Since then, US officials had worked with European allies and Arab powers on a three-week cease-fire between Israel and Hezbollah—a better-armed and more formidable foe than Hamas. As with proposed cease fires in Gaza, Netanyahu ultimately rejected it. The consequences of Netanyahu’s decision to open another front in Lebanon could come to him from many sides. Iran could repeat, with more force, its April barrage of drones and missiles, most of which were shot down by the US military. Already strained relations with the Biden administration, which provides Israel with billions of dollars in weapons, may worsen. So far, Israel appears intent on pushing Hezbollah back without sending in ground troops. But fears of all-out regional war may nevertheless be realized if Iran is drawn directly into the fight—which seems more likely if Nasrallah is in fact dead.

And speaking of Netanyahu, When Netanyahu’s father immigrated to Mandatory Palestine, he hebraized his surname from “Mileikowsky” to “Netanyahu”, meaning “God has given.” More deception from the so called chosen!

Some recession…..

Latest estimate: 3.1 percent — September 27, 2024

The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the third quarter of 2024 is 3.1 percent on September 27, up from 2.9 percent on September 18. After recent releases from the US Census Bureau, the US Bureau of Economic Analysis, and the National Association of Realtors, a decline in the nowcast of real personal consumption expenditures growth was more than offset by increases in the nowcasts of real gross private domestic investment growth and the contribution of net exports to third-quarter real GDP growth.

The blizzard of numbers this morning look okay for stocks. Nothing too earth-shattering and the price inflation data look pretty decent. The downward trend in inflation, according to government data, continues..

August trade balance comes in much better than expected with a smaller deficit. This should put 4Q GDP estimates from the Atlanta Fed at a tad over 3% when the updated GDP estimate comes out later today.

Of course, the last estimate was a while back and there are other factors that could influence this next estimate. But a lower trade deficit definitely helps GDP growth as that marginal consumption is imputed to be sourced domestically…

Core PCE Price Index (MoM) (Aug)

Act: 0.1% Cons: 0.2% Prev: 0.2%

Core PCE Price Index (YoY) (Aug)

Act: 2.7% Cons: 2.7% Prev: 2.6%

Goods Trade Balance (Aug)

Act: -94.26B Cons: -100.60B Prev: -102.84B

PCE Price index (YoY) (Aug)

Act: 2.2% Cons: 2.3% Prev: 2.5%

PCE price index (MoM) (Aug)

Act: 0.1% Cons: 0.2% Prev: 0.2%

Personal Income (MoM) (Aug)

Act: 0.2% Cons: 0.4% Prev: 0.3%

Personal Spending (MoM) (Aug)

Act: 0.2% Cons: 0.3% Prev: 0.5%

Real Personal Consumption (MoM) (Aug)

Act: 0.1% Cons: Prev: 0.4%

Retail Inventories Ex Auto (Aug)

Act: 0.4% Cons: Prev: 0.5%

Wholesale Inventories (MoM) (Aug)

Act: 0.2% Cons: 0.2% Prev: 0.3%

The good news for INTC continues….

According to Bloomberg, another firm threw its hat into the ring trying to buy some of INTC’s assets. Intel management shot it down. I suspect the Intel board will eventually choose to split the company, rather than try some sort of buyout, unless a trillion dollar firm decides to purchase the company in its entirety…..

Market Chatter: Intel, US Government On Track to Finalize $8.5 Billion Funding Agreement by 2024-End, FT Says

09/27/24 4:54 AM

04:54 AM EDT, 09/27/2024 (MT Newswires) — Intel (INTC) and the US government are on track to finalize $8.5 billion in direct funding for the company before the year ends, the Financial Times reported, citing unnamed people familiar with the discussions.

The preliminary terms of the funding agreement were disclosed in March. It would be the largest single subsidiary package awarded through the Chips and Science Act, the news outlet said.

Two sources told FT that while the talks were at an advanced stage, there is no guarantee it will be finalized before the year ends. Any potential takeover of Intel’s business could potentially complicate the talks, they added, according to the report.

Intel and the US Department of Commerce did not immediately respond to MT Newswires’ requests for comment.

https://interestingengineering.com/military/us-navy-deploys-laser-japan. Project 33, china vs USA as you mentioned

Even the US and Japanese military know 2027 is an important year.

We need to be on the lookout as these Non-Adamic orientals are very brutal during war. They don’t bring any biblical mindset with them. The China CCP still remembers the atrocities Japan brought during World War II and has yet to forgive them in any meaningful way.

If war breaks out, I wonder if Japan will be saved by tsunamis. Just like they were 800 years ago:

https://www.worldhistory.org/article/1415/the-mongol-invasions-of-japan-1274–1281-ce/#:~:text=Once%20again%2C%20the%20invaders%20hit,and%20then%20to%20Iki%20Island.

There was a Chinese general who said the Germans lost WWII because they still had somewhat of a Christian mindset still in them . He said the Chinese won’t make the same mistake.

US Joins Five-Nation Military Exercise in South China Sea

(Bloomberg) — The US, Australia, Japan, New Zealand and the Philippines will undertake a joint military activity in the Philippines’ exclusive economic zone in the South China Sea on Sept. 28.

“The Maritime Cooperative Activity demonstrates our collective commitment to strengthen regional and international cooperation in support of a peaceful, stable and prosperous Indo-Pacific,” the Australian Defence Department said in a statement Saturday.

The exercise comes amid rising tensions between Beijing and Manila over competing claims in the South China Sea.

Australia’s HMAS Sydney and a Royal Australian Air Force P-8A Poseidon maritime patrol aircraft would participate, according to the statement.

US Navy Modernizing to Counter China’s Military by 2027

Epoch Times 9/26/2024

The U.S. Navy has released a document outlining its plans to match….

https://www.theepochtimes.com/opinion/us-navy-modernizing-to-counter-chinas-military-by-2027-post-5728449?

There’s that year again! More confirmation for anyone with eyes to see…

Coming to the States….

Poverty Soars Past 50% in Argentina as Milei Austerity Hits Hard

(Bloomberg) — Poverty in Argentina reached its highest level since the aftermath of the 2001 financial crisis in the first half of the year, as President Javier Milei unleashed a shock therapy program to put an already reeling economy back on its feet.

About 52.9% of Argentines were mired below the poverty line in the first half of the year, up from 41.7% in the second half of 2023, according to government data published Thursday. It’s the result of an aggressive cost-cutting exercise meant to tame inflation that the government warns would have continued spiraling higher in its absence.

“This is a number that, surely, will reflect the crude reality that Argentine society is going through as a consequence of the populism that has put Argentina through so many years of disgrace and devastation,” presidential spokesman Manuel Adorni said in a preview of the data at a press briefing earlier Thursday.

Annual inflation nearing 237% drove the increase in Argentina’s poverty rate, which is calculated using a basket of household goods and average wages. The proportion of people who can’t make ends meet has now more than doubled since the second half of 2017.

Yearly consumer price gains are down from a peak of 289% in April but still far higher than the 18% Milei is boldly predicting by December 2025. Monthly inflation has fallen to about 4% after hitting nearly 26% in December, when Milei liberated price controls on everything from milk to phone bills, sharply devalued the currency and let price gains outpace pensions and public wages in the first months of the year.

Though mired in its sixth recession in a decade, South America’s second-biggest economy is showing incipient signs of recovery, with wage growth edging above inflation for three straight months as well as recent gains in both consumer spending and manufacturing. Economic activity rose 1.7% in July from a month earlier, led by agriculture and mining.

Opposition to the government’s austerity push, however, risks jeopardizing the consistent budget surpluses that have helped put a lid on inflation. This month, Milei vetoed a bill that would have significantly raised spending on pensions, triggering violent protests outside congress. Next Wednesday, public universities are threatening more public unrest and a 24-hour strike over the libertarian’s promised veto of their expanded budget.

Evidence of growing hardship is rampant. People begging outside grocery stores, digging through the trash and ringing doorbells for used clothes have become mainstays in the capital of Buenos Aires. The government has increased funding for both the country’s main child support and food stamp programs, Adorni said.

PFE is a sinking ship.

I recall the couple people who disagreed with me regarding owning Pfizer over LLY, because of Pfizer’s bargain price and yield. At the time, Eli Lilly was selling for about $700 and Pfizer was selling for exactly the price it is today.

Their reasoning was that Pfizer had immunity from covid prosecution. My reasoning against owning Pfizer was because I asked this question; if Pfizer did such a lousy job testing its covid injections, why would I want to take anything else from Pfizer?

Pfizer will most likely walk away without paying a dime because of covid problems, but it’s a pyrrhic victory. The rest of their product line suffers as more and more people question the reliability of Pfizer products and their other injections as well.

Pfizer is a piece of shit and their management, who worked with DARPA and the DoD to deploy an injected bioweapon, will burn in hell for the untold misery they have cause their victims. Horrible horrible untold pain.

Pfizer continues to pay out their dividend with cash on hand and not from any profit. Meanwhile CNBC Jew Cramer continues to push Pfizer stock to the masses and says it should be $45 soon. Cramer sold his soul to get on to the position he’s at and when his time comes, he’ll be burning in hell as well for pushing this PFE piece of shit as well as all the other things he’s said over the years to deceive the masses.

Just another sad day for PFE shareholders. Below is a cut and paste story on this morning’s Pfizer’s news feed. I wonder why so many countries around the world are refusing to buy Pfizer’s drugs? That’s because they saw what their covid injections did to their people…

Market Chatter: Pfizer CEO Reports Slow Progress on Plan to Sell Drugs to Poor Countries

09/26/24 9:36 AM

09:36 AM EDT, 09/26/2024 (MT Newswires) — Pfizer (PFE) has signed up only 10 of the 45 countries targeted under a program to make the company’s drugs available to low-income nations at not-for-profit prices, Reuters reported Thursday, quoting an interview with Chief Executive Albert Bourla.

The program started in 2022 and was expanded last year to cover more drugs and vaccines, Reuters reported.

“Few countries are really mobilizing themselves to bring the products in,” Bourla told Reuters.

“It is extremely challenging in terms of bureaucracy,” Reuters quoted Bourla as saying. “They need to change the process of how they’re going to procure and they need to register the products, and those are the bottlenecks.”

Pfizer is in talks with 10 more countries to join the program, Reuters said.

Here’s another story from this morning’s PFE news feed. Look at how poorly management performs at Pfizer. The only way they can make money is by selling poison and having immunity…

Pfizer’s Global Blood Therapeutic $5.4 Billion Acquisition Fails — Market Talk

09/25/24 6:41 PM

1830 ET [Dow Jones]–Pfizer’s acquisition of Global Blood Therapeutic has proved to be a risky, and ultimately failed, deal for the healthcare company. Pfizer acquired Global Blood Therapeutic to grow its rare-disease business unit through the $5.4 billion deal but, two years after the buyout, it is withdrawing all lots of Global Blood Therapeutics’ sickle cell drug Oxbryta due to the health risks. “The data suggest an imbalance in vaso-occlusive crises and fatal events which require further assessment,” Pfizer says. Shares fall 0.2% to $28.88.

US Treasuries suck. Why would anyone want to invest in longer dated treasuries anymore? Anyone buying the 10-year since the Fed’s surprise 50 bp cut on 9/18 has lost money.

To those bond buyers, it serves them right for being stupid. We should thank them for subsidizing the true cost of money, while inflation rips fixed income investors apart.

The world already has caught on that inflation will struggle to fall as short term rates are cut. The Fed is a communist enabler and the world knows it!

US Mortgage Rates Fall Again, Triggering Big Wave of Refinancing

(Bloomberg) — Applications to refinance mortgages surged for a second week as more Americans capitalized on the cheapest borrowing costs in two years.

The Mortgage Bankers Association’s refinancing index jumped 20.3% in the week ended Sept. 20 to the highest level since April 2022, the group said Wednesday. The contract rate on a 30-year fixed mortgage eased 2 basis points to 6.13%, the eighth straight weekly drop and the longest stretch of declines since 2018-2019.

That helped boost the group’s home-purchase applications index by 1.4% last week to the highest level since early February. The fifth straight weekly advance in the measure points to burgeoning demand in a housing market that’s gradually finding some footing.

At the same time, home financing costs may start to stabilize. Yields on the 10-year Treasury note have edged higher in the last week as traders debate the magnitude of Federal Reserve’s expected interest-rate cut in November as well as the path for reductions.

The average contract rate on a 15-year mortgage and the five-year adjustable-rate mortgage ticked up last week after sharp declines in the prior two weeks.

The MBA survey, which has been conducted weekly since 1990, uses responses from mortgage bankers, commercial banks and thrifts. The data cover more than 75% of all retail residential mortgage applications in the US.

©2024 Bloomberg L.P.

Clearly the Fed is a communist enabler by the fact that they aggressively cut the rate by 50 basis points before the election. First the Fed is enabling Kameltoe’s election prospects. Second, the Fed sees the USG deficit ballooning from here and is subsidizing government programs. Hyperinflation is on the way.

Holy moly! The prices of everything are exploding this morning. Asset prices across the board continue to March higher. Gold and silver. Stocks. Of course, bonds suck.

Expect house prices to shoot much higher over the next 6 to 12 months as well. Imagine how insane next year’s spring season is going to be in this country. Wow…

I am warning the reader that the force majeure is more sure the higher these prices move. I am in shock at how quickly this is all proceeding. Wow! I thought it would take a while for INTC to fill the Gap at 28, but my payoff may be sooner than expected.

Yes, the largest financial volcano will blow soon enough and according to plan!

Good luck to the fixed income investors as the entire commodity complex is rising since the 9/18 Fed rate cut. How obtuse can the world be? The feds are spending close to $2 trillion in deficit spending annually and the economy and price levels are still growing above trend.

Fixed income investors are stuck in their old school paradigm and think that the Fed and government can lie to us about price growth and get away with it, so they can lower their borrowing costs and shift the entire yield curve lower, enabling bond investors to make some cap gains.

Instead of buying bonds, buy assets that rise in value with inflation and lower short term rates.

I came across a video presentation regarding treachery in “that” day.

In That Day

https://rumble.com/v5g318h-in-that-day-by-dr.-james-p.-wickstrom-teacher-of-yahweh.html

He sounds a lot like you and I have to agree. All this mixing has the blessing of the Jew synagogue of Satan for a reason. There’s a reason for that and anything they promote has to be rejected. There’s going to be a lot of deceived people at the judgment throne in “that day”. There’s nothing worse than stabbing your own people in the back to get along in this world.

Yes. There is nothing worse than betraying your own race by going outside and finding other peoples and mixing. Father Yahweh was adamant about this. It weakens society, which eventually leads to its collapse. That’s why the Jews promote it so heavily.

In that day, which means the end day, which means the Old testament continually referred to the end day, a lot of Christians are going to be shocked and disappointed. They were deceived and father Yahweh hates the deceiver as well as the deceivee.

The worst part is that these laodicean Christians subscribe to this judeo-christian mentality to get along in the world and not make waves.

My only issue with his excellent presentation is that he doesn’t acknowledge the Son. I have only seen this one video and I looked for a way to contact him and apparently he dies in 2018. I also give him credit for acknowledging the Holy Days!

I agree on that part. He doesn’t like to acknowledge the name Jesus. I understand why, he refers to him and uses all his scripture, but he still calls on Yahweh in the flesh. The world knows of him as Jesus, the synagogue media cut off anyone who mentions the name Jesus, so just on that alone I use the name Jesus.

The United States is a one-party state and that’s because the people went a whoring and mixed up with each other peoples and now we have a cesspool of liberal minds voting for communism. Mixing it up results in catastrophe, societal collapse, and War. War will be coming to the shores of the US this decade. Go out there and breed with other races and have fun.

_______

Putin Broadens Nuclear Doctrine to Counter Western ‘Aggression’

Bloomberg News

In this pool photograph distributed by the Russian state agency Sputnik, Vladimir Putin chairs a Security Council meeting via videoconference outside Moscow.

(Bloomberg) — President Vladimir Putin said Russia will revise its nuclear doctrine to include a response to “aggression” by non-nuclear states that is supported by other nuclear powers.

“Aggression against Russia by any non-nuclear state, but with the participation or support of a nuclear state, is proposed to be considered as a joint attack on the Russian Federation,” Putin said in televised comments to Russia’s Security Council on Wednesday.

The decision comes after Putin earlier this month warned the US and European countries against allowing Ukraine to strike deep inside Russia using Western long-range high-precision weapons. Russia would make “appropriate decisions” based on the new threats, he said at the time.

The US hasn’t announced any decision to permit attacks so far despite pleas from Ukrainian President Volodymyr Zelenskiy that his military be allowed to conduct strikes against airfields and military installations deeper into Russia. Ukraine wants to use British Storm Shadow cruise missiles to carry out the attacks, guided by US navigational data.

Putin issued his warning as world leaders are gathered in New York for the United Nations General Assembly.

He said Russia would consider resorting to nuclear weapons “upon receipt of reliable information that there was a massive launch of air and space weapons and that they crossed our state border. I mean strategic and tactical aircraft, cruise missiles, drones, hypersonic and other aircraft.”

Russia would also defend its ally Belarus with nuclear weapons if necessary, he said.

Russia last updated its nuclear doctrine in 2020. It currently allows for the use of nuclear weapons in response to an existential threat, or in retaliation for the use of weapons of mass destruction against Russia.

©2024 Bloomberg L.P.

M2 money measures data were released yesterday by the Fed. The latest measure rose to $21,174.9 trillion.

Given the exploding values of UST growth, it’s impossible to keep a lid on money stock measure growth as well.

https://www.terminaleconomics.com/wp-content/uploads/2024/09/M20924.png

M2 velocity continues to grow and has filled in the Gap to the pre-covid level velocity numbers.

Although velocity is a dependent variable, it does indicate that with all that extra money that’s sloshing around, people are choosing not to hold on to it, despite elevated yields. I suspect velocity will continue to remain elevated and rise as interest rates fall and people wish to spend their cash.

https://www.terminaleconomics.com/wp-content/uploads/2024/09/Velocity-0924.png

House price data coming in light both on the FHFA and Case Schiller. The FED is doing wage earners and potential home buyers a terrible disservice here as high interest rates help to mask the massive monetary injections into the housing market. As an investor, I’m more concerned about my purchase price as I can always refinance or reconfigure my loan debts against the properties if interest rates come down. House prices where I’ve been buying are up anywhere from 5 to 10% year over year and if I waited to refinance, I’d be missing out on all the ongoing price appreciations. Moreover home deals are becoming more difficult to come by as time goes on.

House Price Index (YoY) (Jul)

Act: 4.5% Cons: Prev: 5.3%

House Price Index (MoM) (Jul)

Act: 0.1% Cons: 0.2% Prev: 0.0%

House Price Index (Jul)

Act: 425.2 Cons: Prev: 424.7

S&P/CS HPI Composite – 20 s.a. (MoM) (Jul)

Act: 0.3% Cons: Prev: 0.5%

S&P/CS HPI Composite – 20 n.s.a. (MoM) (Jul)

Act: 0.0% Cons: Prev: 0.6%

S&P/CS HPI Composite – 20 n.s.a. (YoY) (Jul)

Act: 5.9% Cons: 5.9% Prev: 6.5%

I’m slightly concerned on RMTI in the short term and my trading position has been cut by more than half. Yesterday was most likely a large institution selling for a dollar cost average of around $4.10. they traded it down to $3.92.

For some reason, someone had a large buy order at $4.11 during yesterday’s aftermarket and I sold off a bigger chunk to take advantage of that buy order on the bid. If you look at the aftermarket chart from yesterday afternoon, that transaction was mine. Sometimes it pays to keep the app open during dinner time.

I’m waiting for the dust to settle here, but I still like the prospects.

The best solution for INTC shareholders would be for INTC to split its foundry business into a separately run firm. Maybe INTC will be resigned to this outcome. The foundry business would be worth more than the current INTCs EV.

How long will it be until INTCs board figures this out?

A handful of Federal Reserve officials on Monday left open the door for additional large interest-rate cuts, noting that current rates still weigh heavily on the US economy. “Over the next 12 months, we have a long way to come down to get the interest rate to something like neutral to try to hold the conditions where they are,” Chicago Fed President Austan Goolsbee said in a moderated Q&A event. Neither Goolsbee nor any of his colleagues said they already favor repeating the half-point cut made by the central bank on Sept. 18, saying incoming data would guide their decision making. The Federal Open Market Committee next meets on Nov. 6-7, just after the presidential election. The Chicago Fed chief said he estimated the central bank’s current benchmark interest rate was “hundreds” of basis points above neutral, the level at which policy neither stimulates nor restricts economic growth.

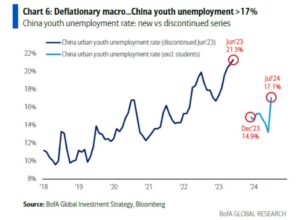

RE: Chinese youth unemployment ……

Bang on observations. Thanks for all your good work.

I’m just curious….what do you think of Slate Grocery Store REIT? (SGR.UN: TSX). Over 8% distribution; solid grocery store locations in the USA, with pharmacies and dollar stores anchoring the properties. I’m not fond of REITS, but since I liquidated my properties, I use this one for income.

Thanks

Gary

I spent about 15 minutes looking into the background of this REIT, including its holdings and earnings and such. It seems pretty good. I just wonder why the yield is so high, but I’m impressed with the long-term stability of its NAV going back 10 years.

I suspect it’s a decent way to diversify your portfolio and capture a nice yield. The types of real estate holdings in its portfolio are something I think would weather economic cyclicality and uncertainty.

Thank you for your reply and interest. I appreciate ALL your insight, comments and observations!

Keep it up.

God speed.

Silver loves even numbers the front month contract could test $34 soon.

Yes, we shall see. I would think the gold silver ratio would start tightening up at some point.

For those who are interested, I sold half my trading position of RMTI this morning at $4.25. I waited for the stock to bounce back this morning from the sub $4 level and unloaded half. I’ll sit and wait for direction. If the stock tests $4 again, I will add some back. I think anything under $4 is a strong buy here.

As for INTC, there are plenty of stubborn sell-side bears on the street and that has been working to suppress the price. Any type of take out deal will be difficult to work with, since the market cap of INTC is about $95 billion. But a takeout can be done. Direct investment is a definite, too.

I suspect it as the street warms up to the idea of the current circumstances surrounding INTC, traders and investors will also look at the stock as having growth potential. This would place a premium on the share price. I still suspect the Gap will be filled eventually up to $28.